Pictured Above: Although selling unmanned aerial vehicles (UAVs) is still an evolving market, dealers see tremendous potential with selling service, such as mapping and data management, to complement the hardware in the future. Photo courtesy of AgEagle.

As frenzied interest and growing expectations for unmanned aerial vehicles (UAVs) in agriculture continues, farm equipment and precision dealers have launched efforts to capitalize on this emerging market, to varying degrees.

Hundreds of farmers have purchased personal UAVs during the past several years, and many undoubtedly are making management decisions based on the information they generate from their fl ights.

But dealers and UAV manufacturers say the business is starting to mature beyond the “What brand did you buy?” stage to “What kind of information can I get from the technology?”

“Ultimately, we have the perspective that we’re less concerned about the aircraft itself than with what it can do for our customers,” says Steve Cubbage, president of Prime Meridian, a precision data company in Nevada, Mo. “We’re looking heavily at what information can we get, how quickly can we get it and what can we do with it.”

Toys to Tools

Despite ongoing regulatory ambiguity, several fi rms have emerged to provide specially-designed UAVs for farm use, and others have come on line to provide data processing for information gathered by the machines. The 2014 growing season gave UAVs a chance to prove themselves as very effective tools to reduce inputs, spot crop problems, and extend farmers’ eyes into hard-toreach fi elds to identify storm damage and crop insurance claims.

Phil Ellerbroek, global director of sales for RoboFlight Systems in Phoenix, Ariz., says he views the industry’s origins as “UAV 1.0” — a time in which his firm and others like it have been taking sophisticated UAVs and providing them to farmers.

UAVs, including this quadcopter model are attractive tools for farm customers to scout fields, but they also want dealers to explain the tangible benefits to validate the investment.

“As commodity prices begin falling, farmers are demanding more actual data to help them maintain profit margins and effi ciency,” Ellerbroek says. “Farmers are entering into the ‘UAV 2.0’ phase, where they are saying ‘I know what they can do, but I’ve determined I don’t want to do it myself. I’m happy to pay someone else to fly my fields and provide me maps, but you have to show me return on investment.’”

RoboFlight manufactures its own RF-1 and RF-70 fixed-wing UAVs, which can cover 500-700 acres per hour. Ellerbroek says, the products are primarily a tool to gather data and the company primarily focuses on acquisition, processing, analyzing and storing remote sensing data.

“Ultimately we’re providing what dealers in this business will have to provide if they are going to be successful in the coming years, regardless of governmental regulations,” he says. “This includes a knowledge of aviation, precision agriculture and agronomy and remote sensing technology.

“If you’re going to compete in this business you have to have people with a deep knowledge in all of these fields.”

One of RoboFlight’s dealers, Total Ag Industries, near Hillsboro, N.D., has embraced the ongoing evolution of UAVs from ‘toys to tools.’ Total Ag began offering the DJI Phantom quadcopter about a year ago as a complement to the company’s seed, application machinery and precision farming business.

Chris Mueller, Total Ag’s chief pilot holds a FAA commercial license and flies both traditional aircraft and UAVs for the company and sees the business moving from “selling drones to farmers” to a commercially-provided service.

UAVs can provide a bird’s eye view of fields that are difficult to scout on foot. This photo, taken from about 70 feet above ground level, is well within FAA hobbyist UAV regulations that allow a maximum 400-foot ceiling and line-of-sight contact with the operator. Photo courtesy of Haug Implement.

“This seems to be the way farmers and agronomists in the area want to see this go,” he says. “We’ve pushed our little multi-rotor copter with a Snap camera and video camera more than the fixed-wing models. Fixed-wing UAVs that do Normalized Difference Vegetation Index (NDVI) and nearinfrared photography are still evolving rapidly, and we don’t want to get folks into them too soon.”

Justin Risovi, Total Ag’s manager, agrees, noting, “This all leads back to data collection sales on our end. A farmer sees what can be done, then he’s more interested in data collection services we offer.”

Mapping Success

Mueller and Risovi are also farmers, which helps them understand and convey the benefits of the technology to customers.

“I flew a field of mine after a 5 inch rain, and I could do a calculation of what had washed out with geo-referencing,” Risovi says. “I had an accurate acre count for replanting.”

Mueller also utilized the UAV after a hailstorm damaged one of his hardto- scout fields, which would have required a half-mile walk for an inspection. The damage wasn’t obvious from the ground, but a 15 minute flight and a quick stitch (computer processing of individual NDVI images into one field image) let Mueller know he had 22.6 acres of damage that would have been “zeroed out” by crop insurance.

Ultimately, Mueller says UAVs are an entry to Total Ag’s fertilizer and seed business.

“We’ve always wanted to be a total service company, so the more data we can collect, the more we can show to our clients,” he says. “We’re not only selling seed, but also inputs, so we can show customers where they can more precisely use fertilizer. This gets people making better management decisions.”

UAV Exemptions Begin to Clear Air for Commercial Use

With a multitude of companies jockeying for position in the unmanned aerial vehicle (UAV) market, federal rules will determine how much airspace there is to fly the technology in the future.

In late 2014, the FAA granted five regulatory exemptions for UAV operations to four companies from different industries that promise to benefit from UAV technology.

Among the companies granted an exemption was Trimble Navigation, which will be allowed to fly its UX5 is an unmanned fixed-wing aircraft for the surveying, agriculture, oil & gas, mining, construction and environmental industries.

“This decision reflects Trimble’s efforts to responsibly operate its UAV business in the U.S. while the FAA addresses air safety issues in opening the National Airspace System (NAS) for commercial UAV operations on a broader scale,” says Erik Arvesen, vice president of Trimble’s Geospatial Division.

U.S. Transportation Secretary Anthony Foxx says, the UAVs in the proposed operations do not need an FAA-issued certificate of airworthiness because they do not pose a threat to national airspace users or national security. Those findings are permitted under Section 333 of the FAA Modernization and Reform Act of 2012.

Companies also asked the FAA to grant exemptions from regulations that address general flight rules, pilot certificate requirements, manuals, maintenance and equipment mandates. In their petitions, the firms said they will operate UAVs weighing less than 55 pounds and keep the UAVs within line of sight at all times.

“The FAA’s first priority is the safety of our nation’s aviation system,” said FAA Administrator Michael Huerta. “These exemptions are a step toward integrating UAV operations safely.”

As of early December 2014, the agency had received 167 requests for exemptions from commercial entities.

With falling commodity prices, Mueller says they’ve sold more UAVs than he would have expected a year ago. But he says the real market for the technology could be with consultants and agronomists who are already providing scouting and prescription services.

“We think a small number of UAVs will continue to sell to producers,” Mueller says. “But agronomists are more up to snuff on this technology and they are eager to use it to boost their business.”

For individual farmers, Mueller says, “If you have more than a couple thousand acres you’ll need multiple UAVs and multiple people trained to use them. It really makes more sense to hire out the service, and way more cost effective at that level.”

Delivering Data

Cubbage is one dealer who understands the value of selling more than just a piece of hardware. His company sells fixed-wing UAVs manufactured by AgEagle, based in Neodesha, Kan., but he also incorporates data service into sales. “2014 was our freshman year,” he explains. “We are still adjusting rates for our UAV service, but the rule of thumb now is $1.50 an acre to process the images, $1-$1.50 per acre if you want someone to fly it for you with an on-site ‘concierge service,’ and $1.50-$4 per acre for the prescription, depending on the services and menu a customer chooses.”

As software becomes more automated, Cubbage expects the cost for image processing will decrease and bundling services into packages is an option that could include in-season crop scouting as an added benefit.

Cubbage says they have invested heavily in promoting their services, but because of FAA regulations, they didn’t charge to fly the fields. “We charged for the data, however, and saw very good success in getting our corn customers to switch from blanket rates to variable-rate on specific areas of their fields. Once they saw the difference, they now know all this has potential.

“We want to create actionable agronomy,” continues Cubbage. “Flying a drone is the easy part. The big challenge is the software and computing power to create a comprehensive field map that one can use for prescription writing.”

A typical 100 acre field requires 400- 500 individual photographs stitched together, he says. This takes a powerful computer along with some sophisticated software.

In 2014, Cubbage experimented with flying corn fields to photograph early-season stand counts. The process to create a whole-field image on 100 acres can require 2-3 hours of work.

“After a while, that gets old, and I don’t think farmers want to learn software,” he says. “So that process became a service, which we decided to offer, and leverage our background in data processing.

“We installed additional computers and invested in the software to be able to handle the photographs. We know this is where the business is headed and we’ve only been in it a year.”

Tom Nichol, business development director, for AgEagle, says the company has sold more than 125 units, mainly during the growing season of 2014. The company’s AgEagle RAPID system costs about $13,000, plus a monthly subscription fee to cover processing photos into a finished mosaic “by the time customers leave the field.”

Nichol says the newly-introduced RAPID program eliminates the need for expensive software and gives growers 16,000 acres of service coverage per year and a $0.15 per acre fee for anything over that amount. This allows smaller farmers to fly their fields several times over the growing season, he says. Images are then stitched and processed while in flight, so the finished mosaic is ready within minutes of landing.

While stitching remains a sticking point for customers and those processing data from UAVs, Cubbage is optimistic that the process will be more streamlined in the future. He mentions a recent California start-up firm that developed a system, known as Drone Deploy, which will allow the next generation of AgEagle UAVs to send images wirelessly to the cloud as they are taken in real-time during the flight. Once there, they will be stitched, allowing a full NDVI field photo within 20 minutes of the flight.

“We haven’t sold many UAVs intentionally,” Cubbage says. “It’s like selling the first cars off the assembly line, with the industry moving so rapidly. One of the things we wanted to sort out was the stitching process.

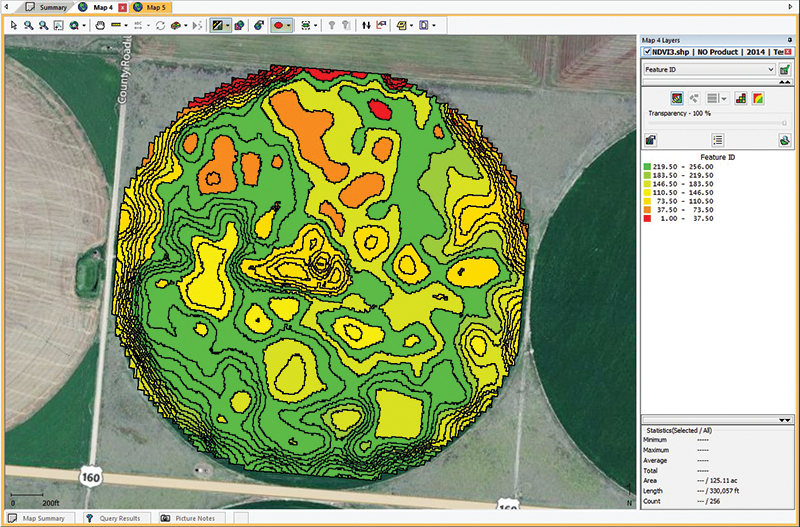

Although precise mapping of fields is a key benefit of UAVs, stitching together the images can be a hassle. Above, a photo mosaic of a fi eld reveals obvious “management zones” by which producers can use variable-rate technology to boost yields and cut input costs. Photo courtesy of AgEagle.

“I believe if Drone Deploy proves itself in 2015, and the FAA settles on regulations for this industry, we’ll see an explosion of business develop around UAVs.”

Regulatory Hurdles

While interest and adoption in UAVs continues, the National Transportation Safety Board (NTSB) has reiterated the FAA’s complete jurisdiction over any “contrivance invented, used or designed to navigate or fly in the air.” That stance, as regulations are written today, means anyone fl ying a 6-pound battery-operated UAV in a commercial pursuit would be required to have a commercial pilot’s license.

FAA hobbyist regulations allow UAV flights at a maximum of 400 feet elevation and line-of-sight contact with the operator.

The troubling question for owners and dealers then becomes, does flying a UAV over a corn crop to assess fertilizer needs and making a subsequent application based on data collected constitute a “commercial pursuit?” Probably so, according to current rules.

Still, if a farmer flies a drone recreationally over his own fields under rules set out for hobbyists, and he just happens to take some pictures, is the FAA going to shut him down?

“We tell our customers up front, if you are using this on your own property for personal use it does not conflict with the regulations,” says Bart Freeland, precision farming manager with Delta Group in Leland, Miss. “But if you’re making management decisions, it does. We don’t want them to get in trouble and then be mad at us.”

The six-store, Case IH dealership group is already heavily involved in precision farming and sells the DJI Vision Plus and Phantom 2 multi-rotor UAVs to a variety of customers. Freeland says they’ve sold more than 50 UAVs to farmers in the Delta region of Louisiana, Arkansas and Mississippi in the last 6 months.

The dealership sells UAVs to farmers, business owners, the general public, wildlife regulatory agencies and high school athletic departments who want to monitor scrimmages and practice sessions, says Freeland. “But, farmers cannot legally use them to make decisions the way FAA regulations are currently written,” he says. “All this will have to be sorted out as FAA is promising to clarify rules for farmers in 2015.”

The FAA has promised specific rules to govern the use of UAVs in agriculture by 2015, but many in the budding ag industry seem skeptical the government agency will make that deadline. But Freeland is among those dealers who see a bright and inevitable future for UAVs in agriculture.

“We got into drones because we know they are going to be part of the industry going forward,” he says. “The laws and rules will be hashed out over the coming months, and we wanted to be prepared for when FAA does release its new regulations.

“We’ve already hired a commercial pilot to fl y the radio-controlled craft, and right now he’s doing repair work on units that crash.”