Precision farming revenue numbers reached new heights for some dealers in 2022 despite an overall decline in growth, and the outlook for 2023 remains mostly positive according to the 10th annual Precision Farming Dealer benchmark study.

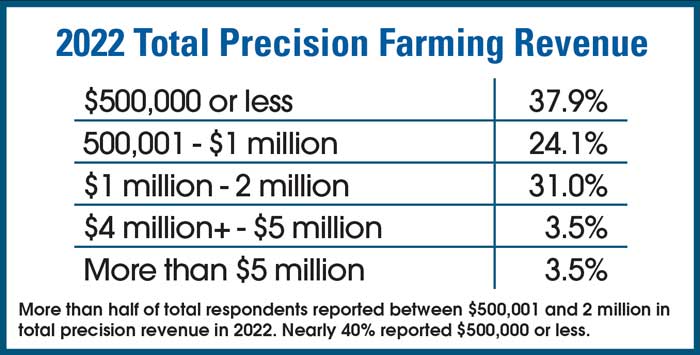

The results show that over half (55%) of total respondents estimated their total precision revenue in 2022 to be between $500,001 and $2 million. That number is up nearly 10 percentage points from 2020 and 27 points from 2019. Some 40% estimated total precision revenue to be $500,000 or less, up 14 points from 2020, while nearly 7% estimated $4 million and more, down nearly 3 points from 2020.

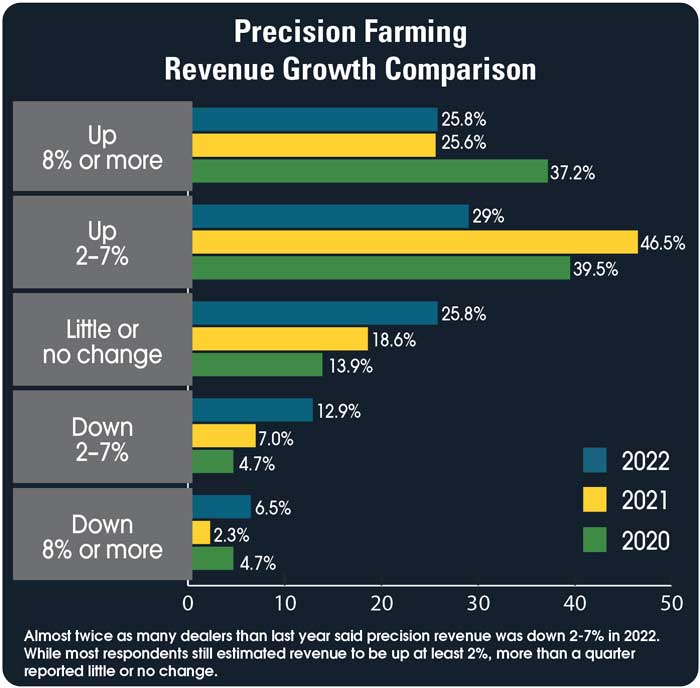

More dealers than last year reported a decline in precision revenue growth in 2022. 55% of total respondents estimated their precision sales and service revenue increased 2% or more in 2022 compared to 2021, a 17-point drop from last year. Some 26% reported little or no change, 13% projected a 2-7% decline, and 6% said revenue was down 8% or more from 2021.

In comparison, looking at the 2021 survey, just under 18.6% estimated little or no change, only 7% saw a decline of 2-7%, and 2.3% said revenue was down 8% or more.

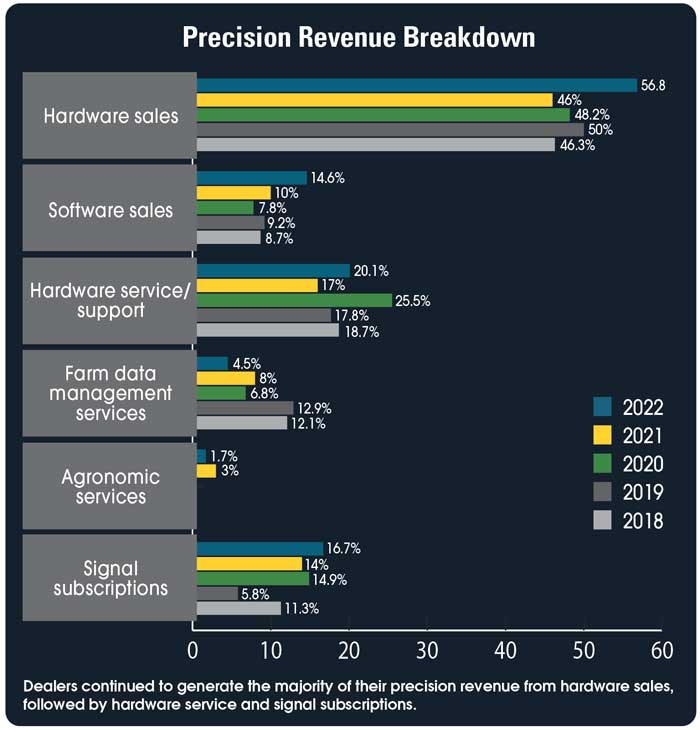

Hardware sales represented most of the total precision revenue in 2022 at 56.8%, a 10-point jump from 2021. Service/support (20.1%), signal subscriptions (16.7%), software sales (14.6%), farm data management services (4.5%) and agronomic services (1.7%) rounded out the top 6.

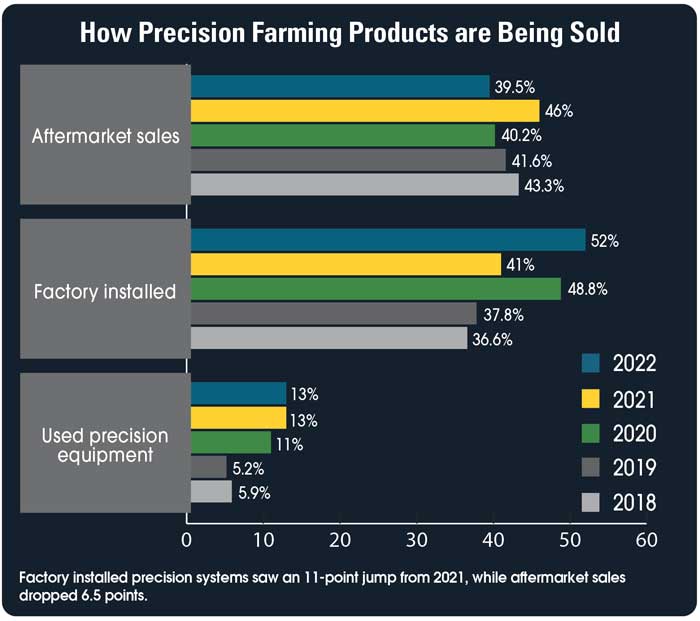

Factory installed precision systems (52%) saw an 11-point jump in sales from 2021, while aftermarket sales were down 6 points to 40%. Used precision equipment made up 13% of sales for the second year in a row.

Expectations for the New Year

Looking ahead to 2023, 47% of dealers forecast precision farming sales revenue to be up 2-7%, while some 13% forecast an even bigger increase of 8% or more. 30% forecast little or no change and 10% project a revenue decline of 2% or more.

Precision ag advisor Kyle Fischer echoes the positive outlook for 2023 despite the supply chain crunch of 2022.

“If everything follows the course of the last 15-16 months then we’re going to have another strong sales year in 2023,” says Fischer, who works for HTS Ag, an independent precision reseller in Iowa. “We had over $1 million worth of products that we ordered but didn’t have on the shelf yet. Normally in a typical year, before COVID messed everything up, we would only keep $60-70,000 worth of equipment on the shelf.”

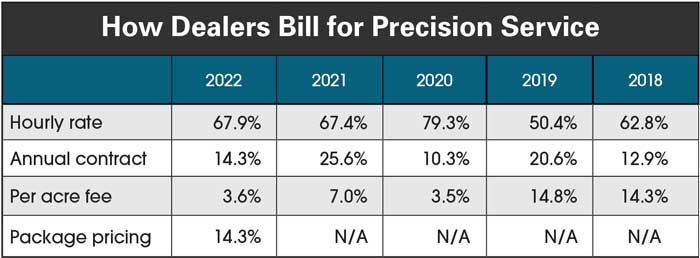

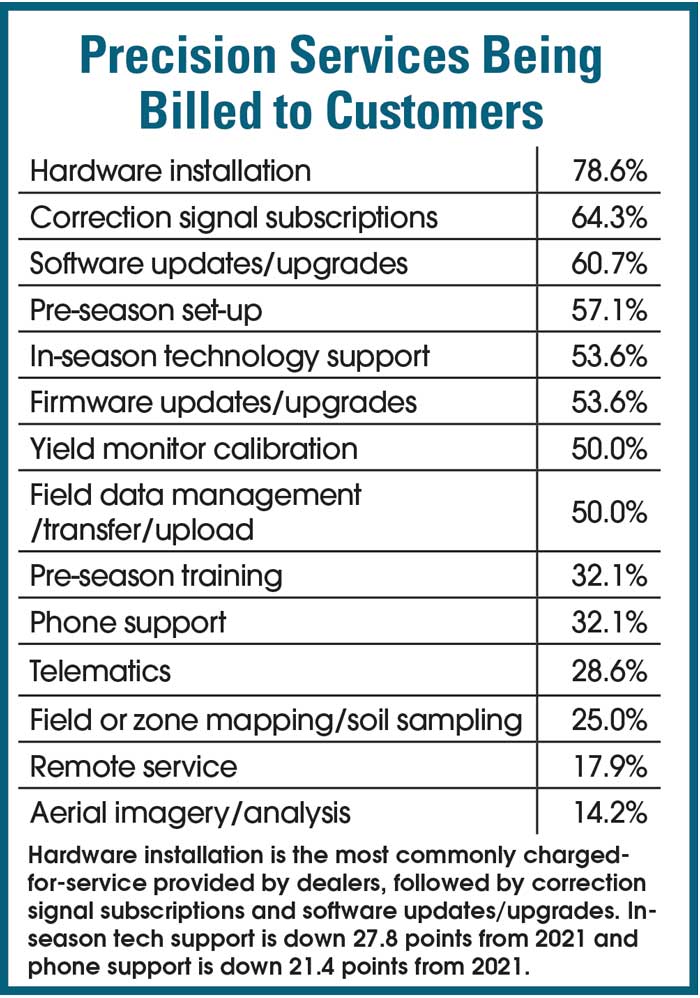

Over two-thirds of dealers prefer to bill precision services by the hour, unchanged from 2021. The percentage of dealers using annual contracts was down 11.3 points from 2021. Package pricing was presented as an option for the first time in the history of the survey.

When asked, ‘Who is responsible for sales of precision farming products at your dealership?’ nearly 52% of total respondents said precision specialists. Fischer confirms that’s true in his case.

“Almost 90% of my day is spent trying to sell products,” Fischer says. “Obviously, that changes a bit in the spring or fall, but we have a dedicated support hotline as part of our service plans. If the phone rings, one of us in the precision department takes care of it.”

How Will Autonomous Machinery Impact Your Dealership in the Next 5 Years?

“In some places it will have a small impact and other regions it will have no impact at all.”

“Not much, customers aren’t ready for it yet.”

“I think we need to be getting ready for it, but I also think it’s in the infancy stage. We are a good 10-15 years away from fully autonomous machines being normal.”

“Not sure our terrain is best suited for autonomous vehicles. I see early adoption occurring in the plains states where fields are flat and there are minimal obstructions.”

“Everyone wants to talk about autonomy taking over. Realistically, only about 5-10% of farmers will use or pay for it so it will not have as big of an impact as is forecasted.”

“We are waiting and ready.”

Some 35% of dealers surveyed said farm equipment salespeople are responsible for precision sales, while nearly 7% said dedicated precision salespeople and 3% said service department.

Data Management & Product Trends

For the second year in a row, over 50% of dealers surveyed are actively selling data management services/packages supported by precision specialists.

69% of dealers said their suppliers don’t have any requirements for data management.

“We don’t have any requirements but the people who are using data management are a little more fun to work with,” Fischer says. “The only reason we’re selling all these products to growers is to provide a solution. If they don’t have the data, then they’re not going to see the good of what we’ve been working on.”

Among those utilizing data management platforms, entry-level services (map printing, field data downloads) were the most frequently used at 77%. Internal operations/communication (70%) and advanced services like variable-rate prescriptions and farm data analysis (43%) were among the other platforms utilized.

Analyzing Customer Behaviors

For the first time in the 10-year history of the benchmark survey, dealers were asked the following question: Do you view selling precision technologies as a competitive advantage in attracting cross-over customers? 84% said yes, 10% were unsure and 6% said no.

Another first-time question about customer behaviors asked if precision customers are more likely to use texting and other digital communications than non-precision customers. 74% said yes, 16% were unsure and 10% said no.

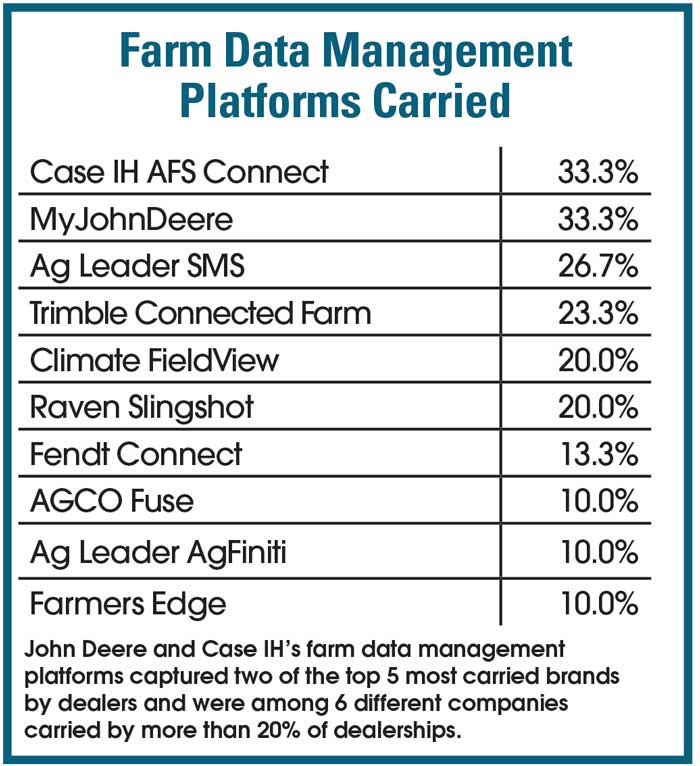

Case IH AFS Connect and MyJohnDeere were tied (33.33%) for the most popular data management platforms offered in 2022, according to survey results. Ag Leader SMS (26.67%), Trimble Connected Farm (23.33%), Climate FieldView (20%) and Raven Slingshot (20%) round out the top 6.

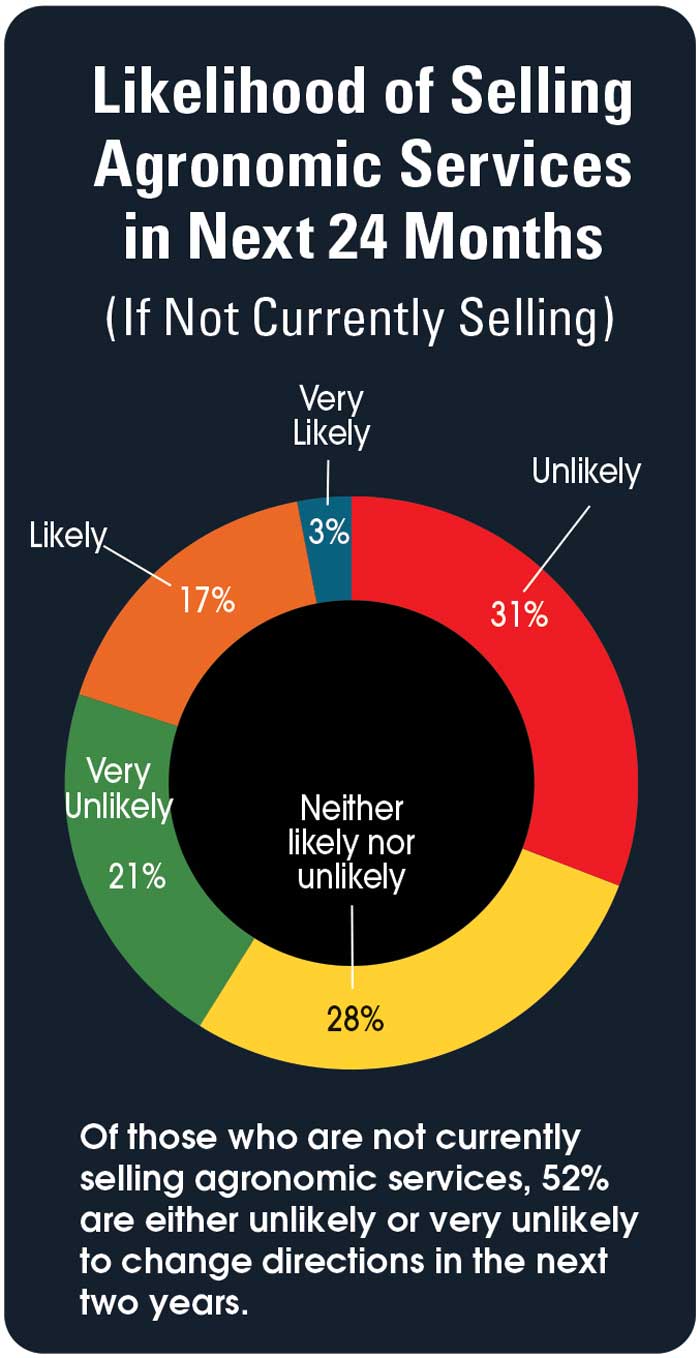

51.6% of dealers surveyed are not involved in selling or supporting agronomic services. Of those who are not currently selling agronomic services, 52% said they’re either unlikely or very unlikely to change directions in the next two years, while 17% said they’re likely to start selling agronomic services in the near future.

How does your precision business compare to other precision dealers? Click here to watch a comprehensive breakdown of the 10th annual Precision Farming Dealer benchmark study with managing editor Michaela Paukner and precision specialist Kyle Fischer. Sponsored by Laforge

![[Technology Corner] A Big Step Forward for Interoperability & Data Sharing](https://www.precisionfarmingdealer.com/ext/resources/2025/12/12/A-Big-Step-Forward-for-Interoperability--Data-Sharing.webp?height=290&t=1765565632&width=400)