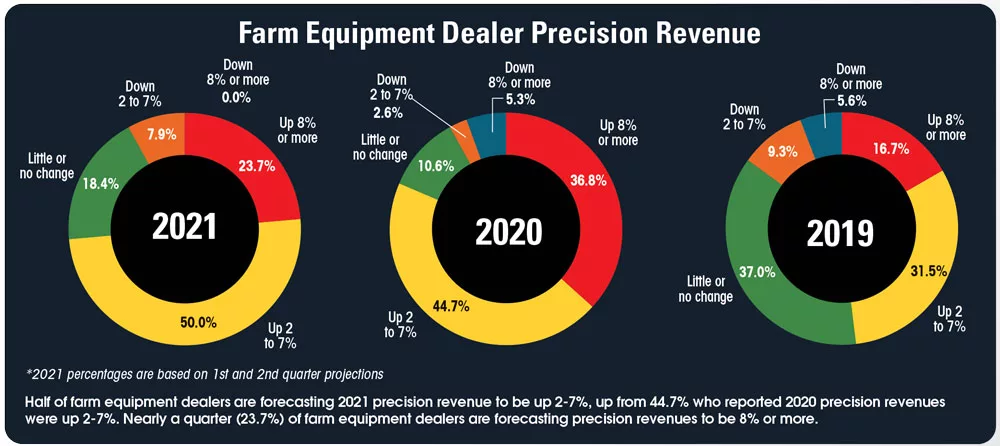

The results of the ninth annual Precision Farming Dealer benchmark study — with contributions from dozens of farm equipment dealers, input retailers and independent precision companies — show that nearly three-fourths of dealers are forecasting revenue growth from precision to be up at least 2% in 2021, despite inventory challenges.

Beyond inventory, dealers note training both staff and customers is one of the biggest challenges facing their precision operation in the next 12 months.

Commenting on the challenges in the next year, one Deere dealer says, “Time to educate ourselves as well as in-field, hands-on training. I am partnering with customers to get more time in the seat and hands on use of the technology that they currently have. [We] also need the same with new precision offerings from Deere, so as to be better versed in what our dealership can provide.”

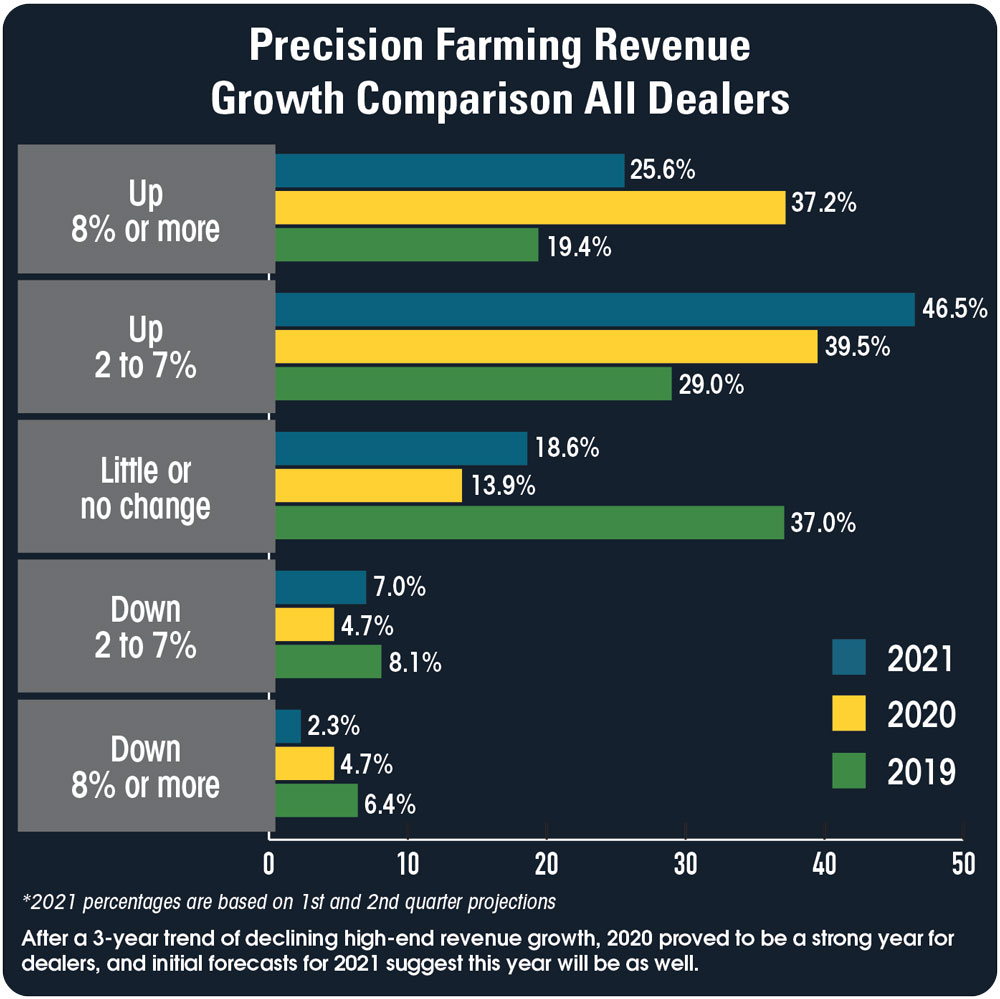

Comparing the responses gathered from 25 different states, provinces and overseas, 37.2% of dealers reported revenue growth of 8% or more in 2020, up from just over 19% who reported the same level of growth in 2019.

Dealers far exceeded their forecast for growth in 2020. At the start of last year, about 11% of dealers were forecasting precision revenue to be up 8% or more. This marked a return to dealers exceeding their higher-end expectations after missing the mark in 2019.

In the 2019 report, 28% of dealers reported precision revenue growth of 8% or more in 2018, slightly ahead of the 26% forecasted.

Some 31.5% of dealers reported precision revenue growth of 8% or more in 2017, more than double the forecast (15.4%), and in 2016, about 23% of dealers reported precision revenue growth of 8% or more, more than doubling that year’s forecast (10%).

After 4 years of slowing revenue growth in the mid-range, nearly 40% of dealers reported precision revenue was up 2-7% in 2020, about 10 points ahead of 2019’s growth in the category.

About 14% of dealers reported little or no change in precision revenue in 2020, compared to 37% who reported little or no change in 2019.

Those forecasting revenues to drop saw some slight changes. Just shy of 5% of dealers reported precision revenues were down 2-7% in 2020 vs. 8.1% in the 2019 report. In 2020, 4.7% of dealers reported revenues were down by 8% or more compared to 6.4% in 2019.

Ag Equipment Dealers

A further breakdown of 2020 revenue showed that the majority of farm equipment dealers went into the year with high revenue hopes. About 46% projected precision growth of at least 2% in 2020, including 11.1% who forecasted growth of 8% or more.

However, the 2021 benchmark study shows dealers far exceeding their 2020 forecasts, with 81.5% of dealers achieving at least 2% growth in their precision farming business. Some 13% of farm equipment dealers had initially forecast a decline of at least 2% in 2020 precision revenue, but data from this year’s study shows that just 7.9% reported at least a 2% decline in precision revenue last year.

Adjusted Expectations

So, what are dealers expecting this year? Overall, 73% forecast revenue growth of at least 2% over 2020, with about 26% projecting growth of at least 8%.

This reverses an increasingly conservative revenue outlook going back the last 3 years. About 19% of dealers expect little or no change in 2021 revenue, while just 9.3% forecast revenue declines of at least 2% — down from 16% last year, which marked the highest total forecasting a decline in the history of the survey.

Consistent with the broader dealership outlook for 2021, 73.7% of farm equipment dealers forecast revenue growth of at least 2%, including nearly 24% projecting an increase of 8% or more.

About 18% expect little or no change this year, while about 8% forecast a revenue decline of at least 2% in 2020.

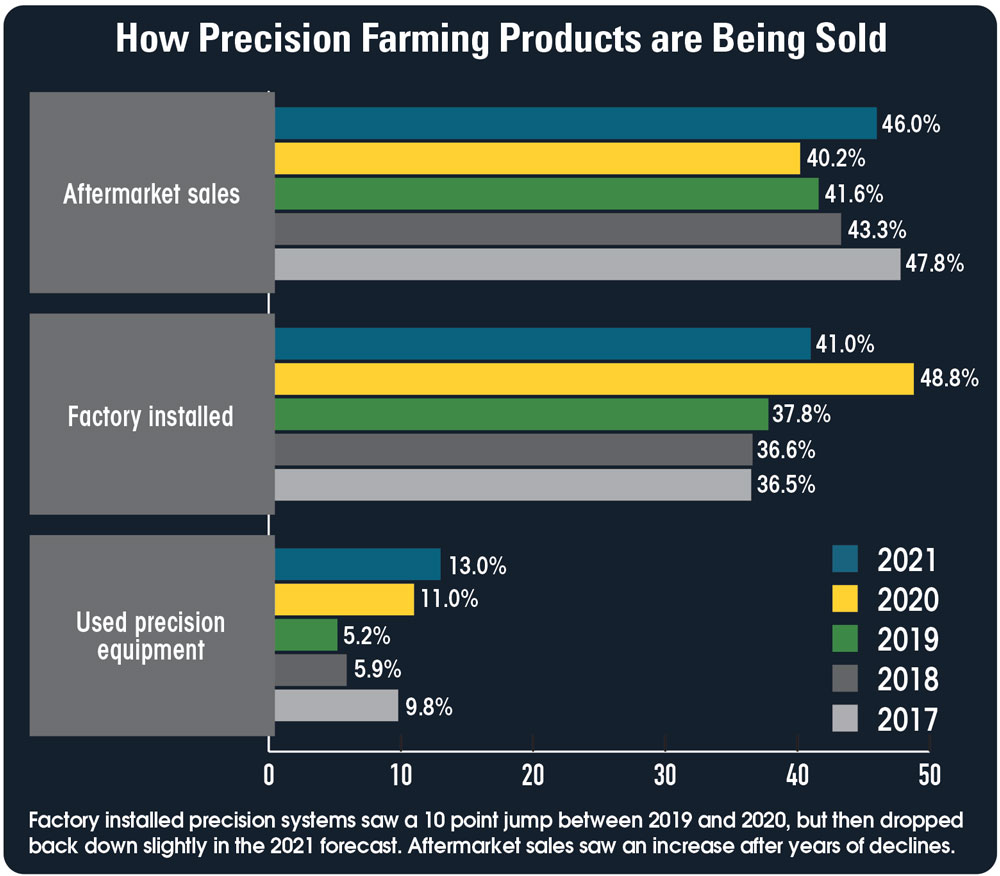

How Products Are Being Sold

After 5 years of dealers reporting declining aftermarket precision sales, in 2021 46% of dealers said their precision products are being sold as aftermarket sales. Some what surprisingly, the number of dealers who reported precision products were being sold factory installed declined (41% vs. 48.8% in 2020) after several years of growth in this category. Used precision equipment sales saw a slight increase to 13% from 11% in 2020.

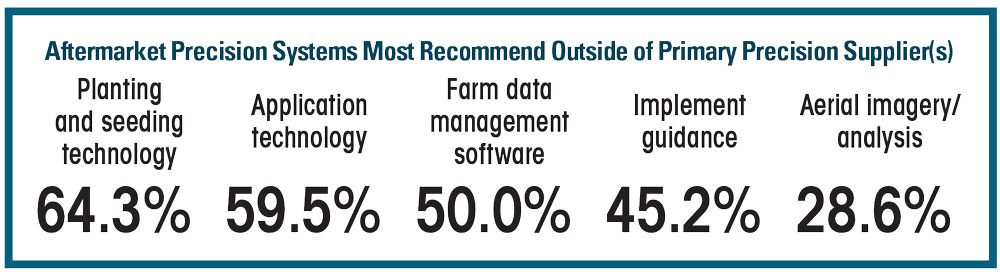

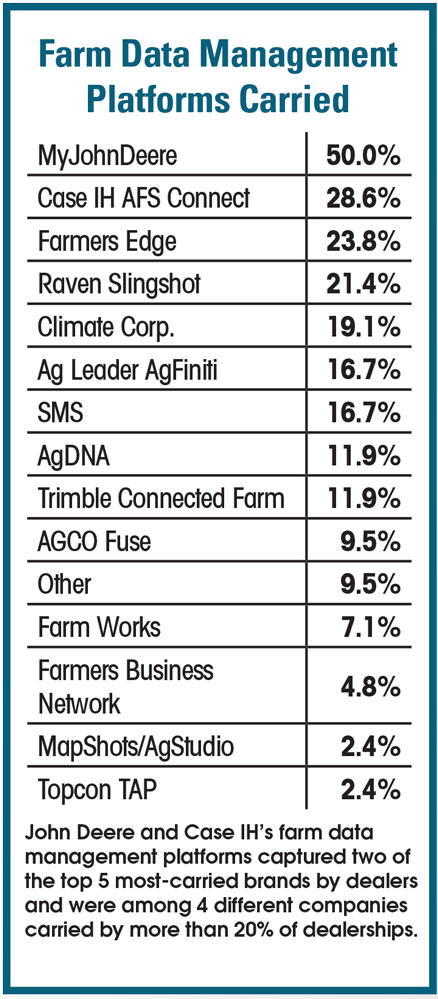

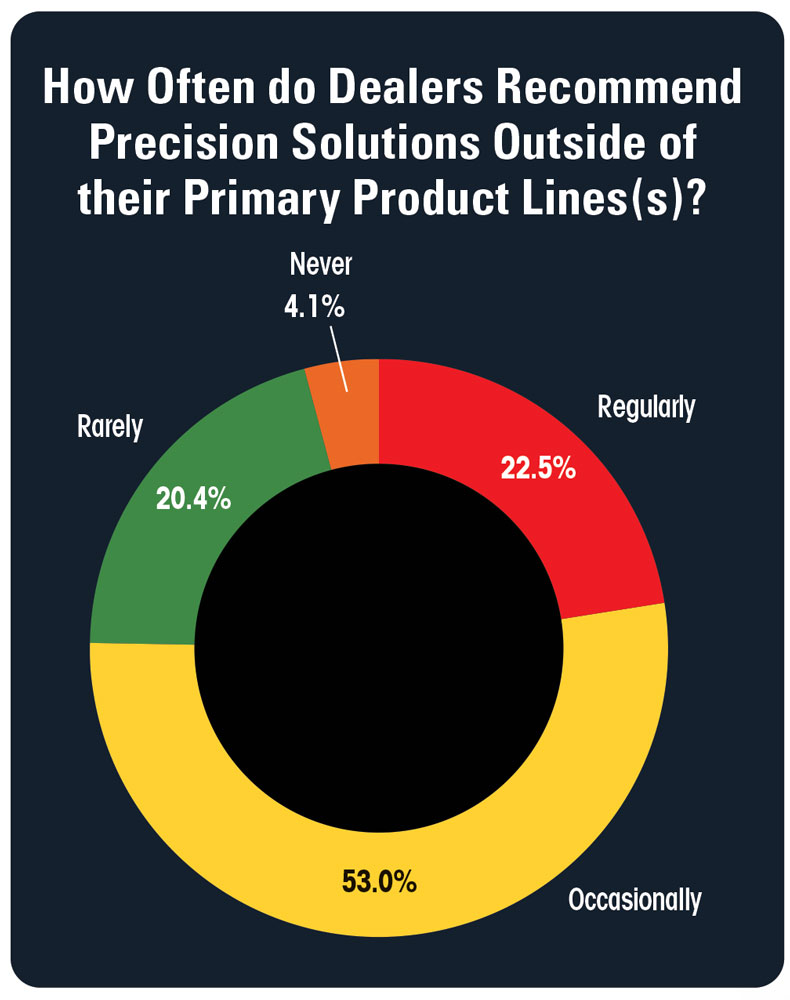

When it comes to recommending aftermarket precision systems outside of their primary precision suppliers, planting and seeding technology is the most frequently pushed by dealers at 64.3%. This is followed by application technology at 59.5% and farm data management software at 50%.

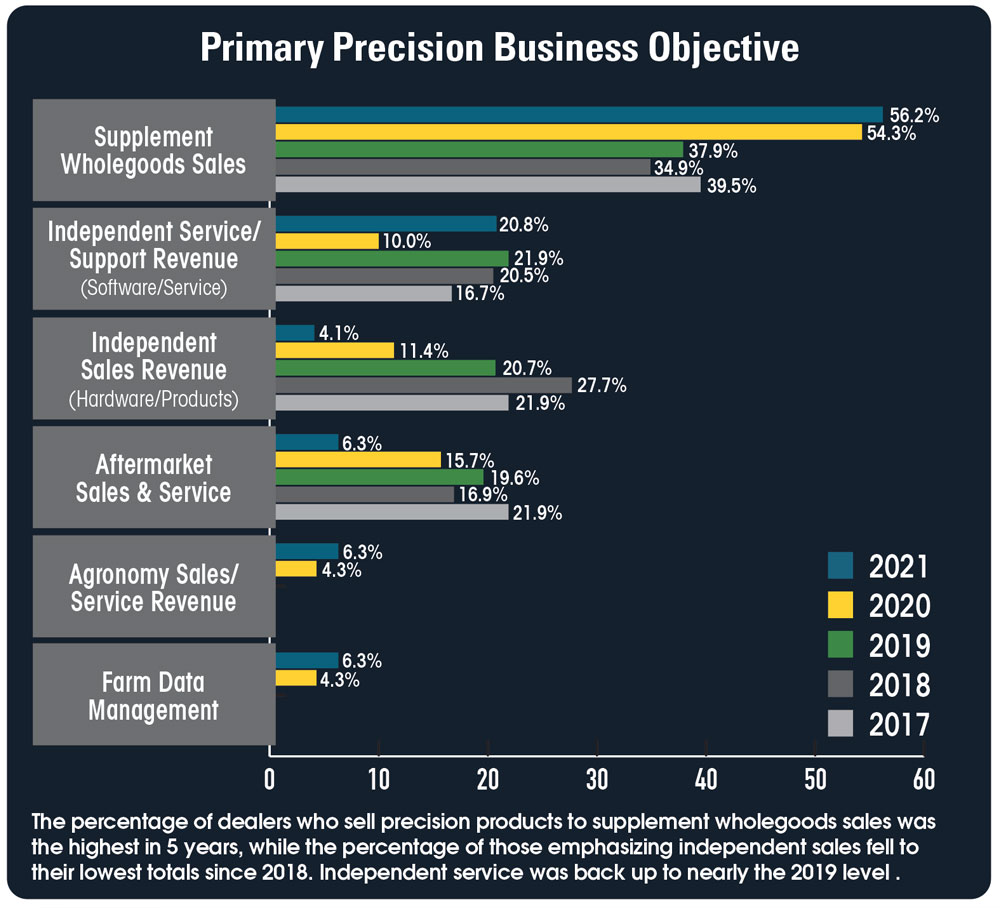

Over half of dealers responding to the survey say supplementing wholegoods sales is the primary objective of their precision business, up slightly from 2020. Independent service/support revenue was the second most common objective for dealers’ precision business at 20.8%, up from just 10% last year.

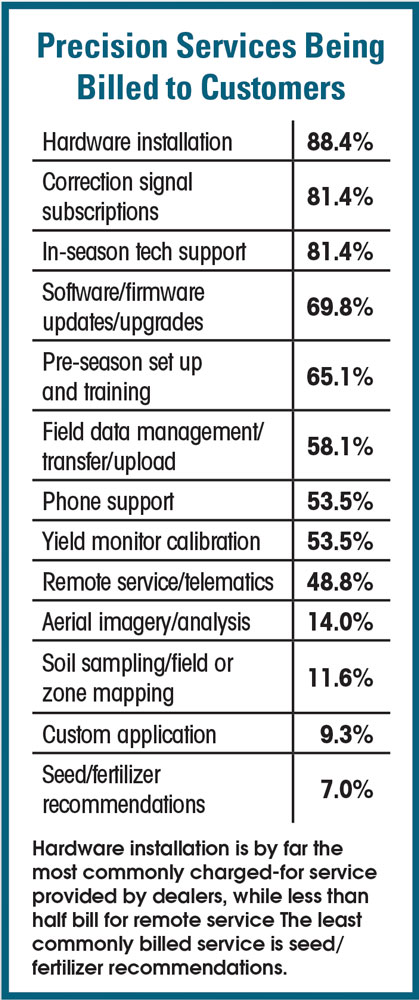

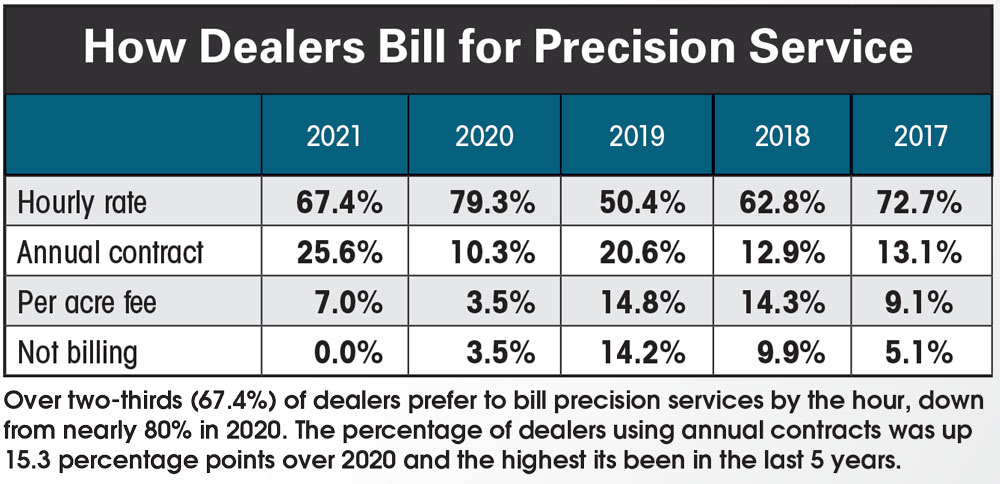

Billing for Service

As more equipment comes with precision technology factory installed, there’s been a push to focus the precision business on service and billing customers accordingly. The number of dealers who are billing for precision service via annual contracts increased to 25.6% from 10.3% last year. Billing an hourly rate continues to be the most popular method dealers use, with 67.4% of respondents saying the bill this way, but this was down from 79.3% in 2020. Just 7% of dealers are charging a per acre fee and none reported that they are not billing for precision service at all.