Pictured Above: When it comes to building out agronomic service business at a farm equipment dealership, Martin White, division sales manager with Enns Bros., says it can take as much as 3 years for staff agronomists to become profitable, but once they do, they can generate $300,000, or more in annual revenue.

Precision agriculture allows producers and their trusted partners an excellent way to add production value through the collection of clean, calibrated data. The rubber meets the road when agronomic intelligence is combined with equipment data to create unique, informed management solutions for each farm customer.

However, getting to the point where a dealership can leverage agronomic insights and precision ag data to show agronomic value can be challenging. As a division sales manager for precision ag with Enns Bros. in Winnipeg, Man., we’ve had the pleasure of watching our customer conversations evolve to more than just equipment.

Our precision ag department has 8 years of experience, which has allowed us to grow in the agronomy space and understand how important our intimate customer relationships have become. Collaborating with customers’ delicate agronomic data requires trust and a clear understanding that their production data will not be shared outside of our precision ag department.

Structured Approach

Total Farm Solutions was an initiative that came out of the enterprise strategy. We wanted to make sure we leveraged the value of service through equipment inspections and optimizations while supporting customers’ agronomic

requirements.

One of our initial challenges was baking precision ag into our enterprise culture. As we continue to remove departmental silos, we realize that to have a successful precision ag program, you need to have buy in from leadership, sales and aftermarket sides of the business as well. We have 6 agronomists, 8 solutions specialist, one GIS specialist and one coordinator to support our 8 ag branches.

“We have a 98% customer retention rate within our precision ag platform. Once we’ve established that kind of intimate grower relationship, we become a key part of that producer’s success…” – Martin White

Currently, field advisors answer through our branch sales managers, and our solutions specialists report to the service managers, both with a dotted line to the Precision Ag manager. Working to better align solutions specialists with our field advisors allows us to optimize equipment correctly to satisfy our producers’ agronomic requirements.

To effectively satisfy customers’ agronomic situations, we have our solutions specialists educate customers on equipment features/functions ahead of the season, then perform calibrations and optimize once in field. Because certain operations are time sensitive, having equipment optimized and ready to go when it’s time is critical.

Service managers found that a large percent of equipment suffering in season breakdowns didn’t receive a pre-season service inspection or belong to our Performance Plus equipment uptime program. We have a GIS specialist to provide customers with drainage and permitting solutions, which also helps to increase producers’ overall crop production.

Growing Pains

We promote our agronomy services a la carte, including soil testing, crop scouting, electrical conductivity mapping, variable rate application, data cleanup, financial tracking, GIS and a data package which includes an end-of-year review where we use production data to gather meaningful insights and design next year’s program. It’s only really started to become part of our business culture in the last 3-4 years.

One of our barriers to growth is that many customers are not sold on the value of data collection. Some customers collect data, but don’t use the information to aid in production decisions. As technology evolves, advanced tools will further increase the importance of collecting data. Roughly 8% of our customer base is using all available data to manage their production practices, which is way too low, in my opinion.

There’s a lot of room for growth, and it will take time, but we are committed to helping our producers evolve in the precision ag space.

“Blurred precision” is a term I use to describe the mishandling of a business’s precision agriculture strategy. Some players’ main goal is to seek venture capital investment or enter the space before showing actual customer profitability or risk reduction, and some don’t have a divorce strategy. This leads to confusion at the farm level, reluctance to explore new partnerships and understandably pushes growers away from the data space. Every new agreement with a customer must have clear expectations, measurable goals, return real value to the customer, and have a divorce strategy in place to create trust.

If a customer wishes to change platforms or seek a new trusted advisor, he should be able to willingly and freely, with his data in hand. A comment from a very established agronomist that stuck with me was, “We have thrown this precision ag ball at our producers for some time now. This time, we need to make sure they really connect.”

Eight years ago, we brought on a couple of customers who understood the importance of using data to make strategic decisions and asked them to trust us with their data. We began working to build an intimate relationship with those customers and have had 98% repeatability

with them.

As new technology becomes available, we can use that data to improve those customers’ decision making, decrease risk and increase profitability.

It’s an investment by us to provide our customers with the solutions they need to fully understand their production practices, nutrient management plan, herbicide plan, yields, moisture levels, equipment information, etc. and how to tie all the data together.

Setting Expectations

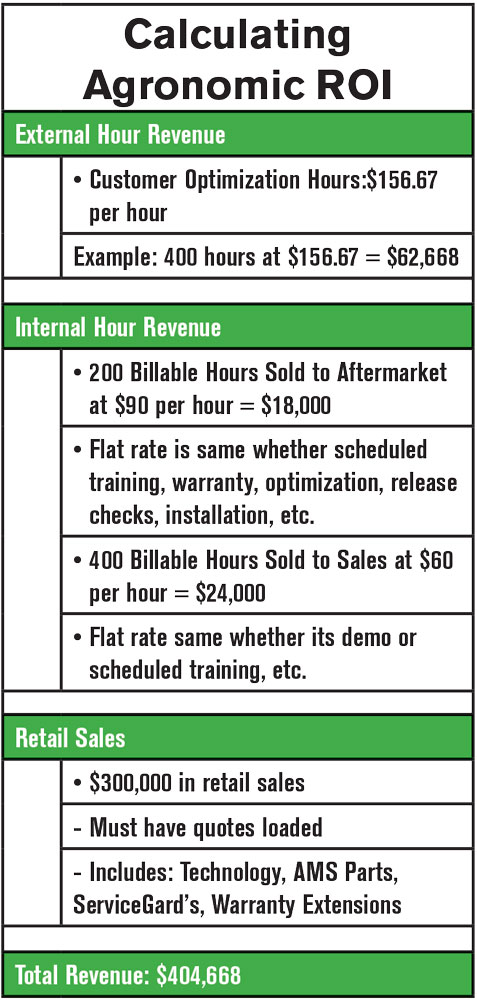

I want our solutions specialists, who are promoting technology and optimizing the equipment, to be selling $350,000 - $400,00 (Canadian) in revenue per year, which is broken down into 3 sections. We have external hour revenue, which is for going out to customers and helping them with their precision ag, so selling their time. We have customers who buy a block of time to help optimize their equipment.

An example of that is our solutions specialist optimizing a piece of equipment during a combine demo. Seeing that, the customer booked him for 50 hours to optimize their current fleet of equipment for a year.

Martin White, division sales manager with Enns Bros., walked through a hypothetical scenario for tracking agronomic ROI, based on the dealership’s experience with developing agronomic services.

That solution specialist effectively became a trusted partner in that farm, which strengthened our customer relationship and created another revenue stream. All we had to do was focus on the details.

Another avenue is internal hours, billable to sales and service. For service, maybe that solutions specialist is performing release checks or installs precision ag technology on equipment that’s already sold. For sales, whenever we sell a piece of equipment, we tie in an optimization package which, upon completion, is charged internally to sales.

Solutions specialists effectively sell technology and performance upgrades, aftermarket kits and other items that our sales team doesn’t always have time to focus on. When we bring our departments together, we can focus on details that further support true agronomic value.

Another benefit of bringing field advisors and solutions specialists together is that our demo strategy has become more successful. We can tailor our demo to better satisfy a customer’s requirements, benchmark the demo data to show increased value and hopefully engage the customer on other details of his operation as well.

On our agronomy side, we want every field advisor to bring in $300,00 to $350,000 (Canadian) in revenue. Their mix of precision ag services will dictate their revenue potential. At that point, their bucket is full.

Like everyone in your organization, the precision ag group has to have clear goals and be held accountable. We’ve made a significant investment in our precision ag strategy over the last 8 years, but we knew we were investing in the future. We have found that you need to add the field advisor before you can grow your precision customer base.

Once on this path, you need to believe in the strategy as it’s a long-term game, especially considering it takes time for a new field advisor to grow his revenue to cover expenses, sometimes up to 3 years. Collaborate with like-minded local retailers, agronomic partners and third-party groups in your area, and your business will continue to grow.

There are many intangible benefits to our enterprise during this time of growth. We’ve given our specialists the tools, made a significant investment in onboarding and training, and over time, their revenue number will grow to $300,000 as well.

Building Relationships

For all the agronomists working with a dealer, be sure to share those wins with customers and departments with the dealership. For example, one of my agronomists told a customer, “I saved you $14,000 last year on inputs alone over and above your investment in our precision ag program.” That’s huge! Make sure you remind the customer where that value is and what you’ve done for him because there are a lot of competitors out there not able to articulate that value statement.

More and more, we hear the relationship with a customer’s field advisor is increasing in importance. “I appreciate my relationship with my Account Manager, but I place huge value on the collaboration with my field advisor.” We’re talking about the ‘why’ of production, what their goal is, and how we’re going to push the land.

In 2012, we were doing $303,000 of revenue with one field advisor. In 2020, we budgeted up to $1.8 million. That’s an important number for me, because we continued to align with our “boots on the ground” vision. A big part of that growth was on boarding the right talent, partnering with the right technology, and ensuring precision ag becomes part of the enterprise culture.

In one year, the solutions specialists sold another $500,000 of precision technology, aftermarket kits and warranties, because we focused on them. There were quite a few years where our precision ag program was not as profitable as we would have liked. Profitability is hard to measure, so dig deep into those details.

Precision ag needs to show a positive return on investment from our dealership and our producers, so it’s up to all of us in the precision space to make sure we can measure ROI. The challenge for us, as dealers, is to tie equipment and technology together in a meaningful way that promotes sustainable agronomic practices.

Some of this will come from using data to satisfy transparency and compliance requirements for the other end of supply chain.

Create Balance Between Precision Hardware Sales & Agronomic Service

Mitchell Hora, Owner, Continuum Ag

With precision ag tools, we were miles ahead in utilizing grid testing, soil sampling, tissue sampling, aerial imagery and now drones, which has been great. We’re taking it one step further to utilize agronomic zones and the Haney soil health test, which gives us our phosphorus (P), potassium (K), pH and organic matter, but also plant available nitrogen (N) in the nitrate, ammonium and organic form, organic, P and inorganic P, micronutrients, carbon in the soil and biological activity.

Soil health is one of the biggest buzzwords and it’s definitely sticking around. A couple of years ago, it seemed like a fad, but it’s not. Sustainability is here to stay. Soil health is here to stay. Transparency from farm to fork is here to stay.

Technology continues to help this happen even faster. It boils down to being able to talk to customers about the principles of soil health: minimizing disturbance, keeping armor on the soil, keeping living roots at all times, keeping cover crops or more diversity in our operations, getting out of only farming corn and soybeans. For many of the customers you work with, looking at the profitability of changing things up and maybe integrating livestock as well.

As we’re implementing more sustainable practices and soil health methods and having conversations with our customers because they’re reading about it in magazines, we need to be able to have data to help guide them and show them where they are at now and where they’re going.

We utilize our Continuum Ag RightWay Program and we’re able to scale the system by wholesaling this program on the back end of their consultants, agronomy companies and precision dealers. It’s not expensive to do this stuff and the cost to the farmer ends up about the same as they pay for grid sampling today.

To interpret the data, we built the TopSoil Tool where data can be managed, and action can be implemented. The system is web-based to manage this information from your phone, iPad, or computer as you’re having a conversation with a farmer. This is the first system to manage soil health data.

What we’re able to do is track through these different soil data layers like carbon and biology activity and these new parameters that we haven’t really quantified before. Now, we can actually toggle through those layers as you are field scouting.

It tracks your location in real time, and you can toggle through management data layers to utilize this more advanced information, differentiate our operations, and provide that next layer of agronomic value to the customer.

Essentially, we’re going from grid soil sampling, which has helped us get to where we are now, to utilizing zones to fine-tune this even more. We’ve got the equipment to do it, we’ve got the know how to do it.

Cashing in on Credits

Carbon credit markets are one example. There are a couple of different groups working on this and companies like Walmart or FedEx made a $200 million commitment to developing these markets. These groups are saying that we have a large carbon footprint, with our equipment, shipping and industry we’re emitting a lot of carbon dioxide into the atmosphere.

With social pressure and consumer-facing pressures on their sustainable emissions, they want to offset their carbon footprint. They can only clean up their supply chain and do so much internally such as making engines that are more fuel efficient, shortening supply chains, etc.

To offset the rest of their carbon footprint, they’re asking farmers to put that carbon back into the soil. Now farmers are going to be able to be rewarded for this based on tons of carbon stored in the soil. We’re able to quantify some of that carbon. Having this conversation with growers is super important and a way they’re going to be able to be more profitable going forward.

As farmers, building carbon in the soil and organic matter means improved water holding capacity, better nutrient holding capability, better efficiencies and more money in my pocket. They’re going to pay us to pump more carbon into our soils, which helps us agronomically.

Same thing for improving our impact on water quality and nutrient efficiencies, utilizing our precision equipment to its maximum potential. Seeing that return on investment through better input utilization and improved yields, but now a consumer-facing dollar as well. We know we have to be able to infiltrate water, reduce flooding and improve our water usage so we’re less susceptible to weather issues.

Learn More

-

8 Tips for Building Better Dealer-Farmer Precision Partnerships

Three farmers and three precision equipment specialists discuss strategies for anticipating service needs, maximizing sales opportunities and avoiding customer conflict.