A common refrain from dealers who reflect on the hey-day of precision products is that technology tended to sell itself, with little or no assistance needed by salespeople.

Those days are gone, as dealers are embracing a more comprehensive sales approach — tying hardware, software, subscriptions and service together in an attractive package.

Dealers have cited decreasing margins on components alone, and one precision dealer from Kansas adds, “We need to determine which technology products, precision services and data systems make the most sense for us to provide our customers. We can’t take on every new thing in the market, so we need careful analysis of new products, services and systems before investing in them.”

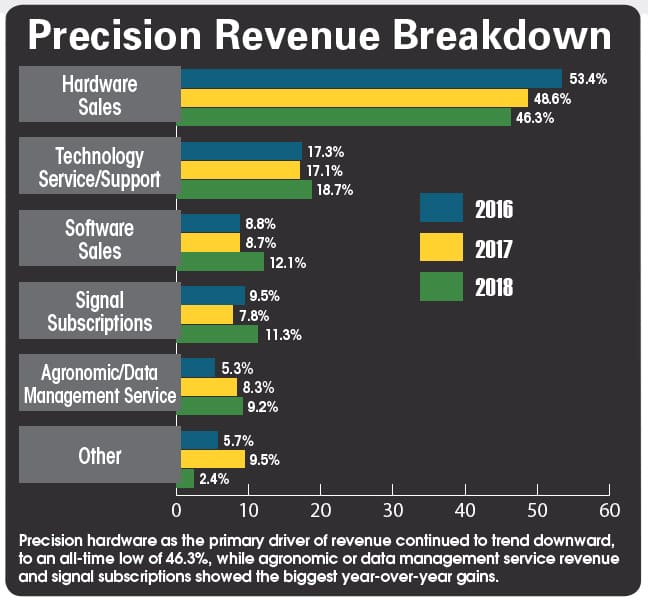

This mindset is reflected in a continuing trend toward a more balanced breakdown of precision revenue sources according to results of Precision Farming Dealer's most recent benchmark study. For the third straight year, dealers’ reliance on hardware as the primary driver of precision sales dropped to an all-time low of 46.3% — a nearly 10% cumulative decline since 2013.

Trending up year-over-year as growing pieces of the precision revenue pie are agronomic or data management service (+3.8%), signal subscriptions (+3.5), technology service and support (+1.5%) and software sales (+0.6%) (See chart, "Precision Revenue Breakdown").

Standalone Momentum

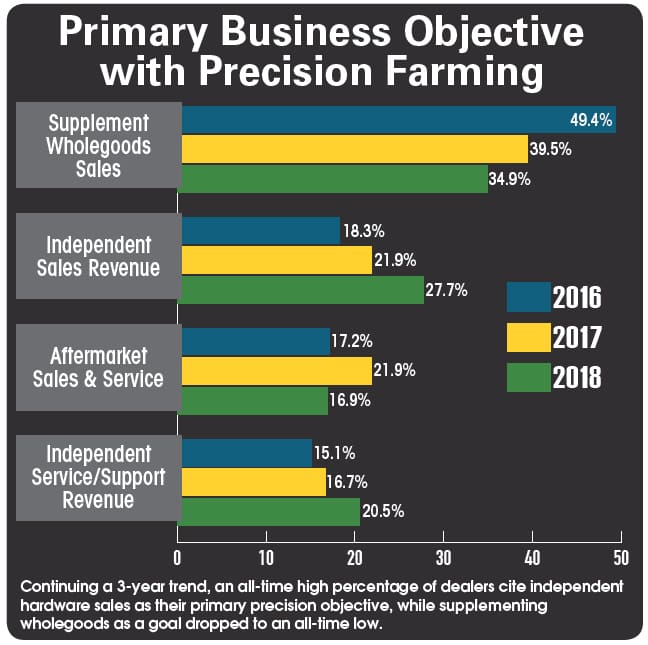

For the sixth consecutive year, the majority of respondents say their primary business objective with precision is to supplement wholegoods sales. But 2018 was also the lowest percentage — 34.9% — in the history of the study and continued a 3-year decline.

In as many years trending upward is a growing percentage of dealers making independent sales of hardware, software and services their primary objective to generate precision revenue. Some 27.7% identify standalone hardware sales as their main goal, a 6% jump over last year and 10% increase over 2015.

Another 20.5% cite independent service and software sales as their primary precision revenue objective, also double the total from 2015 and up more than 3 points year-over-year.

Visiting with single-store independent precision dealer Pete Youngblut, owner of Youngblut Ag in Dysart, Iowa, in late 2017, he shared his competitive strategy for growing profits at his 5-year old dealership.

You May Also Be Interested In...

20 Ways to Build Your Billable Precision Service Revenue

Precision Farming Dealer has collaborated with a diverse group of retailers of all sizes, colors, and locations to provide YOU with the best advice, insights and experienced-based tips for your precision business. This FREE eGuide is equipped with 20 proven tips, tactics and techniques for making precision services a recurring revenue stream with your dealership’s precision business. Download now »

“When we’re servicing, we’re selling,” he says. “We’ve done steering system installs and a customer’s planter is in his shop, so if there’s two of us in the job, one will talk to the farmer about planter upgrades, while the other one works on tractor. By the time we walk out, we’ve got another order to place.”

This dual-purpose mentality can be a valuable asset for developing a pipeline of precision business. At the same time, multitasking can come with the job for dealers who are emphasizing sales and service, separate from farm equipment sales.

Precision Point Person

Visiting with precision farming managers during the last year, more have emphasized their efforts for department cross-training, specifically to troubleshoot low-level technology problems.

Having service techs or even parts department staff with working knowledge of hardware installations, planter calibrations and display setups can free up experienced precision specialists to tackle more complex, time-consuming projects — which can also translate to more billable time.

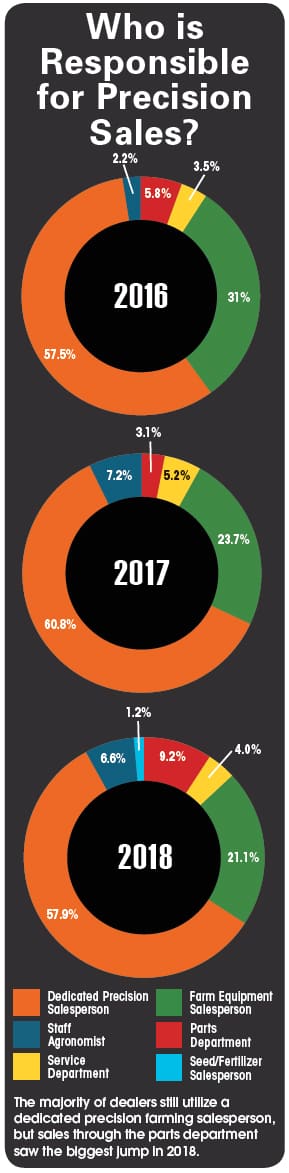

That said, the majority of dealerships still rely on a dedicated precision salesperson, though the percentage has fluctuated in recent years. Some 57.9% have someone specifically for precision sales, down about 2 points from last year, but consistent with 2016.

The biggest year-over-year increase came in the percentage of parts department staff selling precision products — up more than 6 percentage points over 2017 to 9.2%. It will be interesting to see if this growth continues next year and perhaps is part of dealers’ strategy to stock and sell precision components through the parts department.