Pictured Above: Third-party partnerships with independent agronomists is a potentially cost-effective option for precision farming dealers to offer data management service to farm customers. Photo courtesy of Terry Brase.

When it comes to selling precision ag technology, farm equipment dealers have had success with tools that customers can hold in their hands and easily translate to efficiency in their fields.

Auto-steer systems and GPS navigation offer tangible paybacks, both for the grower buying the system and the dealer selling it.

But a far more abstract, yet no less valuable tool — precision data management — is only beginning to be realized as a potential revenue source by dealers.

‘Potential’ still being the operative word, says Matt Liskai, co-owner of Green Field Ag, a precision ag dealership in Gibsonburg, Ohio.

“Our bread and butter is always going to be selling that precision equipment,” he says. “The profit comes in the form of precision equipment sales, but a lot of us dealers are seeing the opportunity to offer value to customers and make money with data management services as well.”

Liskai and a business partner recently purchased Green Field Ag — formerly the precision equipment side of Widmer & Assoc., which offers agronomic services and fertility products. Liskai acknowledges that agronomic expertise isn’t a trait farm customers tend to associate with their equipment dealership.

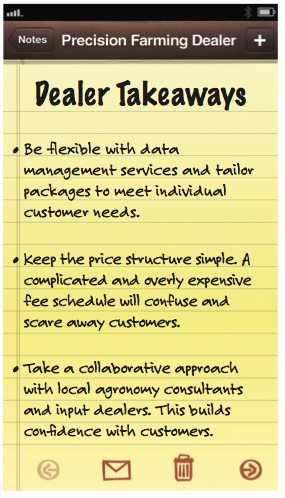

Precision farming dealers are exploring ways to generate revenue through data management services. Some are offering introductory training sessions or tiered service packages to complement sales of other precision farming products. Photo courtesy of Case IH

However, the roles and responsibilities of precision farming dealers are evolving to the point that they are being called on to do more than simply install and service technology.

“The key thing is getting customers to collect that yield data. That is three-fourths of the battle,” Liskai says. “I think where precision ag dealers can assist is by providing good products and good data collection, which helps sell more equipment when the customers see that return on investment.”

Getting Started

But one of the ongoing challenges for dealers looking to turn data management from a complementary piece to a profit center, is where to start.

Green Field’s approach is to let customers initially decide — at a reasonable cost — how invested they want to be in managing their data.

The dealership offers software training clinics, where for $150, customers can spend a day learning about how to best collect data and what they can do with it. About 30 growers attended a clinic last winter held at the dealership.

The clinics are designed to be educational, but have also resulted in customers taking advantage of the dealership’s data management services.

Green Field Ag offers software training sessions at its dealership in Gibsonburg, Ohio. For $150, customers get an introduction to data management that opens the door for the dealership to provide additional services or equipment to customers. Photo courtesy of Green Field Ag

“If you come right out and drop a $65-70 an hour fee on guys who have never been in front of a computer, you are going to scare them away and they aren’t going to want to pay for it,” Liskai says. “But bringing them in to a one-on-one training course or with a group is how we generate revenue from the software side of the business and data management.”

Green Field uses three different types of data analysis software — SMS Basic and Advanced, Farm Works and Ag Connections Land DB — to process precision data for customers.

While Liskai is not an agronomist, Widmer has four on staff who work with him to help growers organize and make sense of their data.

“A lot of it is pure management of the data, so our customers don’t have a mess in front of them,” Liskai says. “We’ll charge per hour and help guys map AB lines during the winter or clean up their monitor and then present them with a report.”

Customers then decide if they want to take the next step and have Widmer’s agronomists work with them on planting prescriptions.

Liskai says there is no obligation or pressure for farmers who attend the training sessions to invest in Green Field’s data management services. The majority of his precision customers don’t work with Widmer’s agronomists, he says.

But the data management clinics have led to future precision sales and opened the door for long-term business relationships with customers.

But the data management clinics have led to future precision sales and opened the door for long-term business relationships with customers.

“Customers feel like they are getting what they pay for with those clinics,” Liskai says. “We try not to overwhelm them at the start, and if they end up paying the $65-70 hourly fee for our software management or buy another piece of equipment, then we know it’s worth it.”

Bundling Up

The ability to show customers the initial value that precision data holds, while not overloading them with information or cost, can give dealerships flexibility with how they package data management services.

The goal is to have agronomic service offerings and precision equipment sales feed off one another, says Adam Gittins, general manager at HTS Ag in Harlan, Iowa.

For the last six years, HTS Ag — a precision equipment dealership — has incorporated tiered data management service packages with sales of new precision equipment.

“It’s something we’ve helped pioneer and it definitely works when you can start tying services together because customers see a package of things and we can cater to what will work best for them,” he says. “If you can bundle multiple things together, that makes it more enticing for customers and allows us to offer a lower price point for the entire package. If you break things apart, we’ve got to charge a higher price.”

HTS Ag offers three different data management packages. The introductory plan includes mapping of yield data for $0.75 per acre. The mid-level plan for $1.50 per acre includes some investigation of yield variability due to soil type or hybrid seed selection. The top-tier package, at $3.50 per acre, includes variable rate prescriptions based on yield data analysis.

“Our precision service agreements include onsite visits to farmers, phone support and firmware updates, but we’ll also offer those different levels of data management,” Gittins notes. “It’s worked well for us.”

HTS Ag handles and processes the data from a technology standpoint, but partners with independent agronomists to prescribe planting recommendations for customers.

Gittins says HTS Ag is essentially the “back office” for data processing and ensures that the agronomists they work with have the right information to be able to make an accurate recommendation to customers.

“The real missing key is a lot of the agronomists can make a very sound agronomic recommendation, but have no idea how to process the data through a computer system to get them to the correct file or the items they need to effectively implement it,” Gittins says. “That’s where we come in.”

Leveraging Independence

Although the sale of precision farming technology and managing the data collected by those tools can be a profitable partnership for a dealership, Gittins says it’s important to make sure employees know their role in that equation.

Although HTS Ag doesn’t sell iron, Gittins says the dealership made a commitment to offering data management services in conjunction with its sales and support of precision farming technology.

This means having the right people in place for each service, and not trying to put someone in a role they can’t handle.

“I’ve got technicians who are very mechanically inclined and also guys who are data gurus and don’t like to have grease under their fingernails,” Gittins says. “There is some overlap, but it’s pretty rare.”

Since many growers seek their agronomic advice from their seed or fertilizer dealers, it’s imperative that equipment dealers market themselves as both knowledgeable and independent when it comes to data management, says Harold Reetz, Reetz Agronomics in Monticello, Ill.

In other words, equipment dealerships need to give customers a reason why they should turn to them for data management services.

“Don’t take a top mechanic and make him an agronomist,” Reetz says. “You have to make a serious commitment to do it right, or you will risk bad relationships with customers.”

Adding a full-time agronomist is one option for equipment dealerships, but a potentially more efficient option, says Reetz, is partnering with a third-party consultant to handle the agronomic analysis.

The benefit for precision ag dealers is being able to serve as “data managers” for customers, rather than having to hire a full-time agronomist.

“Having a third-party vendor providing the agronomic service could be a way for dealers to save the overhead cost of another staff person,” Reetz says. “But the dealer can also sell that idea of data management and it’s an opportunity to tie sales of new equipment with that service.”

Keeping it Simple

For multi-store dealerships, the ability to cast a wider customer net through data management offerings is an asset.

John Deere dealership 21st Century Equipment LLC operates 11 stores in Colorado, Nebraska and Kansas and offers several different data management programs, in conjunction with support from local agronomists.

“It’s predominantly independent crop consultants in our area. For us, it comes down to respecting those relationships and working with them if we want people to come back to us,” says Justin Childears, director of precision ag technology and systems for 21st Century. “So we certainly collaborate with those folks.”

But the dealership starts the data management conversation with customers through its internal John Deere FarmSight services. This includes an initial meeting with one of six precision ag specialists employed by the dealership and tailoring a data management plan to suit the customer.

From there, customers can choose what services they want to invest in, including soil EC mapping, soil moisture monitoring and variable rate application on a per acre basis.

“I like to think there’s three areas of data management — the mechanical, the electrical and the computer software,” Childears notes. “Our goal is to sit down with customers, look at each of those pieces and make them fit.

“Keeping it simple for the end user is pretty important.”

Future Opportunity

One way 21st Century sought to make their data management services more user friendly is by moving toward a flexible price structure.

“We initially had some complexity from a pricing standpoint that was making it difficult for customers to get their arms around the services,” Childears says. “We tried to establish different levels and that seemed to complicate things, instead of simplify them.”

The dealership has since moved to a less rigid pricing system that gives customers more flexibility to package the data management services that best suits their farm.

Childears says the switch is spurring growth in the dealership’s data management business and eventually he sees the service structure emulating that of other non-ag professions.

“I see this becoming like legal advice or accounting where customers pay a professional fee and they have a clear understanding of what to expect from that service,” he says. “We’re not there yet, but data management is going to be part of our revenue growth in the future and we expect it to be self-sufficient.”

As Gittins puts it, he sees additional opportunity for precision farming dealers as depositories for precision data. Dealerships will maintain and store farmer-owned data.

“Much like farmers or businesses will seek out an accountant to help them with taxes or tax preparation, I see our role moving forward as data curators,” he says. “We’ll be the ones who will centralize the data coming in from different places and manage that for customers and make sure it’s securely backed up.”

But in order to get to that point, Childears says it will take time to convince customers that equipment dealerships are equipped to take on data management.

For 21st Century, this will come through their success selling and servicing precision products.

“It’s building on the reputation we have with customers starting with the sale and right through support of the technology,” Childears says. “Exceeding their expectations allows us to have that discussion on the agronomic decision support side.”

The ability to have an individual solely dedicated to data management collection is another vision of the future for dealers.

While Green Field focuses on precision ag products and Widmer provides the agronomic expertise, Liskai notes that having a full-time person whose only job is to manage and gather data could be the next step toward increasing the dealership’s data management footprint.

“I’d love to see us get to the point of having a computer guru where all they do is go grab data and then generate reports for customers to turn into the FSA on their acreage,” he says. “Right now, we get so wrapped up with getting equipment installed, we’ll get pulled off the computer and tend to value equipment sales more than the record keeping side.”

Learn More

-

8 Tips for Building Better Dealer-Farmer Precision Partnerships

Three farmers and three precision equipment specialists discuss strategies for anticipating service needs, maximizing sales opportunities and avoiding customer conflict.