By Bill McNeil

There is a pervasive and underlying feeling that commercial drone operations will flourish once the FAA finalizes regulations. This may only be half true because the rate of growth is solution specific. Put another way, the speed that unmanned aerial systems are adopted depends on whether the offering is a product or service. In this article we’ll look at some of the markets prosumer drones are most likely to impact and explain why there is significant growth disparity between drone products and drone services.

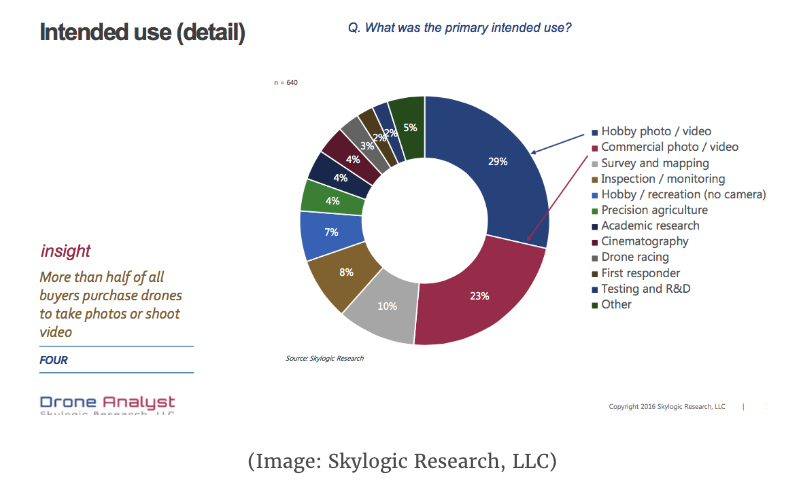

The chart below is from the April 2016 Drones in the Channel: 2016 Market Report developed by Skylogic Research. I like this report because they have not only researched different industries, but also channels of distribution, purchasing trends, price points and popular brands.

Product

On the product side, drones are sold through a fairly traditional one- or two-step channel of distribution. One-step distribution means unmanned aerial vehicles are sold directly from the manufacture to the end user, usually via the manufacturer’s website. In the two-step method, drones are first sold and shipped to web resellers like Amazon or eBay or to brick-and-mortar stores like Best Buy, drone dealers or hobby stores. These retailers then resell the UAVs to end users.

This system works well for amateur or commercial photographers and cinematographers because drones are simply another platform in the photographer’s toolbox. The photo and video category composes well over 50 percent of all prosumer drone sales and it will continue to have the fastest growth rate for a couple of reasons: (1) at a cost of less than $2000, most prosumer drones in this category are relatively inexpensive, and (2), although drones provide a new platform for shooting video and photos, the UAV camera output is standard JPEG, TIFF and MP4 files. This means these files can be processed by existing applications like Photoshop, Magisto and GoPro Studio. In other words, the learning curve for using UAVs for photography is limited to understanding how to fly the drone. The tools and post-processing workflow has been in place for years and is currently being used by tens of thousands of amateur and professional photographers.

Selling products, as opposed to services, also appeals to manufacturers because they have a well-defined path to the consumer, and they can limit support for the drone and accessories they produce.

Service

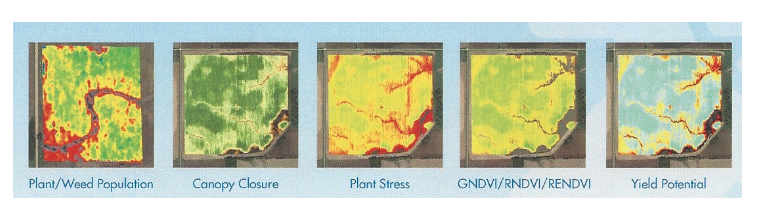

Precision agriculture is an example of a service that holds the promise of completely transforming crop measurement and agriculture analysis. Lightweight cameras and sensors will deliver NDVI vegetation indices and diagnose plant population, weed density, plant stress and yield potential.

(Image: SLANTRANGE)

Although prosumer UAV cameras provide crop scouting data, the real value comes from the sensors drones carry and the software used to analyze the collected data. This means the solution may involve three different vendors: the drone manufacturer, the sensor provider and the application developer. The question then becomes, who provides and supports the composite solution? Generally speaking, all of these entities would rather sell products and let somebody else provide the service.

There are opportunities for system integrators to fill the gap; unfortunately, there just aren’t enough of these companies to support the growth potential of precision farming. To make the situation even more complex, most farmers don’t want to purchase drones; they only want the data unmanned aerial vehicles collect. Much of the crop Information farmers currently get comes from crop consultants or agronomists. These companies are, therefore, the likely target market for selling drones to the agriculture industry, not the farmers themselves.

To recap this process: a system integrator purchases unmanned aerial vehicles, sensors and software applications from the manufacturer or reseller. These components are then integrated into a bundle and sold to agronomists. The agronomist, in turn, provides an enhanced data analysis service to the farmer, the ultimate consumer, from the UAS data they collect and analyze. This example is not unique to precision farming. The same general model holds for other services like surveying, mapping, inspections and mining.

Unmanned aerial systems are truly a disruptive force because not only have they dramatically lowered the cost of data collection and analysis, they have also impacted distribution, marketing and software applications, and even fostered low-cost lightweight sensor development. It has happened at such a rapid pace that, unlike the simple product model, the infrastructure to support a service business has not been fully implemented.

In summary, about half the use categories listed in the Skylogic Research report are product-based and the other half are service businesses. This means half the UAS industry will enjoy rapid growth while the other half will be paced by the rate of channel development.