If the ag industry has taught precision farming dealers anything during the last few years, it’s that no longer can they rely on singular sales of hardware and expect to grow business.

For some, this has been a hard lesson learned. But the evolving market has allowed adaptable dealers to capitalize on changing technology priorities among their farm customers.

The results of this year’s sixth annual Precision Farming Dealer benchmark study — with contributions from nearly 100 farm equipment dealers, input retailers and independent precision companies — reflect increasing momentum for multi-layered products and agronomic services.

Says one farm equipment dealer in Nebraska, “Validating the ROI from previous year’s field trials and demo plots show customers that precision is the last place they should be cutting their budgets. Most farmers have the equipment to use the data they collect, but they just don’t do it. We need to show them how and why.”

The 2018 data — collected during the first quarter — continues dealers’ optimistic revenue outlook, with the majority of respondents forecasting measurable growth for the second straight year.

While confidence is trending upward, challenges persist in the form of market saturation, technician training and a bankable billing strategy for precision service.

Profitable Forecast

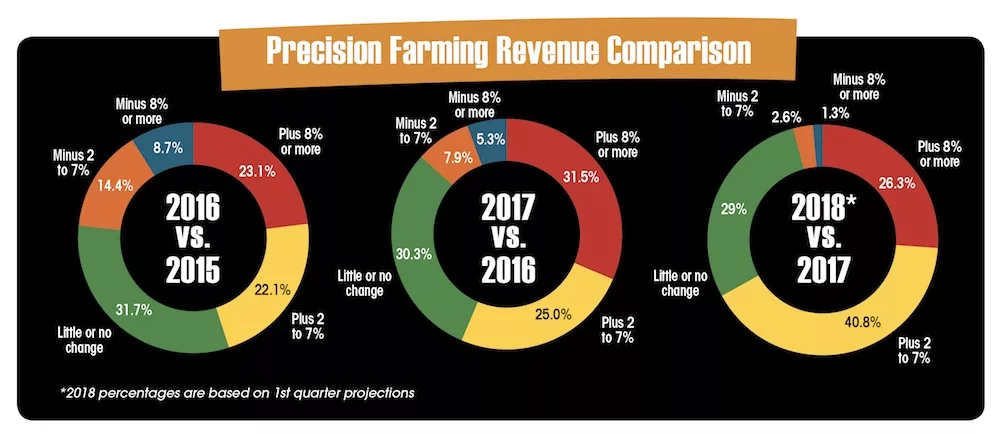

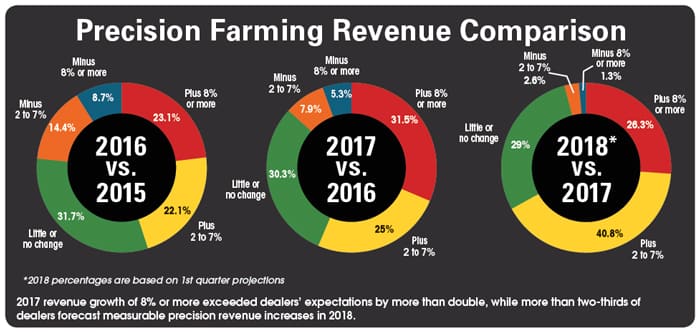

Results of this year’s benchmark study continue the generally positive outlook and results dealers had in 2017. Based on the responses gathered during the first quarter of 2018 from 29 different states and Canada, 31.5% of dealers reported precision revenue growth of 8% or more in 2017, more than double the forecast in last year’s report (15.4%).

This marks the second consecutive year dealers exceeded their higher-end revenue expectations by more than double. Last year, 23% of dealers reported 2016 precision revenue growth of 8% or more, more than doubling the forecast (10%) from the 2015 report.

However, dealers fell short of more modest revenue projections in 2017. Some 44.2% forecasted growth of 2-7% in last year’s report, but 2018 data shows that only 25% achieved that goal. A slightly higher percentage of dealers reported revenue declines of at least 2% (13.1%) than projected in 2017 (11.5%).

Still, the declines are less significant than in 2016, when 23.1% reported a dip of at least 2%, including 8.7% that saw a decline of 8% or more.

Further analysis of 2017 revenues shows that 30.4% of farm equipment dealers — which account for 74% of survey respondents — reported precision growth of 8% or more, doubling projections (12.5%). However, only 23% reported revenue growth of 2-7%, well below the 2017 forecast of 45%.

Independent precision dealers accounted for 16.9% of respondents and fell short of 2017 revenue growth expectations. Last year, 80% forecasted an increase of at least 2%, but only 57.2% reported achieving that goal. However, it’s worth noting that no independent precision dealers reported a decline in revenue, consistent with the 2017 forecast.

So what are dealers expecting this year? Overall, 67.1% forecast revenue growth of at least 2% over 2017, with 26.3% projecting growth of at least 8% — the highest total since the study began tracking revenue outlooks 4 years ago.

Sizing Up Revenue Forecasts: Big Dealers See Biggest Growth Potential

Although dealer consolidation is a growing part of the ag industry, smaller dealerships represent the largest percentage of participants in the 2018 benchmark study at 47%.

But 1- to 2-store farm equipment dealers also represented the smallest segment dealers that saw at least 2% revenue growth in 2017, at 36.8%. In addition, 21% of this segment reported 2017 revenue declines of at least 2%.

Single or 2-store dealers also have the most conservative outlook for 2018 precision growth of 8% or more, at 15.8%. However, only 5.3% are forecasting a measurable dip in revenue.

Perhaps not surprisingly, larger dealer groups reported the most substantial revenue growth in 2017 and have the most aggressive outlook for 2018. Some 91% of dealers with 11 or more stores reported revenue growth of at least 2% last year, and 54.6% of this segment project growth of at least 8% in 2018.

Some 9.1% of this segment reported revenue declines of at least 2% in 2017, and none project a decrease in 2018.

That’s not to say the pathway to increasing precision profit for larger dealerships isn’t without its challenges. One precision farming specialist at a 14-store dealer group in the Midwest notes, “We’re facing the integration of a newly acquired company and molding the 2 organizations together. Training on new systems and helping to get the new organization up to speed is a substantial undertaking.”

Only 3.9% of respondents project revenue declines of at least 2%, a record low. Some 29% expect precision revenues to remain flat in 2018, consistent with the 2017 forecast.

Optimism for 2018 is highest among farm equipment dealers, with 69.6% projecting precision growth of at least 2%. Only 3.6% project a measurable decline in precision revenue.

Seed and fertilizer retailers or co-ops follow with 66% anticipating growth of at least 2% and none projecting a decline. While only 57.1% of independent precision dealers forecast measurable revenue growth in 2018, some 35.7% project revenue gains of 8% or more — tops among the different dealer classifications this year.