CNH Industrial views autonomy and automation of farm equipment as key to its technology strategy.

The message came from several company leaders at CNH Industrial’s Capital Markets Day presentation for investors held in Miami Beach in late February.

Scott Wine, CEO of CNH Industrial, says dealers and customers regularly told him CNH makes great iron, but they wanted better technology. The company’s acquisition of Raven Industries in 2021 advances its technology capabilities and delivers on customers’ wants.

“Machine automation is something that our customers value,” Wine says. “It’s in our combines with world-class productivity. This game in ag is really about productivity and yield.”

Parag Garg, chief digital officer of precision technology at CNH Industrial, says the acquisition positions CNH to “leapfrog” the competition.

“They bridge our autonomous gap and add tremendous automation capacities as a leader in sprayer applications and their expanded suite of guidance technology,” he says.

The company previously announced the first in-house products featuring fully integrated Raven precision agriculture systems will become available in 2022. Additional autonomous farm equipment solutions are planned for the near future as well.

“We are confident that in the next 3 years, we’ll bring a significant amount of autonomy to market,” says Derek Neilson, president of agriculture at CNH. “You’re going to see it progressively through the planting period. You’ll see some equipment coming this year, next year and in 2024.”

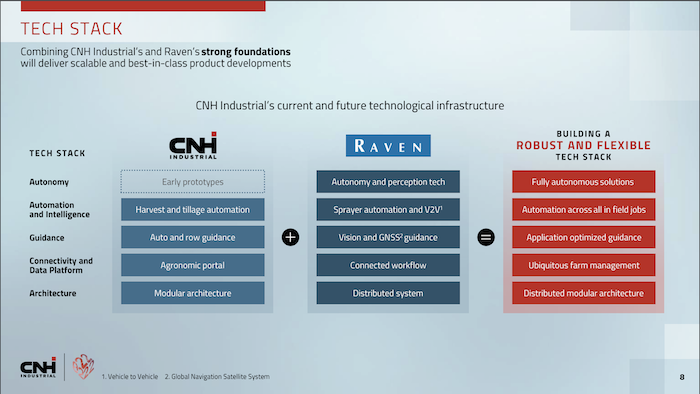

CNH Industrial outlines its current and future technological infrastructure with the acquisition of Raven Industries.

CNH Industrial outlines its current and future technological infrastructure with the acquisition of Raven Industries.CNH’s Autonomous Offerings

Neilson says the CNH combine of today has 12-15 autonomous functions that previously would have been operator dependent. Tech stack capabilities include harvest and tillage automation, auto and row guidance, an agronomic portal as a connectivity platform and modular architecture.

“The level of automation in our combines has largely taken the need for a skilled operator out of the equation, which is a higher level of automation than the competition,” Garg says.

The acquisition of Raven adds OMNiPower, a self-propelled power platform with interchangeable farm implements, and OMNiDrive, the aftermarket autonomous driving kit formerly known as AutoCart, to CNH’s autonomous offerings. Garg says OMNiPower has been shipping since 2020, and OMNiDRIVE has been shipping since 2021.

CNH introduced a new Case IH 50 series precision sprayer that uses Raven technology to deliver automated boom height leveling, rate control monitoring, individual nozzle control and vision steering guidance. The sprayer sold out for 2022.

CNH is also developing a version of the sprayer that uses the See & Act artificial intelligence vision system created by Augmenta, a company that received a minority investment from CNH in 2021. See & Act can perform a real-time canopy scan of crop health, and Garg says the technology can reduce the application of fertilizers by up to 40%. Augmenta and CNH Industrial are currently testing the combined system in Texas. Garg says the companies will start testing See & Act with “customer validation” in the second quarter of this year.

Other autonomous farm equipment in the works is Auto-Tillage and Auto-Spread. Garg says customers used Auto-Tillage in the fall, while Auto-Spread is currently in product development. CNH’s product management groups are taking feedback from the customers who tried the products and will figure out what needs to be changed before the products are ready for customer use.

Neilson says CNH has an extensive plan in place to test the products in the Northern and Southern hemispheres with different crops in different conditions.

4 Pillars of Precision

Supporting CNH’s autonomous vision are 4 pillars of precision technology: customer obsession, technology-first culture, tech stack and a plug-and-play approach to partners’ ecosystems.

Garg says CNH brought mobile command centers to farms so engineers can work side-by-side with customers in the U.S. and beyond. The engineers can monitor performance of the products and make improvements when needed.

Over the last 10 months, CNH reorganized to create a precision technology team responsible for product development of precision applications. Garg says CNH insourced five times more tech talent in 2021 compared to 2020 and has been working internally to streamline its development process.

Part of CNH’s technology roadmap is to put technologists close to the engineering teams for full-cycle development, according to Garg. He says it takes an enterprise commitment and thought about how and where people are hired to bring the teams together for the benefit of the customer.

Garg says CNH has also given accessibility to other solutions providers to enhance customer experience and further scale CNH’s tech offerings. It makes it easy for CNH when the company considers acquisitions and industry partnership opportunities, Garg says, but he declined to say what types of acquisitions were on the horizon.