For nearly the last 100 years, agriculture has witnessed only consolidation. This has been true across the board, from machinery manufacturers, to seed companies, to farm cooperatives and grain elevators. The last few years, however, have reversed the trend. We are seeing startups and venture capital gravitate towards the ag sector. Technology and big data are leading this resurgence.

But I also see new ag technology firms making mistakes because they assume farming is just like any other business. Farming is different. Here’s my list of the five things every Silicon Valley startup should know about Midwestern farmers.

1. Farms are collection of small, medium, and large businesses. Farmers are not consumers. Of course farmers consume all sorts of products for their farms, but these are business decisions, not made as lightly as picking salad dressing at the grocery store. New companies entering the ag market should treat their potential farm customers as sophisticated business owners, not relatively uneducated consumers who make split second purchasing decisions.

2. Farming is a relationship-driven business. If you have never lived on a farm, you might assume that farmers lack the close neighborhood relationships that come with living in a city. But you would be wrong. Even before cell phones, email, and the internet connected everyone, farmers were tightly knit into their local communities. This is because the local community provides so much for the farm, from the local church, grain elevator, café, to the hardware store. I knew my neighbors better when living on a farm than I do now, when they are just down the street. Farming is built on these relationships, and farmers are loyal to the people they know. If you want to sell your product to farmers, you need to develop those relationships. Relationships will trump product every time.

3. Farmers are notorious experimenters. A technology company might mistakenly interpret farmer interest in their product as indicator for long-term success. I think farmers have always been tinkerers, willing to experiment here and there to see if they can squeeze a few more dollars out of their production costs. Need proof? Pick up an issue of Farm Show magazine. If farmers seem really interested in your new startup product, that may be a sign you’ve got something. Or it may be a sign farmers like to experiment. If you cannot deliver a consistent return on investment, year after year, farmers will move on to experimenting with something else.

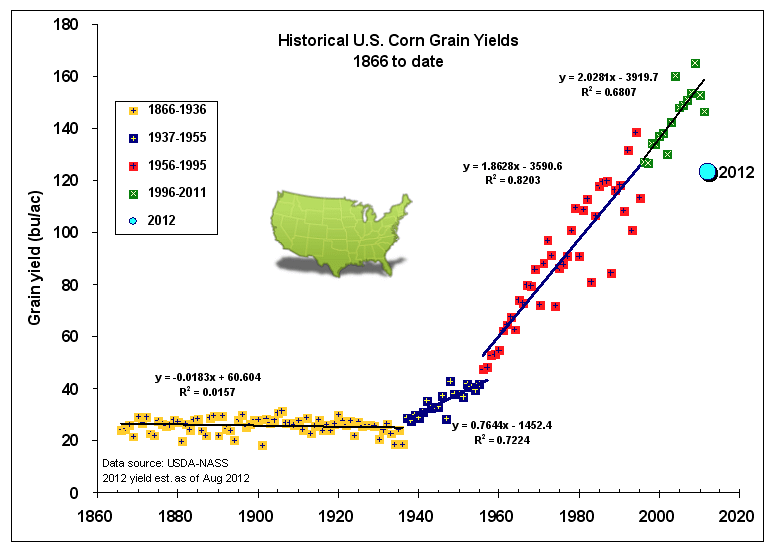

4. There are no shortcuts to results. With a couple of exceptions, improvements on the farm have come in small increments. Each year farmers get more efficient, and yields and productivity tick up. Look at this chart showing corn yields over the past century. Hybrid corn was a revolution in the late 1930s, but ever since we have seen gradual increases in production.

I am believer that big data is going to revolutionize farming, but new companies entering the market should not over-promise results. Show farmers how your product or program will increase yields by 3%, but only cost an additional 1% per acre, and farmers will come. Promise them 10% increase and only deliver 3%, and they will quickly leave. The digital revolution to farming, like all technological progress over the past century, is going to come in small increments.

I am believer that big data is going to revolutionize farming, but new companies entering the market should not over-promise results. Show farmers how your product or program will increase yields by 3%, but only cost an additional 1% per acre, and farmers will come. Promise them 10% increase and only deliver 3%, and they will quickly leave. The digital revolution to farming, like all technological progress over the past century, is going to come in small increments.

5. There is no prize for collecting the most junk data. We are in the midst of a digital land grab. If I added up all of the data startup companies’ claims about how many acres they have in their database, I would probably get a land mass 3 times the size of the United States. Just having “acres” of data in your database means nothing if the data is junk. That’s where I see a lot of companies going wrong. In the effort to prove they have more acres of data than competitors, they are uploading data without determining whether it has any value or is accurate. Eventually, this junk data will come home to roost, skewing big data analytics and causing farmers to doubt company promises.

John Deere is a great example of a company that understands these points. Deere serves all sizes of farms and treats even the hobby farmer like a business owner. It has built its brand on long-term relationships, continually developing its dealer network. Rarely does Deere unveil a totally new product; more commonly it improves last year's equipment, making it incrementally better. Deere is collecting ag data, but it is doing so to improve its products and deliver higher productivity to farmers. Data collection has a purpose. John Deere has survived for over 175 years because it knows its customers.

Know your customer. It's as simple as that.