Deere & Company reported net income of $1.790 billion for the second quarter ended May 2, 2021, or $5.68 per share, compared with net income of $666 million, or $2.11 per share, for the quarter ended May 3, 2020. For the first 6 months of the year, net income attributable to Deere & Company was $3.013 billion, or $9.55 per share, compared with $1.182 billion, or $3.73 per share, for the same period last year.

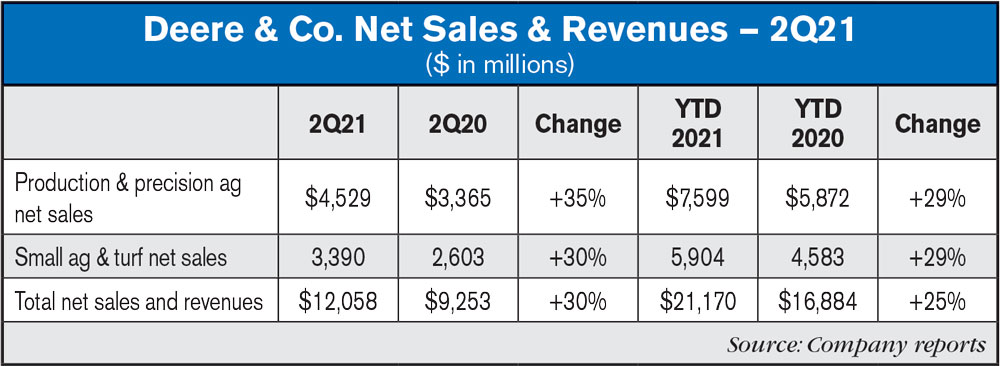

Worldwide net sales and revenues increased 30%, to $12.058 billion, for the second quarter of 2021 and rose 25%, to $21.170 billion, for 6 months. Net sales of the equipment operations were $10.998 billion for the quarter and $19.049 billion for 6 months, compared with $8.224 billion and $14.754 billion last year.

“With another quarter of solid performance, John Deere closed out the first half of the year on a highly encouraging note,” said John C. May, chairman and chief executive officer. “Our results received support across our entire business lineup, reflecting healthy worldwide markets for farm and construction equipment. Our smart industrial operating strategy is continuing to have a significant impact on performance while also helping customers do their jobs in a more profitable and sustainable manner.”

Company Outlook & Summary

Net income attributable to Deere & Company for fiscal 2021 is forecast to be in a range of $5.3-$5.7 billion.

“While the company is clearly performing at a high level, Deere expects to see increased supplychain pressures through the balance of the year,” May said. “We are working closely with key suppliers to secure the parts and components that our customers need to deliver essential food production and infrastructure. Despite these challenges, Deere is on track for a strong year and we believe is well-positioned to unlock greater value for our customers and other stakeholders in the future.”

In last year’s second quarter, Deere recorded impairments totaling $114 million pretax. In the first half of 2020, total voluntary employee-separation program expense recognized was $136 million pretax.

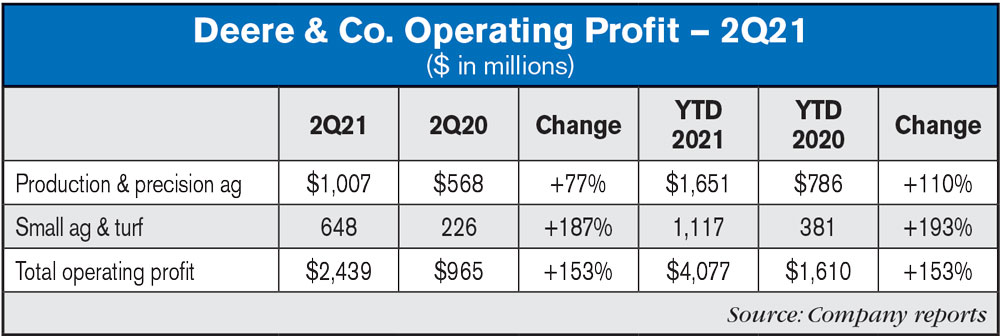

Production and precision agriculture sales increased for the quarter due to higher shipment volumes and price realization. Operating profit rose primarily due to price realization and higher shipment volumes/sales mix. These items were partially offset by higher production costs.

Small agriculture and turf sales for the quarter increased due to higher shipment volumes, price realization and the favorable effects of foreign currency translation. Operating profit increased primarily due to higher shipment volumes/sales mix, price realization and the favorable effects of foreign currency exchange. These items were partially offset by higher production costs.

For its industry outlook for 2021, Deere forecasts large ag sales to be up around 25% in the U.S. and Canada, and for small ag sales to be up around 10%. European ag & turf sales are expected to be up around 10%, South America tractor and combine sales are forecast up around 20% and Asia ag & turf sales are expected to be up slightly.

By segment, Deere forecasts both production & precision ag net sales and small ag & turf net sales to increase 25-30%. Production & precision ag price realization is forecast at +7%, while small ag & turf price realization is forecast at +3%.