In the midst of a downturn in the agricultural economy, precision farming dealers are finding that the once lush landscape for technology sales is changing, as customers become more discerning with their immediate on-farm expenditures.

By no means is precision ag a shrinking industry, but dealerships are continuing to adapt and evolve business strategies to emphasize recurring services and complementary products rather than one-time equipment sales.

As one owner of a Midwest precision company notes, “It used to be that hardware would practically sell itself off the shelf. To be successful today, we need to sell ourselves, our service and our reputation, more so than any single product.”

The 2015 Precision Farming Dealer benchmark study reflects this ongoing transition among nearly 70 farm equipment dealers, independent precision companies and input retailers who contributed to this third annual report. While this year’s results continue the trend of dealers incorporating more perpetual revenue streams and data management services, the long-term outlook appears to have shifted somewhat as dealers search for profitable — and perhaps undervalued — pockets of the precision industry to capitalize on.

Spreading the Wealth

As reported in last year’s benchmark study, many dealers forecast declining or stagnant precision sales in 2015. To better track year-over-year revenue changes, this year’s report asked respondents to share precision sales growth or contraction during the last year, and compare those percentages with their outlook for 2015.

Based on responses gathered during the first quarter of this year from 21 different states and Canada, fewer dealers expect 2015 to be as profitable as last year. More than 58% of dealers reported precision revenue increases of at least 2% in 2014 vs. 2013, with 30.3% indicating a jump of 8% or higher.

But dealers are less optimistic this year. Only 19.7% of respondents forecast precision sales growth of 8% or more in 2015, while the percentage of dealers who expect revenue growth of 2-7% remained the same at 28.8% year-over-year.

The percentage of respondents who anticipated little or no change in revenue this year, compared to 2014 increased to 25.8% from 16.7% between 2013 and 2014.

Perhaps some good news is the percentage of dealers who expect revenue to decline this year is less than 2% higher than in 2014. And those forecasting a revenue decline of 8% or more remained unchanged at 10.6% compared to 2014.

Overall, nearly one-half of dealers (48.5%) expect revenues from the sales of precision ag equipment and service to increase 2% or more in 2015. This compares with 59.1% of dealers who indicated increases of 2% or more a year ago.

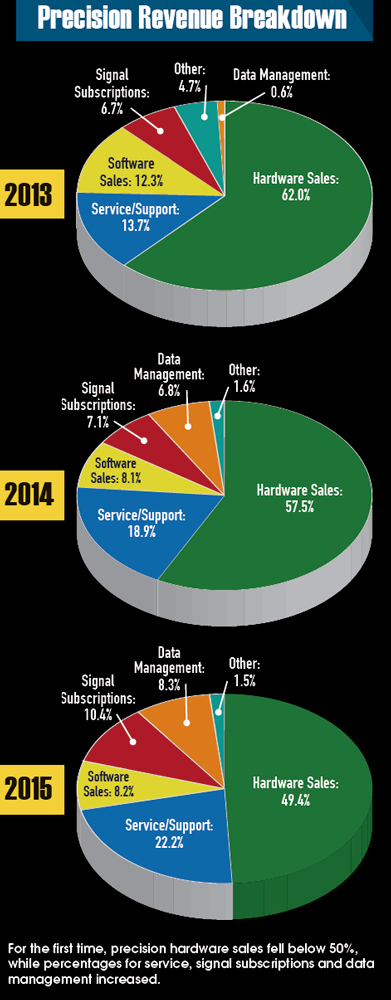

While it’s not surprising that revenue projections are trending downward, it is interesting to note a continuing shift in how dealers are generating precision profit. Hardware sales have historically accounted for the overwhelming majority precision revenue, but for the first time in 3 years, this total dropped below 50% in 2015.

In 2013, hardware accounted for 62% of dealers’ precision revenue, compared to 57.5% in 2014 and 49.4% this year. Decreasing dependence on core technology as the primary profit center is an ongoing business strategy for many dealers.

Diversifying offerings and including more service and support options are some ways which dealers are looking to supplant sagging hardware sales and also stabilize revenue during the market slowdown.

One precision dealer in Missouri has gradually shifted his business focus away from hardware sales since the last economic downturn in 2008. At that time, about 75% of his dealership’s precision business came from selling auto-steer and GPS systems. Today, that is closer to 25% as the company moved into more sustainable revenue sources, including data management service.

“We had hardware to rely on during the last downturn, but we knew there would be another decline at some point,” the Missouri dealer says. “If we didn’t have anything to replace that hardware revenue today, we’d be more worried.”

Since 2013, the percentage of revenue coming from precision service has increased by nearly 10%, from 13.7% in 2013 to 18.9% last year and 22.2% in 2015, according to the survey. Data management is close behind with a similar increase since 2013 from less than 1%, to 7.1% last year and 10.4% in 2015.

Another emerging source of annual revenue is signal subscriptions, which increased from 6.7% in 2013, to 7.1% last year and 10.4% in 2015. While some dealers say RTK subscriptions alone are a “breakeven” venture, they can create additional revenue through service calls and sales of new receivers or software updates.

Shifting Priorities

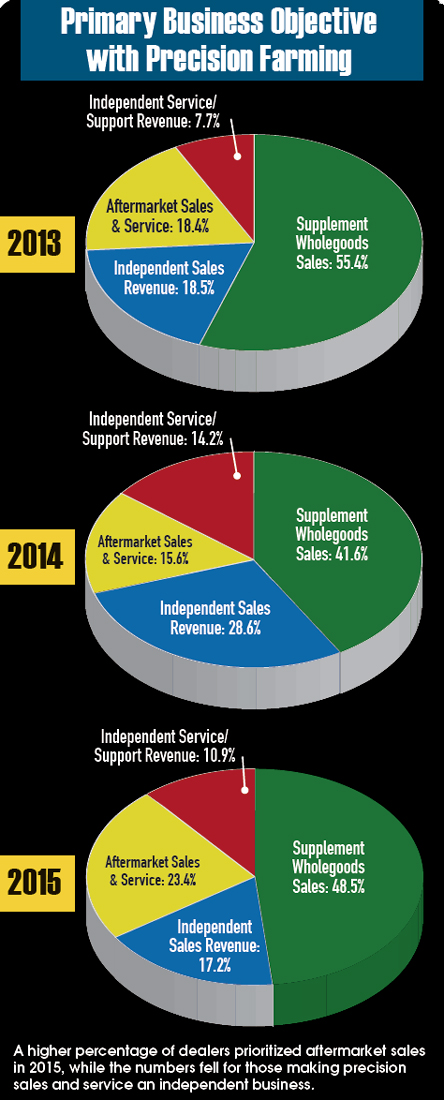

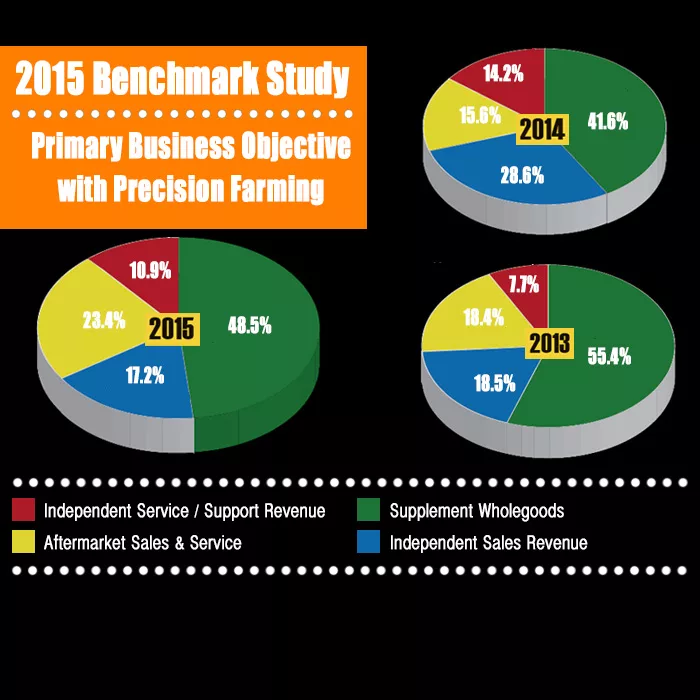

We asked dealers to identify their primary business objective with precision farming, and as dealers diversify or broaden their precision portfolios, a smaller percentage are prioritizing sales or service as an independent source of revenue, compared to 2014.

Last year, 28.6% of respondents cited independent sales revenue as their main goal with their precision business and 14.2% noted independent service revenue as their primary objective. This year, both those percentages dropped closer to 2013 figures, with 17.2% emphasizing independent sales revenue and 10.9% prioritizing independent precision service revenue.

On the flip side, there was a notable spike in the percentage of dealers with the primary goal of selling precision products to supplement wholegoods’ sales, from 41.6% in 2014 to 48.5% this year, but still below the high of 55.4% in 2013.

Another interesting jump came in the percentage of dealers emphasizing aftermarket precision sales and service, from 15.6% last year, to a 3-year high of 23.4% in 2015. The increase in OEM equipment coming factory-installed with precision systems would suggest a shrinking market for add-on products.

However, dealers are also expecting a drop in large ag equipment sales, which means fewer factory-installed precision systems being sold as well.

Yet another contributing factor to increasing aftermarket focus could be that some dealers are tapping areas like irrigation, tile plows and grain bin monitoring to sell complimentary hardware.

“I try and find add-on products or services that offer a higher margin, of maybe even 30-40%,” says one precision dealer in Ohio. “It’s taking that McDonald’s mentality of adding fries to a meal, which is a pretty profitable strategy.”

Further supporting the strength of the precision aftermarket, 53.1% of respondents cited this method as the most common avenue for selling products, up slightly from 2014 (52.1%) and well ahead of 2013 (37.4%).

Given the economic climate, sales of factory-installed precision products continued to decline, from 53.8% in 2013, to 40.5% last year and 38.1% in 2015. Sales of used precision equipment continued to trend slightly upward, from 7.7% two years ago, to 7.9% in 2014 and 8.3% this year.

Strength of Service

While the overall precision hardware market may not be as robust as in recent years, dealers are continuing to compensate for lost revenue by expanding service and support offerings.

As noted before, precision services are contributing more recurring revenue to companies’ bottom lines. The percentage of dealers offering a precision service package to customers continued to increase, from 29.8% in 2013 to 50.7% last year and 54.1% in 2015.

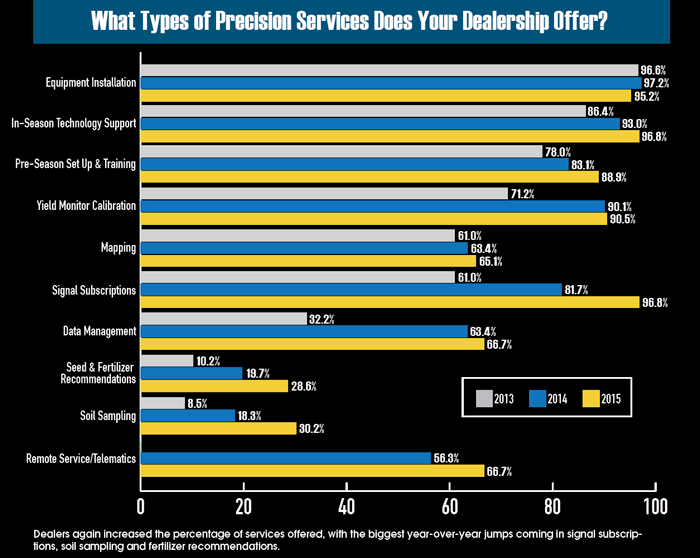

Though not as dramatic of an overall jump compared to the year prior, dealers expanded the types of services they offer, almost across the board. In 9 of the 10 service categories included in the survey, only the percentage of dealers doing equipment installation dipped — albeit slightly — from 97.2% last year to 95.2% in 2015.

The biggest year-over-year increase came in GPS/RTK signal subscriptions with 96.8% of dealers offering the service, vs. 81.2% last year and only 61% in 2013.

Some dealers are investing in cellular RTK tower networks, or partnering with local companies or signal providers to offer cost-effective GPS options to customers, with the intent of selling annual subscriptions or equipment upgrades.

Another major mover is soil sampling services. In 2013, only 8.5% of respondents offered this service, but the percentage more than doubled in 2014 (18.3%) and climbed again this year to 30.2%. A similar pattern emerged with seed and fertilizer recommendations, which started at 10.2% in 2013, nearly doubled in 2014 (19.7%) and increased again this year to 28.6%.

Introduced in last year’s survey, remote service/telematics also saw a significant spike from 56.3% in 2014 to 66.7% as dealers offer more cloud-based and wireless solutions to customers.

These increases aren’t surprising as dealers are adding or expanding agronomy-based services, especially those tied to data management. More specific comments from survey respondents on the scope of services they offer included “nutrient management,” “variable-rate prescriptions,” “remote assistance” and “electrical conductivity mapping.”

It will be interesting to see if agronomic offerings continue to grow at the same rate in coming years. This will likely depend on how aggressively dealers develop their data management service programs.

After nearly doubling in 2014 from 31.1% to 54.1%, the percentage of dealers offering data management service rose at a slower pace to 62.1% in 2015. However, there were more dramatic changes in how dealers are delivering these services.

The biggest jump came in respondent’s use of an in-house agronomist, from 24% in 2014 to 36.5% this year. This represents a 22.7% increase since 2013, the largest of any delivery method for data management service.

One-quarter of dealers sub-contract with a crop consultant or agronomy firm for data management service, which is ahead of the 2014 total (14%), but close to that from 2 years ago (24.1%). Also rebounding from 2014 was the percentage of respondents who sub-contract with local ag chemical firms. In 2013, the total was 13.8%, then fell to 4% last year and increased to 11.5% in 2015.

Precision specialists remained the most popular option for delivery of data management service, at 73.1% this year, down slightly from 2014 (78%). One thing to watch is if this percentage erodes in coming years, and whether dealers will further forge third-party partnerships or add agronomy-specific staff to deliver data management service.

Independent but Integrated

Precision farming is an increasingly specialized part of the ag industry and dealers continued to reflect this reality in the structure of their precision business. Two new questions added to this year’s survey asked dealers if they have dedicated precision salespeople and departments within their operations.

In both cases, the majority answered yes, with 66.7% of dealers operating a separate department for their precision farming business and 68.6% having a dedicated precision salesperson primarily responsible for technology sales.

But dealers still tend to divide the responsibilities of precision support staff throughout multiple departments. For the first time this year, dealers allocated the highest percentage of precision employees to the service department (33.6%), compared to 29.3% in “other,” 28.2% in sales and 8.9% in parts.

The relatively equal distribution of precision staff among different departments has remained consistent during the last 3 years, and seems to support the ongoing approach by dealers to have multiple precision touch points within their operation.

Says one precision dealer from Pennsylvania, “We’ve opted for a more integrated relationship between our heavily trained precision specialists and the traditional parts/sales/service departments to help spread out the workload.”

Precision cross-training throughout different departments is a point of emphasis for some dealers, but the majority of training for precision specialists continues to come from suppliers. However, this percentage dropped from 69.1% in 2014 to 60.3% this year, with the difference absorbed by specialists turning to the Internet as an educational resource.

The percentage of respondents going online for precision training more than doubled from 7% last year to 15.9% in 2015. One contributing factor to the increase could be that more dealers are producing product-specific training and service videos for internal use or to share with other dealers on YouTube and through social media.

Online training for precision customers is also increasing in popularity. This year, 26.7% of dealers offered online training for farmers, compared to 22.7% in 2014.

Pre-season clinics remained the most popular customer training option, with 96.7% of dealers offering them, up from 93.9% last year. Some dealers have taken creative approaches to attract attendees and market new products at these events.

One dealership in Wisconsin asked an experienced precision customer to share his experience at a customer clinic, and the tactic translated to same-day sales of several precision systems. “Customers are going to trust a fellow farmer more than they’d trust me standing up there with a sales shirt on,” the Wisconsin precision specialist says. “When farmers talk, other farmers listen.”

The biggest year-over-year decline in customer training offerings was precision ag field days, from 54.6% in 2014 to 48.3% this year. While not a huge decrease, in a slower market, dealers may be more closely evaluating the costs of organizing and executing a field day.

The Next 5 Years

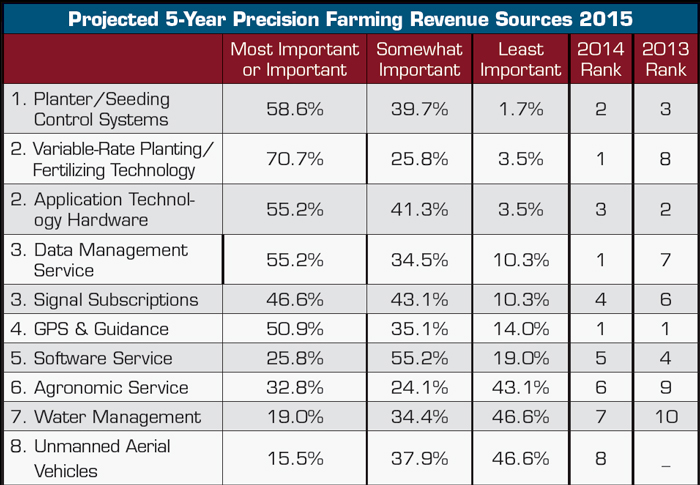

Current market conditions are certainly changing the way dealers do business today, and likely will have an impact on how they approach the future. Looking at where respondents foresee the most opportunity to grow revenue in 5 years, the outlook shifted for several categories, compared to prior years.

GPS and guidance fell from the top spot for the first time, as dealers put more emphasis on planting and application technology.

For the last 2 years, GPS and guidance topped the list of areas where dealers see the most revenue potential in the future, with 91% identifying it as most important or important in 2013 and 89.7% doing so in 2014. But this category dropped to fourth on the 2015 list, at 86%.

While still a high percentage, it’s possible that dealers are starting to view GPS and guidance as a saturated market and they are turning their attention toward more specialized areas of precision. Topping this year’s list was planting and seeding control systems, with 98.6% of dealers citing the category as most important or somewhat important during the next 5 years.

This category has trended upward since ranking third in 2013 (76.9%) and second in 2014 (86.7%) and dealers note that planting technology is been a point of emphasis during the downturn because of it’s tangible paybacks.

Coming in second on this year’s list was variable-rate planting and fertilizing technology at 96.6%. Though this category tied for first in 2014, the overall percentage increased about 7% this year, including 70.7% of dealers citing variable-rate technology as the most important category, tops on the list.

Tied for second this year was application technology (96.5%), which ranked third in 2014 (83.8%) and second in 2013 (85.8%). Data management service maintained the same percentage as in 2014 at 89.7%, but tied for third place this year, compared to a first-place tie last year. Also tied for third in 2015 were signal subscriptions, which moved up one spot from 2014 (74.9%) and three from 2013 (71.4%).

Last year’s new addition, unmanned aerial vehicles, again placed last on the list, but had the highest percentage increase of any category in 2015. In 2014, only 27.9% of dealers ranked UAVs as most important or important, vs. 53.4% this year.

One Minnesota dealer says, “We’ve done flyovers with the UAVs and they’ve sold and paid for themselves in one field on one flight. But I’m much more interested in the service side, and ultimately, farmers still want to know what their return on investment is with this technology.”

Increasing precision revenue during the next 5 years may come with some challenges for dealers, but they remain committed to investing in their personnel and customers.

For the third year in a row, the order of importance for future investment in precision business remained unchanged. Employee training ranked first on the list, with 91.2% citing it as the most important category. This was nearly 20% higher than the second place category, precision staff, which had 72.4% of dealers ranking it as most important.

The percentage of respondents prioritizing customer training continued to increase. In 2013, 43.3% of dealers cited this area as most important or important, compared to 48.2% in 2014. This year, 65.5% ranked customer training as most important, which underscores the emphasis dealers are placing on keeping farmers educated on the value of precision technology.

“A customer base that is more informed of what is available as well as how it might apply to their operation is a customer base that will keep the precision trend moving forward, and also keep challenging us as their dealer to be informed, trained and stocked with what they want,” says one dealer from Pennsylvania.

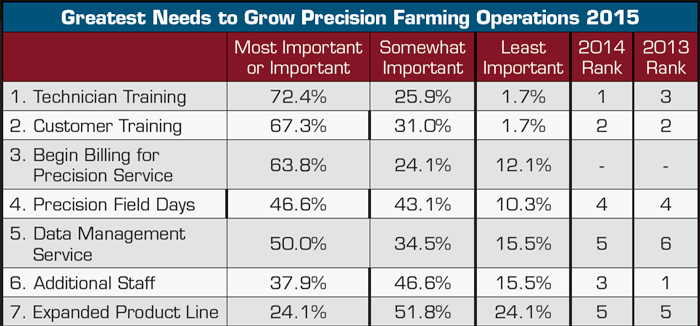

Training efforts remained top priorities for dealers, along with the goal of billing for precision service.

This same philosophy applies to dealers’ greatest needs to grow their precision business. For the second year in a row, technician training and customer training were at the top of the list, with 98.3% of respondents ranking these areas a most important or somewhat important.

A new category added this year, begin billing for precision service, ranked third on the list, with 87.9% of dealers saying this is their most important or somewhat important need to grow business. The high percentage and ranking would suggest there are plenty of dealers still figuring out how to best charge for precision support.

The range of service hours being billed by respondents continued to vary, from as few as 20 hours per year, to as many as 10,000. Several dealer responses included “unknown,” “not sure” and “not tracked.”

Interestingly, adding precision staff continued to drop down the priority list for dealers. This need ranked first in 2013, but slipped to third last year and fell to sixth in 2015. This could be that dealers are simply placing a higher priority on training the staff they have in-house, rather than dedicating time and resources to recruit new talent, which is still in short supply in the precision industry.

While dealers have an eye on the future, conquering more immediate challenges presented by the ag market is on the mind of many. When asked to identify the biggest anticipated obstacle in the coming year, more than a dozen cited farmers’ tightening of the purse strings.

“A huge challenge across our whole business will be the reduced cashflow for our customers,” says one dealer in Canada. “We are seeing this reflected in sales numbers already. To deal with this, we plan to focus more on selling the value of our precision farming equipment, services and support.

“With less money to spend we want our customers to focus on how much they can save with the correct precision farming system which is installed and supported correctly.”

![[Technology Corner] A Big Step Forward for Interoperability & Data Sharing](https://www.precisionfarmingdealer.com/ext/resources/2025/12/12/A-Big-Step-Forward-for-Interoperability--Data-Sharing.webp?height=290&t=1765565632&width=400)