Use of precision agriculture technology continues to increase among no-till farmers, a demographic that experts say has a strong history as early adopters of farming technology.

No-till is a growing market in the U.S. and worldwide. Research from 2018-19 estimates there are 162.8 million no-till acres in North America and 507.6 million conservation agriculture acres worldwide.

No-Till Farmer, a sister publication to Precision Farming Dealer, conducts an annual benchmark survey of growers in North America, asking about operational plans, equipment expenditures and more. The 2022 No-Till Benchmark Survey received 480 responses from growers in the U.S. and Canada. The average respondent is 45 or older, farms 1,365 acres of mostly corn and soybeans, and has at least 6 years of no-till experience.

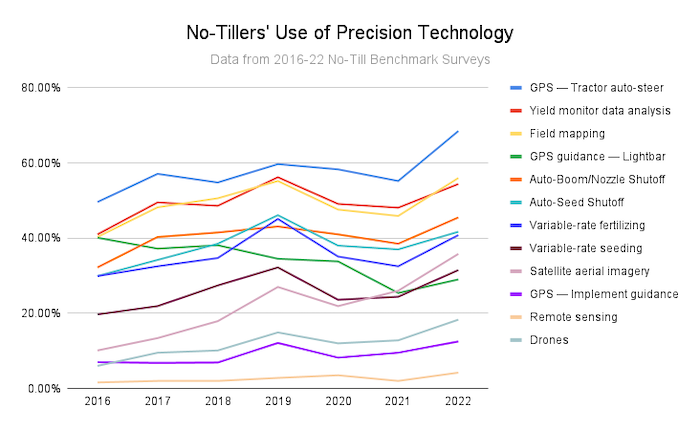

The survey asked farmers if they used 12 types of precision technology in their operations: GPS — tractor auto-steer, yield monitor data analysis, field mapping, GPS guidance — lightbar, auto-boom/nozzle shutoff, auto-seed shutoff, variable-rate fertilizing, variable-rate seeding, satellite aerial imagery, GPS — implement guidance, remote sensing and drones.

In 2022, usage of all of the technologies increased compared to 2021. Some highlights include:

- Auto-steer is the most used precision technology with 68.5% of no-tillers planning to use it in their operations in 2022.

- The second and third most popular technologies are field mapping (56% in 2022) and yield monitor data analysis (54.4% in 2022).

- Usage of implement guidance increased to 12.5% after usage dropped from a high of 12.1% in 2019.

- While planned usage of lightbar GPS guidance is up in 2022 (29% compared to 25.4% in 2021), this category has been on the decline from the 40.1% reported in 2016.

No-tillers' use of all 12 types of precision technology listed in this chart increased in 2022, compared to 2021.

- Auto-steer is the most used precision technology with 68.5% of no-tillers planning to use it in their operations in 2022.

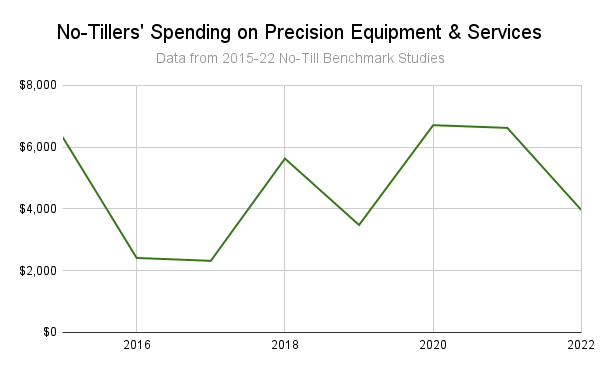

Projected spending on precision equipment and services fell by nearly 60% compared to 2021. Surveyed farmers expected to spend an average of $3,960 per farm on precision equipment and services in 2022.

No-tillers' projected spending on precision equipment and services fell by nearly 60% in the 2022 No-Till Benchmark Survey, compared to respondents' projections in 2021.

As illustrated in these charts, usage of precision technologies is up in 2022, despite a decrease in spending. The reason is likely due to two factors, according to Scott Shearer, chair of the department of food, agricultural and biological engineering at Ohio State University.

“The cost has come down for a lot of the precision technology, and a lot of people aren't separating out their expenditures on these purchases because it’s baked into the price of either the new machine or used equipment,” Shearer says.

He recalls when auto-steer systems using RTK GPS corrections had to be added onto the tractor for an additional cost of $50,000-$60,000. Today, the same technology comes baked into the price of the tractor.

“It’s just cheaper to build the tractor with the technology and expect the farmer to use it,” Shearer says. “When the farmer purchases that tractor, they’re essentially buying the unlocks and getting all the hardware for auto-steer upfront. That tells you how some of these technologies mature.”

Similarly, new combines already come with yield monitors on them, so a separate monitor added to an older machine usually stays with the old machine when the farmer trades it in and becomes part of the traditional equipment costs.

Shearer spoke to Precision Farming Dealer for the article Which of Your Customers Were Early Adopters of Precision Technology?. The article details why no-tillers have a strong history of precision agriculture adoption and predicts what technologies no-tillers will seek next.