While the Yield Force agronomic service team was already in year 7 with Sinclair Tractor when agronomic consultant Ethan Smidt joined as the third member in 2015, the late arrival didn’t mean the service provider was well established across the eastern-Iowa landscape.

For every farmer subscribed to their year-long service program, there were a handful of others confused as to whether or not Yield Force was trying to sell them a combine or be an AMS specialist, an occurrence Smidt notes as common to this day.

“Agronomy within a John Deere dealership is not very common around here, so half the battle is just getting in front of customers and explaining to them exactly what it is we’re doing,” Smidt says.

From soil analysis to nitrate samples and planter assessments, “exactly what it is” represents a customized plan for each Yield Force customer, which Smidt describes as a long-term journey to understand each field and find the solutions for soil sustainability, return on investment and yield improvement.

Dealer Takeaways

- Soil sampling services can be a useful, affordable entry point into agronomic services.

- Showing customers ROI, not just telling them about it, is essential to building an agronomic service business.

- Customized agronomic services can increase relevance, reliability and retention of customers

Providing a Precision Perspective

Starting primarily as a variable-rate prescription provider for planting and fertilizer spreading, Smidt says Yield Force has since transitioned into a full gambit of agronomic services. But the primary focus remains on data analysis and collecting as much information from growers as possible over the course of a growing season.

The calendar year of services kicks off with an annual meeting in January, when Yield Force consultants review data and analytical findings from the previous season with growers. From there, Smidt says customers can get a preview of the upcoming months, from planting season all the way through harvest.

“Once we have yield data, we use it to analyze everything else and pick apart all of the fields,” Smidt says. “From there, we can answer farmers’ questions on hybrid varieties, fertilizer, fungicide or tillage practices in relation to their particular soils or farming practices.”

While the Yield Force team is a division under the Sinclair Tractor’s 11-store John Deere dealer umbrella, Smidt says most longer-term customers view the 3-member team — of Smidt, Brett Gregory (agronomic consultant) and Brent Pacha (agronomic consultant) — as trusted third-party advisors since they aren’t beholden to any brand of seed, fertilizer or chemical input.

Carving Out Your Agronomic Niche

One of the keys to figuring out how to best incorporate agronomy services into your dealership is to determine your place in the market, says Paul Bruns, owner of Precision Consulting Services in Canby, Minn.

“There’s a lot of people in this industry who are awfully darn good on equipment. There’s also a lot of people in this industry who are really good at agronomy. And there’s a group that falls right in the middle there who are good at equipment and agronomy. Then we have people who are good at software and data services. Some of them understand agronomy, some of them understand equipment,” he says.

“There’s a nice little sweet spot in the center that [Precision Consulting Services] falls into. I actually have a agronomy degree from South Dakota State, and have always loved the software, the technology side and being able to view the big picture of how does it all come together.”

Bruns takes a consultant’s approach when working with customers, both with agronomy and equipment. In 2018, he decided to take a look at what sets his business apart from everyone else. As the technology industry matures, he says, margins are going to erode. So, dealers have to figure out how to differentiate themselves.

“How many people can say they sell an auto-steer system? How many vendors are there in the marketplace today? Well, pretty soon when everybody’s got the same thing, it gets down to a price issue. So how are we going to drive value from it?

“All services and products we sell have one purpose — to ultimately make that producer more money. I want to cut his input costs, drive more yield, hopefully make their life simpler, and just increase efficiencies overall,” he says.

When you focus on ROI, price is no longer in the picture, Bruns says. However, he admits selling on ROI isn’t easy. “It’s hard. I will not disagree one bit. Selling based on ROI and agronomy is not as easy because it’s a warm, fuzzy, it’s not just a I got 180 pounds of trip pressure on the seal cultivator. They got 200. Well, does that make theirs better? I don’t know, it depends. Why do I want to buy this widget or service?”

— Kim Schmidt, Associate Editor

“We don’t care if our analysis indicates that Pioneer is better than Dekalb because we’re not connected to any of those brands,” Smidt says. “We’re free to interpret the data because we don’t have any bias.”

Precision, à la Carte

The standard, year-long data collection service package for Yield Force — which includes prescriptions, data analysis, the annual meeting and hybrid/variety seed plans — starts at $3.50 per acre with hourly rates on top of that for more extensive projects. A rising demand for a less comprehensive plan, however, sparked the launch of Yield Force XD: a program that launched in 2018 offering many of the same services, but on an a more specialized scope.

The standard Yield Force XD program includes at least 4 customer visits. One for a planter performance/seeding assessment, then soil nitrate sampling, followed by tile nitrate sampling and then stalk nitrate sampling. Through the Yield Force XD program, those visits are charged differently as individual, fixed fee appointments. Prices vary depending on how many services are utilized, Smidt adds.

Putting Planter Performance to the Test

Yield Force’s planter performance study in 2015 indicated little correlation between spacing on corn yields, but a considerable one between later emerging corn and yield reduction.

To improve the quality of on-site visits in the spring with benchmark data, Sinclair Tractor’s Yield Force agronomic service team conducted an experiment to evaluate planter performance in 2015. Among the key questions they sought to answer were the effects of spacing and emergence on yield.

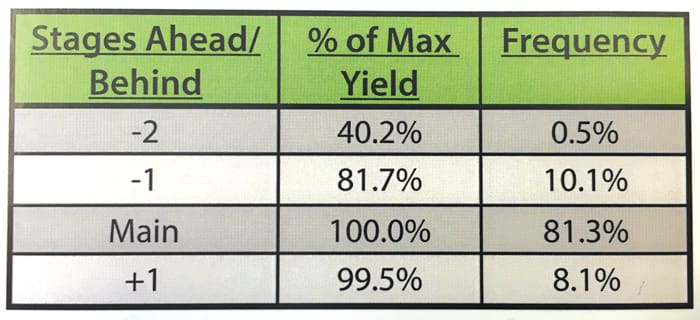

The experiment was based on data from 32 different planters in 64 different fields across southeast Iowa. In each field, the Yield Force team went to 10 unique locations and measured spacing between 10 different plants, in addition to staging each plant to analyze the emergence process. Each location was flagged and GPS-marked so the team could return in the fall for hand harvesting and grain yield measurement for over 6,000 ears of corn.

The results indicated that spacing has a minimal effect on corn yields, with corn yields producing within 3 bushels per acre regardless of perfect or poor spacing. Uneven emergence, however, was shown to have a notable impact. Plants that were 2 stages behind in the emergence process produced only 40.2% of their max grain yield on average compared to their counterparts.

“If a grower has different hybrids, we’re going to all of those different places with varying seeding rates to give the grower our most accurate yield estimate, but they may not elect to take a soil nitrate test,” Smidt says. “For customers who prefer only one or two services, it gives them the flexibility beyond the year-long data analysis program.”

Quantifying Agronomic Value

When it comes to justifying the investment in an agronomic department within the dealership, Smidt says the key is open dialogue with customers. Regardless of how valuable a service may be to a grower, they won’t invest unless the value is conveyed in a way that makes sense to them.

Part of demonstrating agronomic ROI comes as a collaborative effort with equipment sales staff, allowing the technological expertise of the Yield Force team to intersect with iron specialists.

“We’ve seen the benefits of different downforce systems and planter setups, from no-tillers to full-tillage farmers who applied hog manure,” Smidt says. “When the sales staff is closing a deal on a planter and trying to figure out whether to recommend spiked or rubber closing wheels, we can come in as that complementary presence.”

Agronomic Service Essentials: Discover, Evaluate, Analyze

While Southern States Co-op, based in Richmond, Va., doesn’t sell any hardware or machinery, they are involved in precision farming. Agronomy services account for nearly 50% of total revenues for the 200,000 member co-op.

“We’re not on the equipment side, we’re agronomists. But, we work closely with the dealers, both for our applicators and for our salespeople,” says Chris Conway, precision ag coordinator. “They need to have the knowledge of downloading recommendations into combines for the farmer to get going. Not only that, we have a weigh wagon and we also help them calibrate their combines at the end of the year because we want good data.”

To further brand its precision and agronomic services — and build up customers’ technology stamina — without overwhelming them, Southern States developed and launched a 3-tiered program in 2016.

The structure is designed to graduate customers from one tier to the next over time, while still offering flexibility within each to tailor the most beneficial services for individual operations, according Conway.

“One of the motivations for developing the tiered programs is that we were having a lot of success selling grid sampling by soil type, but within those grids there might be three different soil types,” Conway says. “That left a lot of questions about variability and we realized we can’t treat every farm the same way. We wanted to make it easier for them and us, so we can now sample in 2.5 acre grids and do more in-depth testing to get a more accurate picture.”

The introductory program, called “Discovery” started at $3.95 per acre and provides pre-season, in-season and postseason evaluations, along with one satellite image of a field to determine soil sample zones or evaluate crop health. The beginner tier also includes 3 zone soil samples per 50 acres, 1 field site verification, 1 tissue sample and yield data processing.

The second tier is “Evaluation” and the most popular option since the program formally launched in May 2016, according to Conway. Starting at $14.95 per acre, this level includes all of the Discovery services, along with soil sampling (zone or grid), additional in-field visits and a season review of the customer’s operation.

“This is the comfort zone for a lot of our customers,” Conway says. “It’s a longer-term, more refined approach that establishes a baseline for crop management programs and systematically monitors and evaluates crop progress throughout the growing season.”

The 2-3 year package starts with 2.5 acre soil samples the first year and adds in-season satellite imagery to the Discovery program services. The second and third years rely on production sampling that includes soil sampling, in-season tissue sampling and visual evaluation of three specific points within 50 acre zones to spot-check and evaluate nutrient levels and ensure fertility recommendations are accomplishing the desired goals.

The final tier is “Analysis” — the most comprehensive package starting at $19.95 per acre. Focusing on an entire farm management strategy, the top-level program adds a postseason evaluation that includes performance outlined by seed variety, crop protection treatments and soil type. As-applied data is also processed, providing customers with a digitized record keeping of any and all applications of seed, nutrients and crop protection products.

From 2014-17 enrolled service acres nearly doubled, from 550,000 to 900,000.

One of the services contributing to the increase is compaction testing. While the service is part of the Analysis level, it may be added to other tiers given that compaction is a problem more area farmers are seeking to fix.

The Yield Force team also conducts internal training for the Sinclair sales and service staff, which enables more employees to answer agronomic questions in the field, and also alleviates the volume of questions the Yield Force team needs to address on a daily basis. Ultimately, it makes it so that one person has 10 phone calls instead of 100, Smidt says.

Grappling with Customer Growth

Over the past 10 years, Smidt says the customer base for Yield Force has expanded from an estimated 3 growers in the opening season all the way up to over 60 in 2017, in-part due to the expansion of Sinclair’s locations. The biggest ongoing challenge Smidt sees for Yield Force is brand awareness.

“We’re becoming more mainstream with people in our area, but there’s still plenty who need us to explain that we aren’t here to sell equipment, but instead help make decisions on fungicide application or plant population.”

“We don’t care if our analysis indicates that Pioneer is better than Dekalb because we’re not connected to any of those brands. We’re free to interpret the data because we don’t have any bias…” — Ethan Smidt

The greatest competitive advantage Smidt sees going forward is the number of farmers that aren’t yet utilizing a third-party agronomist/consultant for their operation. While soil sampling services are established in different regions of the dealership’s service area, untapped opportunities remain.

“Certain areas we work in have very strong soil sampling businesses, so we work with them to get results and use that as a layer with the rest of our offerings,” Smidt says. “We don’t have the manpower or time to do soil sampling ourselves, so honestly that helps us with helping growers take that next step with their information.”

As customers collect more usable data in the years to come, Smidt hopes to take a more interactive approach as cropping/disease detection tools continue to improve in accuracy.

“The next 5 years will focus on aerial imagery and the ability to diagnose issues with crop health,” Smidt says. “There’s all sorts of options out there that either we don’t do today or could do a much more in-depth analysis with, whether it’s a field day to showcase different downforce systems or fungicide application methods, for example.”