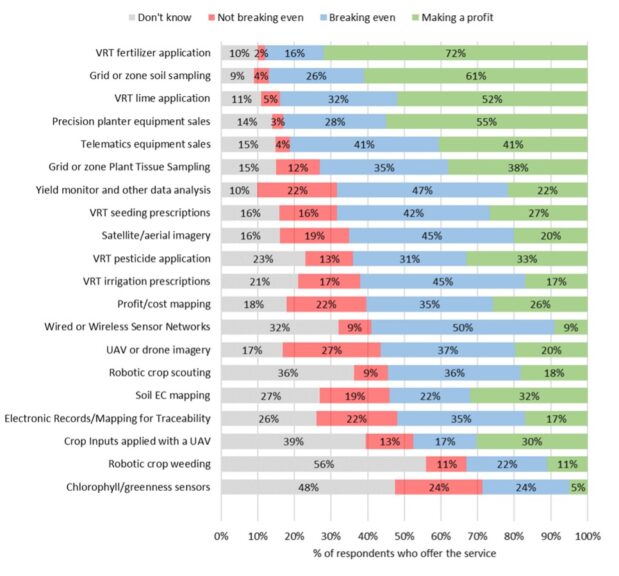

Ag retailers made the most profit on variable-rate fertilizer application, grid or zone soil sampling, and precision planter sales in 2022, according to results of a survey from CropLife/Purdue.

The 2022 CropLife/Purdue Precision Survey received 141 responses from agricultural retailer input suppliers. Most are located in the Midwest, and they include cooperatives, independent retailers and retailers who are part of a regional or national chain. While this survey relates to ag retail and not the farm equipment dealer market, there are lessons to learn from your precision counterparts in crop input retail.

Grid/zone sampling and variable-rate fertilizer applications are the most profitable precision services offered by retailers in 2022. The percentage of dealers reporting a profit on these services roughly doubled in the past 20 years, and these two services have also been consistently more profitable than others, according to CropLife’s analysis. Ag retailers’ third-most profitable precision service in 2022 was precision planter equipment sales.

Dealer profitability of precision services in 2022. Source: CropLife-Purdue University Precision Agriculture Dealership Survey.

This year’s survey respondents found drone imagery and chlorophyll/greenness sensors to be the least profitable services. These retailers also aren’t making much of a profit on yield monitor and other data analysis, profit/cost mapping and satellite/aerial imagery.

Like many customers, retailers are investing in technology to streamline operations and offer more precision application options. More than two-thirds of retailers offer precision soil sampling, yield monitor analysis, satellite or aerial imagery, variable-rate fertilizer and lime application and variable-rate seeding.

Since 2017, an increasing number of retailers have been making crop management decisions based on data. Fifty percent of respondents said data had a major influence on their phosphorus and potassium decisions. P&K decisions are the most common use of data for retailers, followed by liming, overall hybrid or variety selection, and nitrogen decisions. More survey results are available here.