Benchmark Study

ARTICLES

Benchmark Study

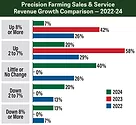

2026 sales outlook looks solid with 42% forecasting at least 2-7% bump, according to Precision Farming Dealer Benchmark Study

Read More

Precision Dealers Eyeing Bounce Back Year After Challenging 2024

12th annual Precision Farming Dealer Benchmark Study reveals 60% of dealers predict higher sales in 2025

Read More

Precision Farming Dealer 2022 Benchmark Study

Precision Revenue Outlook Remains Positive Despite Slight Decline in 2022

10th annual Precision Farming Dealer benchmark study reveals nearly 60% of dealers forecast precision sales to be up at least 2% in 2023.

Read More

2021 BENCHMARK STUDY

Dealers Remain Positive on Precision Revenue Growth for 2021

In a year when dealers are facing inventory shortages from wholegoods down to parts — including precision offerings — their outlook for precision revenue in 2021 is largely positive.

Read More

2020 BENCHMARK STUDY

Precision Outlook: Dealers Shift Focus to Application Hardware, Maintain Need for Training

Training for staff and customers as well as application technology hardware came in as dealers’ top priorities for the future of their businesses

Read More

2020 BENCHMARK STUDY

Precision Revenue Growth Slows as Dealers Navigate an Evolving Market

For the first time in 5 years, dealers did not exceed higher-end growth projections in 2019, and forecast more conservative growth in 2020.

Read More

2019 BENCHMARK STUDY

Part 4: Dealer Priorities Trending Toward Data Management & Staff Training

Data analysis, staff retention and avenues to navigate the ag economy topped the list for dealer focuses in 2019 and beyond.

Read More

2019 BENCHMARK STUDY

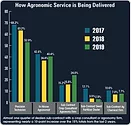

Part 3: Putting Agronomic Emphasis on Service Revenue & Customer Retention

In-house agronomists and annual service contracts see jumps in 2019, while fewer rely on precision specialists for delivery of data management support.

Read More

2019 BENCHMARK STUDY

Part 2: Mix & Match Approach with Precision Products, Services Sets Up Comprehensive Sales

Hardware sales rebounded, independent sales revenue dipped and fewer dealers have a separate department for precision farming.

Read More