Precision sales and service provided a silver lining for many farm equipment dealerships during a challenging 2025, according to the latest Precision Farming Dealer Benchmark Study.

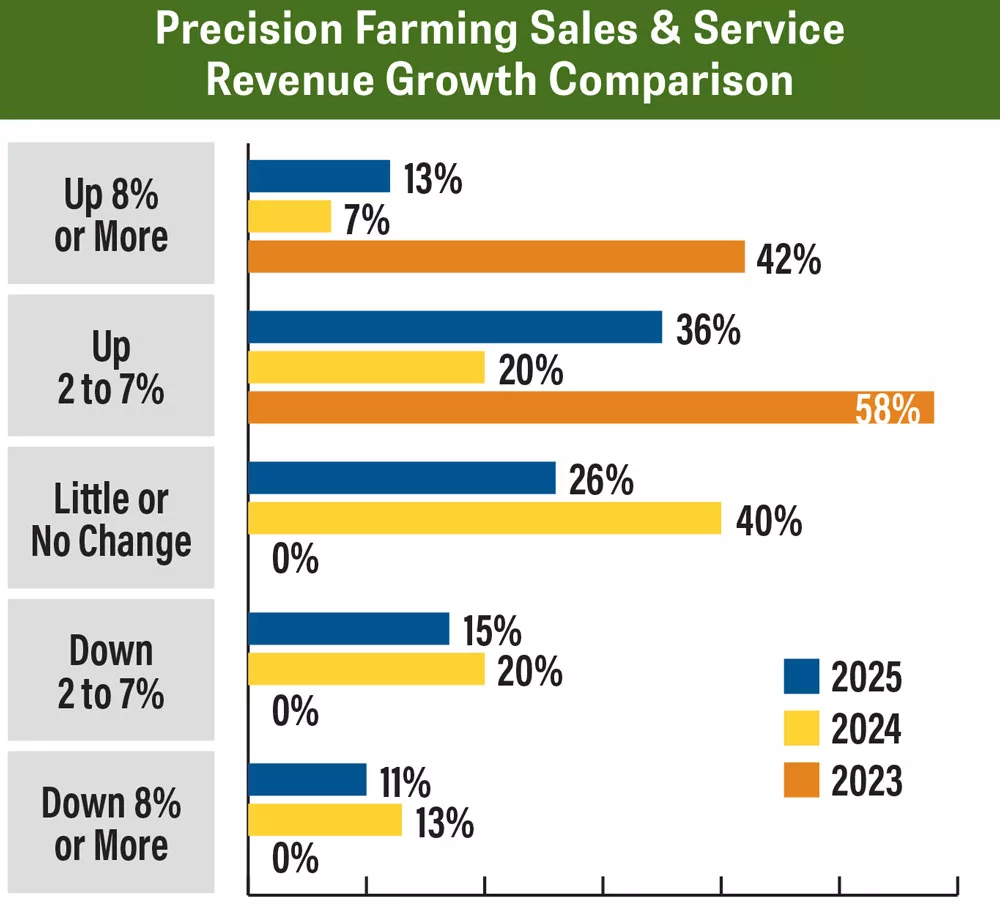

Over 49% of dealers surveyed reported an increase in total precision (sales and service) revenue in 2025, compared to only 27% who reported an increase the year before. Nearly 36% said their revenue was up 2-7%, while almost 13% said it was up 8% or more.

“In 2025, we learned new ways for farmers to have objections to a sale,” says Jason Pennycook, precision farming manager for Johnson Tractor, a Case IH dealership with 11 stores across Wisconsin and Illinois. “Before this year, we had a long streak of not having to run around to make sales. They came to us. This past year, the sales were there, but we had to knock on a lot more doors before actually getting a sale.”

On the other end of the spectrum, about 26% of dealers reported a decline of at least 2% in total precision revenue in 2025, compared to 33% who reported a decline in 2024. Some 26% of dealers saw little or no change in their revenue in 2025, compared to 40% who saw little or no change in 2024.

Revenue Breakdown

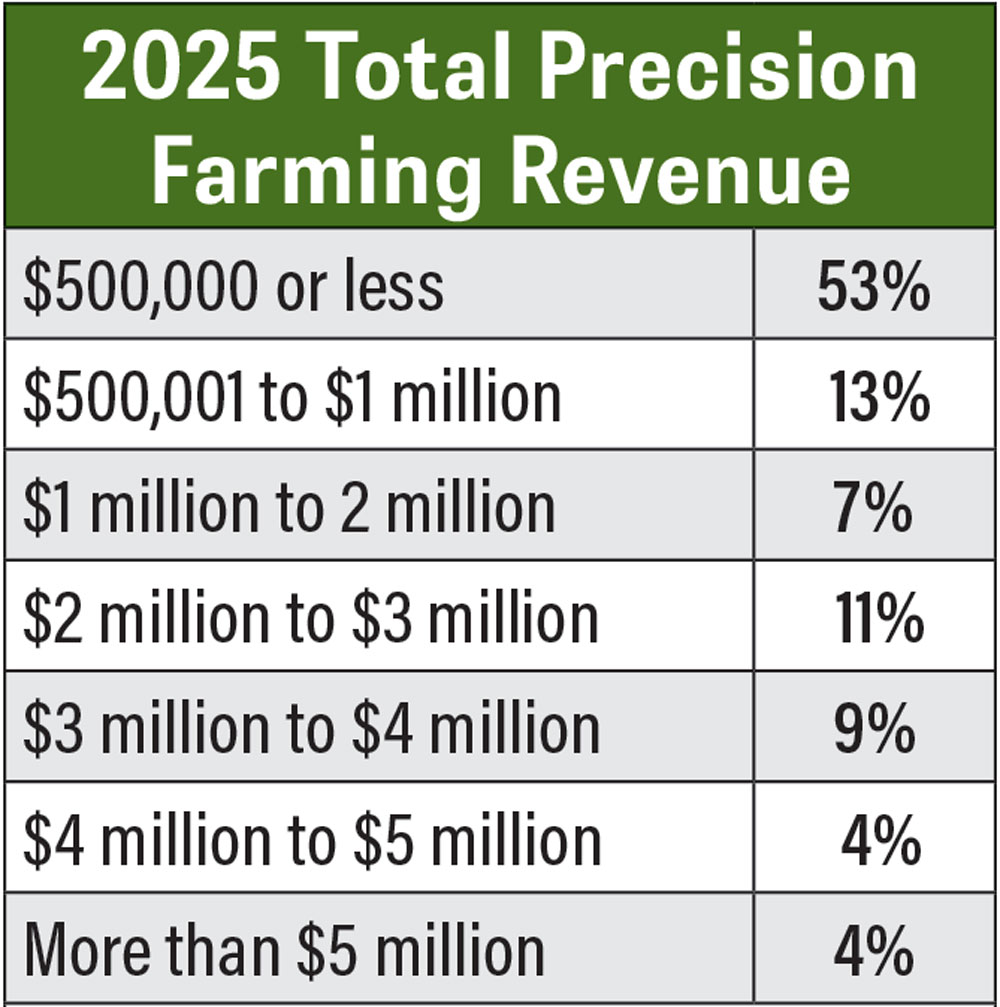

Over half (53%) of the dealers surveyed estimated their total 2025 precision revenue was $500,000 or less. About 13% made between $500,001-$1 million and 7% were in the $1-$2 million range. About 11% reported between $2-$3 million, 9% made between $3-$4 million, 4% made between $4-$5 million and another 4% brought in more than $5 million.

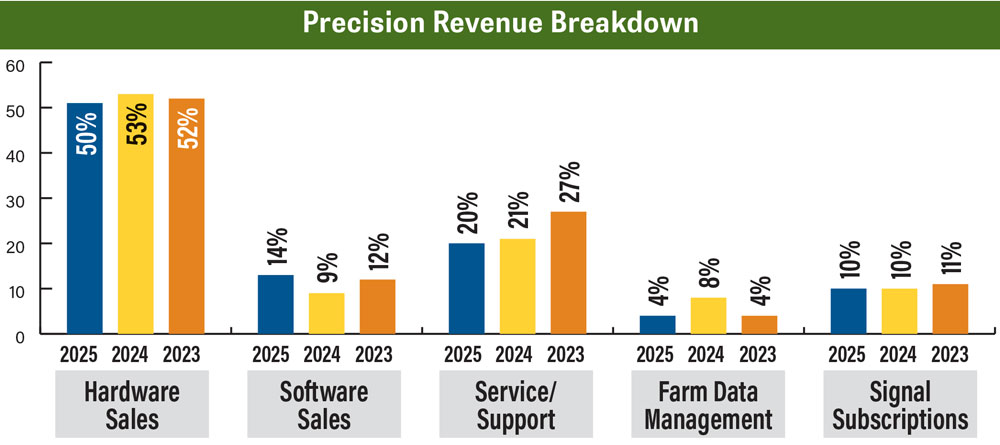

Hardware sales once again represented most of the total precision revenue in 2025 at 50%, down slightly from 53% in 2024, and service/support was second at 20%, also down slightly from 21% the previous year.

Over half of the dealers surveyed said their estimated total precision revenue was $500,000 or less in 2025. Source: Precision Farming Dealer Benchmark Study

Software sales increased from 9% to 13%, while farm data management dropped from 8% back down to 4%, exactly where it was 2 years ago. Signal subscriptions remained steady at 10%, the same as 2024.

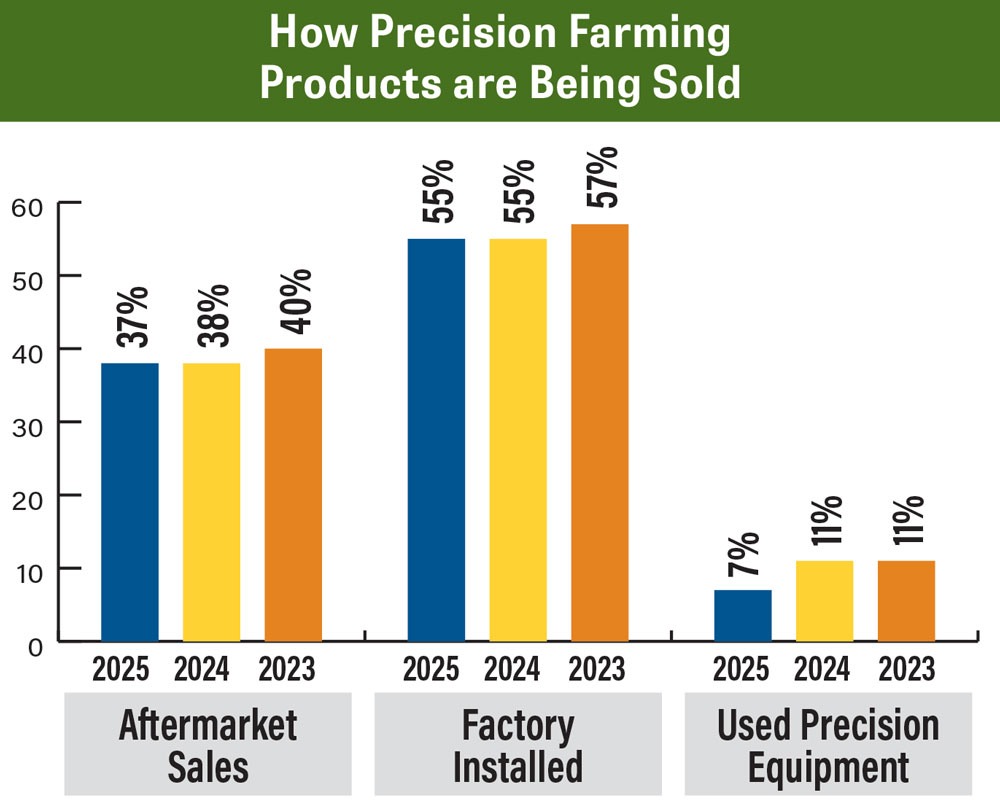

Factory installed precision systems made up almost 55% of total sales in 2025, the same as 2024 and in the ballpark of 2023 (57%). Aftermarket sales (38%) remained the same as 2024, while used precision equipment dipped from 11% the previous year to 7% in 2025.

Autonomy Outlook for 2026 & Beyond

Dealers were asked, by what year do you expect autonomous driving tractors will represent 10% of new tractor sales? Here are some of the top predictions.

- “2030. The technology is already there, but it will take time for farm profitability to allow more farmers to take risks on new technology.”

- “2030. The industry is not ready for liability/support.”

- “2030. We sold 2 autonomous grain cart kits this year. I still think we’re 5 years out until we hit the 10% mark.”

- “2050. Cost and feasibility are barriers.”

- “2040. Slow development and we’ll utilize more smaller implements.”

“There was a lot of interest in equipment but the biggest challenge of 2025 was actually making the sales,” says Curtis Martin, ag technology manager for Agriteer, a 5-store AGCO dealership in Waynesboro, Pa. “It was kind of a flat year for us for technology sales. It went well from a support standpoint though because we weren’t overwhelmed with a lot of new equipment out there. I’m excited for the opportunities in 2026.”

Sales Outlook

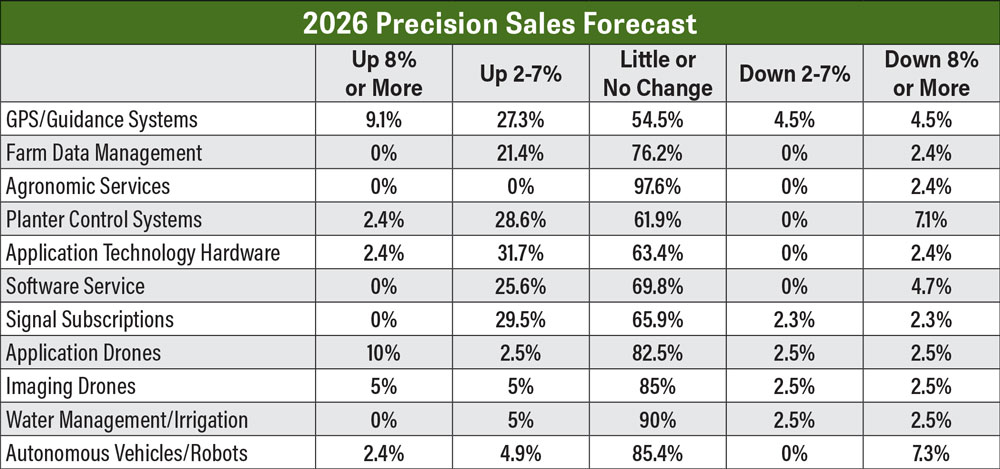

Looking ahead to 2026, several dealers (42%) are optimistic that precision revenue will improve by at least 2-7%, but many (38%) are still hedging their bets with a forecast of little or no change. Almost 19% predict revenue will decline by at least 2-7%.

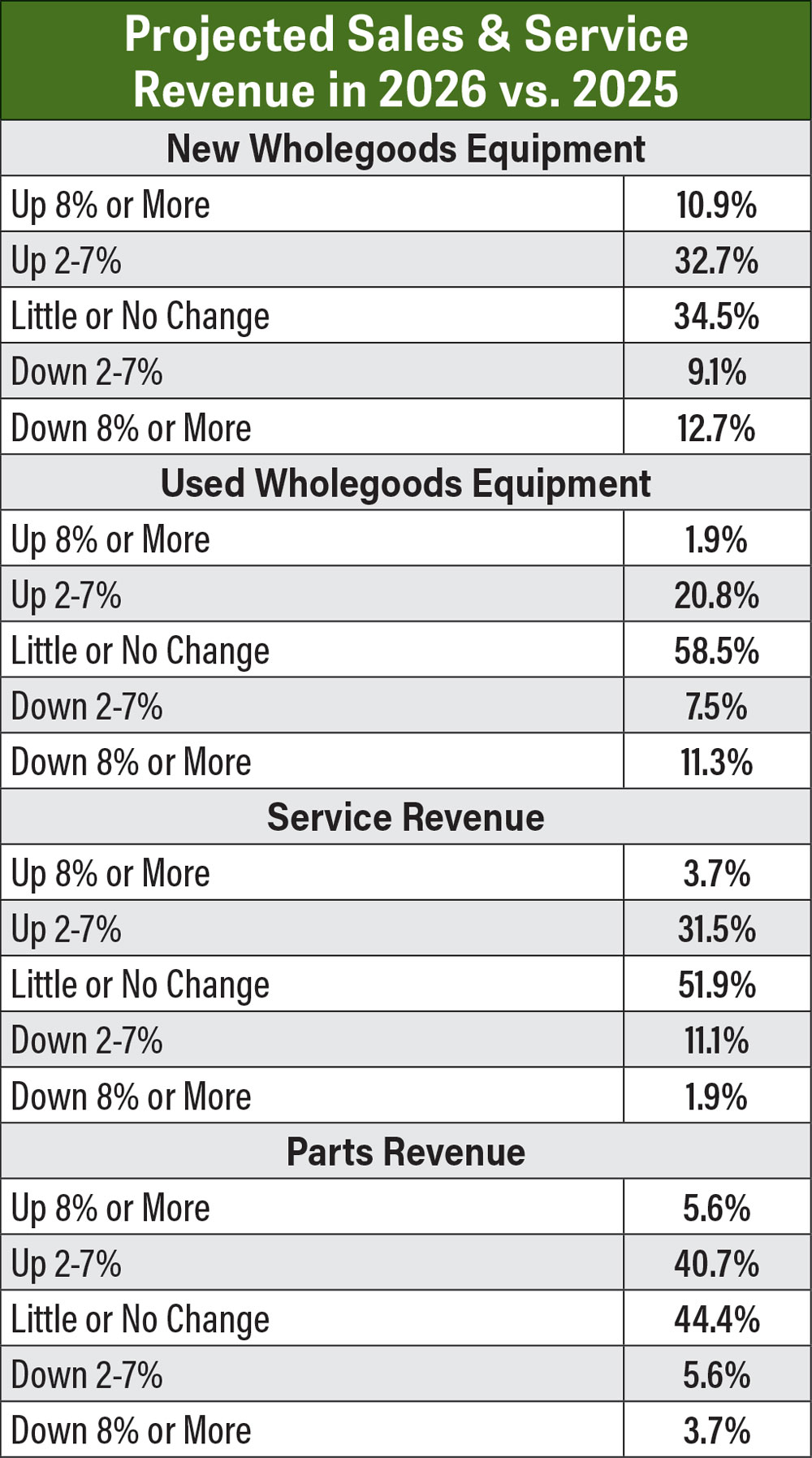

Digging deeper into the numbers, about 33% of dealers forecast new wholegoods equipment sales and service revenue will be up 2-7%, while about 21% expect it to drop by at least 2% or more. About 44% forecast little or no change. The used wholegoods equipment outlook is slightly less optimistic, with almost 59% predicting little or no change and only 21% predicting an increase of 2-7%.

Factory installed precision systems continue to get the biggest chunk of sales for precision dealers. Aftermarket sales remained consistent, while used sales dropped 4 percentage points. Source: Precision Farming Dealer Benchmark Study

“Sales on the wholegoods side were definitely down for us in 2025,” says Jordan Batman, integrated solutions specialist for BTI, a 6-store John Deere dealership in Kansas. “But that allowed for more opportunities in the used equipment market and the auction market as well.

“It was a good year for us on the precision side,” he adds. “When farmers aren't buying equipment, they have to work on what they have. So, we saw almost record years in our parts and service departments on the aftermarket side of things. I expect more of the same in 2026. There are going to be sales out there, but you’ll have to work for them.”

Data Management Trends

About 21% of precision dealers surveyed offered data management services in 2025. The most popular (58%) data management platform offered was John Deere Operations Center, followed by Case IH AFS Connect (FieldOps) at 25% and Ag Leader SMS and Farmobile, both at just under 17%.

Almost 32% of dealers expect precision service revenue to increase 2-7%, while most (52%) forecast little or no change.

Almost half of the dealers surveyed forecast little or no change in parts revenue, while 36% are eyeing an increase of 2-7%.

“If commodity prices come up a little bit, farmers are going to buy,” Pennycook says. “You just need to make sure you’re out there talking to them, so they know you’re an option when they need to update their equipment.”

Connected Customer Stats

Most (96%) precision dealers have at least some connected customers signed up in 2026. When asked what percentage of their customers are connected, almost 56% said between 1-25%, while 19% said 26-50%. Some 11% have between 51-75% connected customers and another 11% are in the 76-100% range.

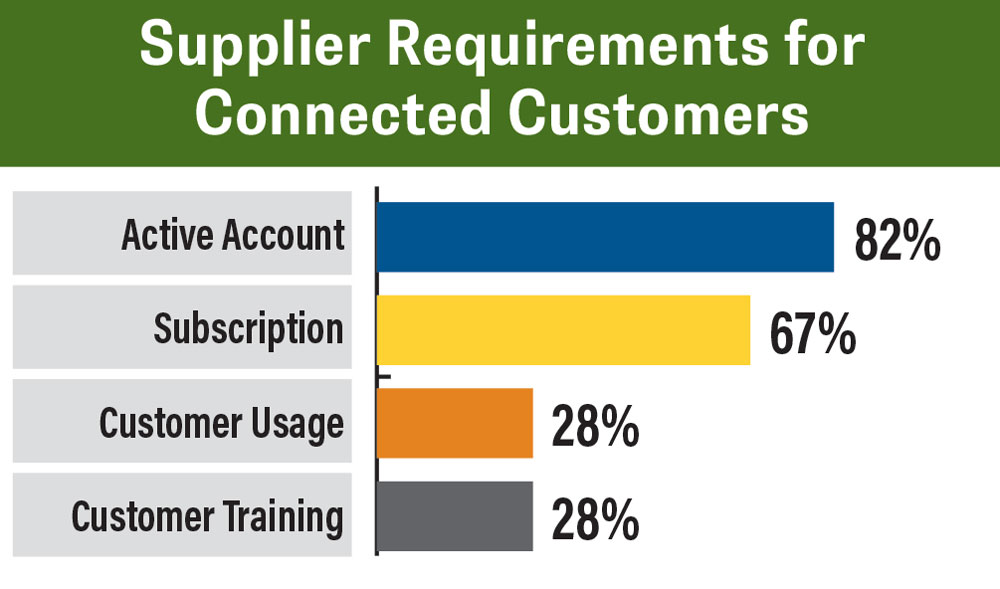

When asked what requirements their suppliers have for connected customers, just over 82% said active account, 67% said subscription, 28% said customer training and another 28% said customer usage.

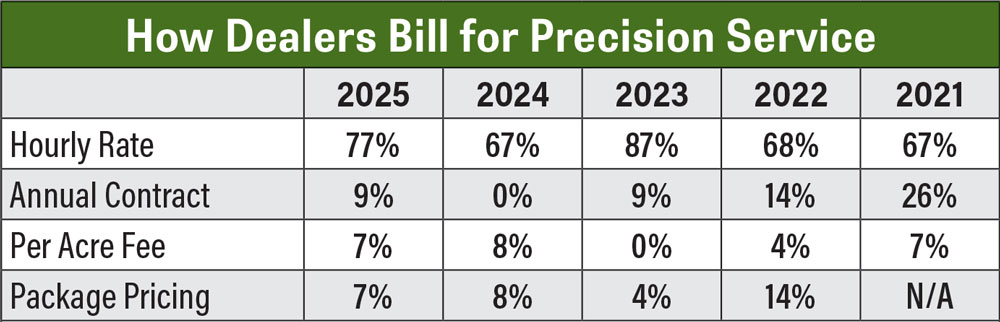

Just over 77% of dealers surveyed prefer to bill precision services by the hour, up 10 percentage points from 2024. Source: Precision Farming Dealer Benchmark Study

Various employees are dedicated to monitoring connected machines, according to the survey, with the responsibility most often falling on the service manager (66%). Over 58% of dealers surveyed said the precision farming specialist is the one who is dedicated to monitoring connected machines, while 38% said the precision farming manager and 28% said the service tech.

Precision farming specialists (66%) are usually responsible for setting up connected customer accounts. Other roles performing this duty in 2026 include sales staff (36%), precision farming manager (30%), service manager (23%), service tech (19%) and sales manager (11%).

Inside the Precision Department

Most dealers surveyed, on average, have 6 employees who are considered members of their precision staff. One dealer reported having a whopping 30-member precision team, which is the highest total among survey participants.

The primary objective of the precision farming business in most dealerships (52%) is to supplement wholegoods sales and service. Another 22% of dealers surveyed said the primary objective is customer support, while 10% said aftermarket parts and service.

Dealers continued to generate most of their revenue from hardware sales. Software sales increased slightly in 2025 while data management revenue dipped back down to the 2023 mark of 4%. Source: Precision Farming Dealer Benchmark Study

Survey participants were asked who is most influential in making big decisions at their dealership. Almost 33% said the precision farming manager has the biggest influence on adding new precision products and platforms. About 27% said the dealer principal has the final vote on adding new products, while some 20% said the sales manager has the biggest influence.

The dealer principal most often (40%) has the biggest influence on hiring additional staff, followed by the general manager (19%) and the precision farming manager (17%).

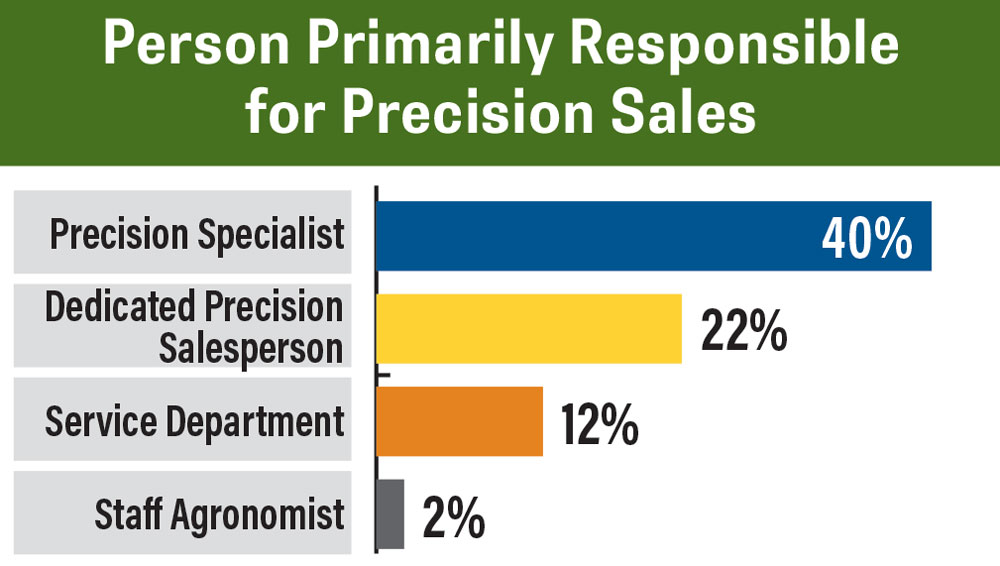

Precision farming specialists have the most influence (43%) on making product recommendations to farm customers, followed by precision farming managers (23%) and sales managers (17%).

Dealers were asked about the requirements their suppliers have for connected customers. The overwhelming majority require an active account. Nearly 66% of dealers surveyed said their service managers are responsible for setting up connected customer accounts, while 59% said precision farming specialists, and 38% said precision farming managers. Just over 55% of dealers surveyed said 0-25% of their customers are connected customers, 19% said 26-50%, 11% said 51-75% and another 11% said 76-100%. Source: Precision Farming Dealer Benchmark Study

Precision farming managers have the biggest influence (29%) on the structure of packages and pricing, followed by sales managers (21%) and precision farming specialists (19%).

Dealers were also asked how they're currently using AI technologies. Almost 57% reported using AI for marketing, 27% for customer prospecting and 24% for staff training. Another 35% said they'd use AI, but don't know how, and 11% have no intention of using AI in 2026.

Chris Hunsaker, co-founder of Acuitus Ag, a company that provides software tools to farms, supply chain partners and OEMs, says people in the ag industry should be ready to leverage the potential benefits of AI.

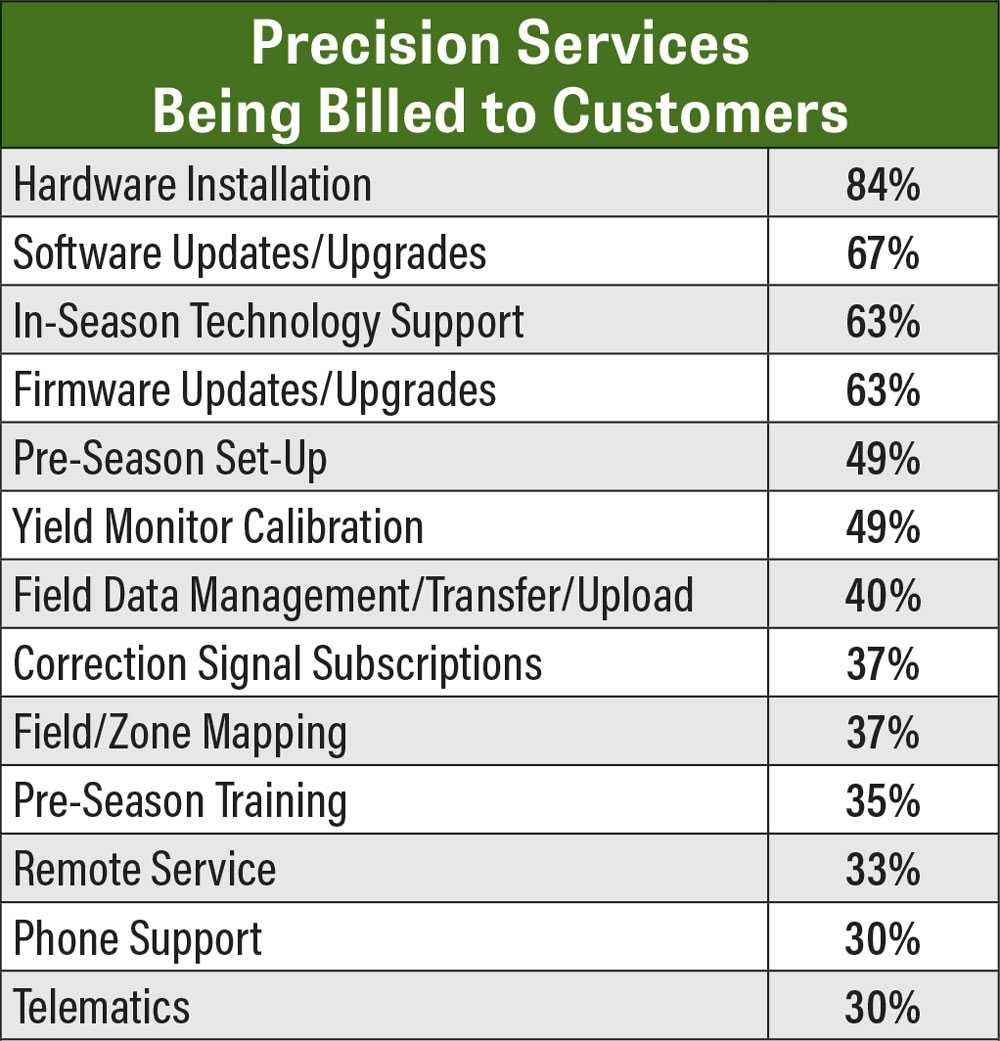

Hardware installation remains the most commonly charged-for-service provided by dealers, followed by software upgrades, in-season tech support, firmware updates, pre-season set-up and yield monitor calibrations. Source: Precision Farming Dealer Benchmark Study

“If an agronomist isn’t current on what these tools are and can’t integrate them into their workflow so they’re better at their job and can cover more acres quickly, they won’t exist anymore. The people who do that will still be in demand. The people who figure out how to harness AI, it will make them 10 times more valuable because of all the things they’ll be able to do faster and at a lower cost.”

Among survey participants, 36% are primarily Case IH dealers, 23% AGCO, 18% John Deere, 14% New Holland, 5% Kubota and 4% have no major line.

Biggest Challenges for 2026

Dealers were asked about their biggest anticipated challenges for 2026, which included OEM support, the economy, staffing and more.

- “Technology is moving so fast.”

- “The lack of Case IH support, especially training.”

- “Our wholegoods sales are down 20-30%.”

- “Finding a full-time precision farming specialist and keeping qualified specialists.”

- “The farm economy — low commodity prices, high input costs.”

- “Getting customers to understand the ROI.”

- “Billing what should be billed to customers.”

- “The competition.”

- “Lack of new products from our major manufacturer to keep us on par with other majors.”

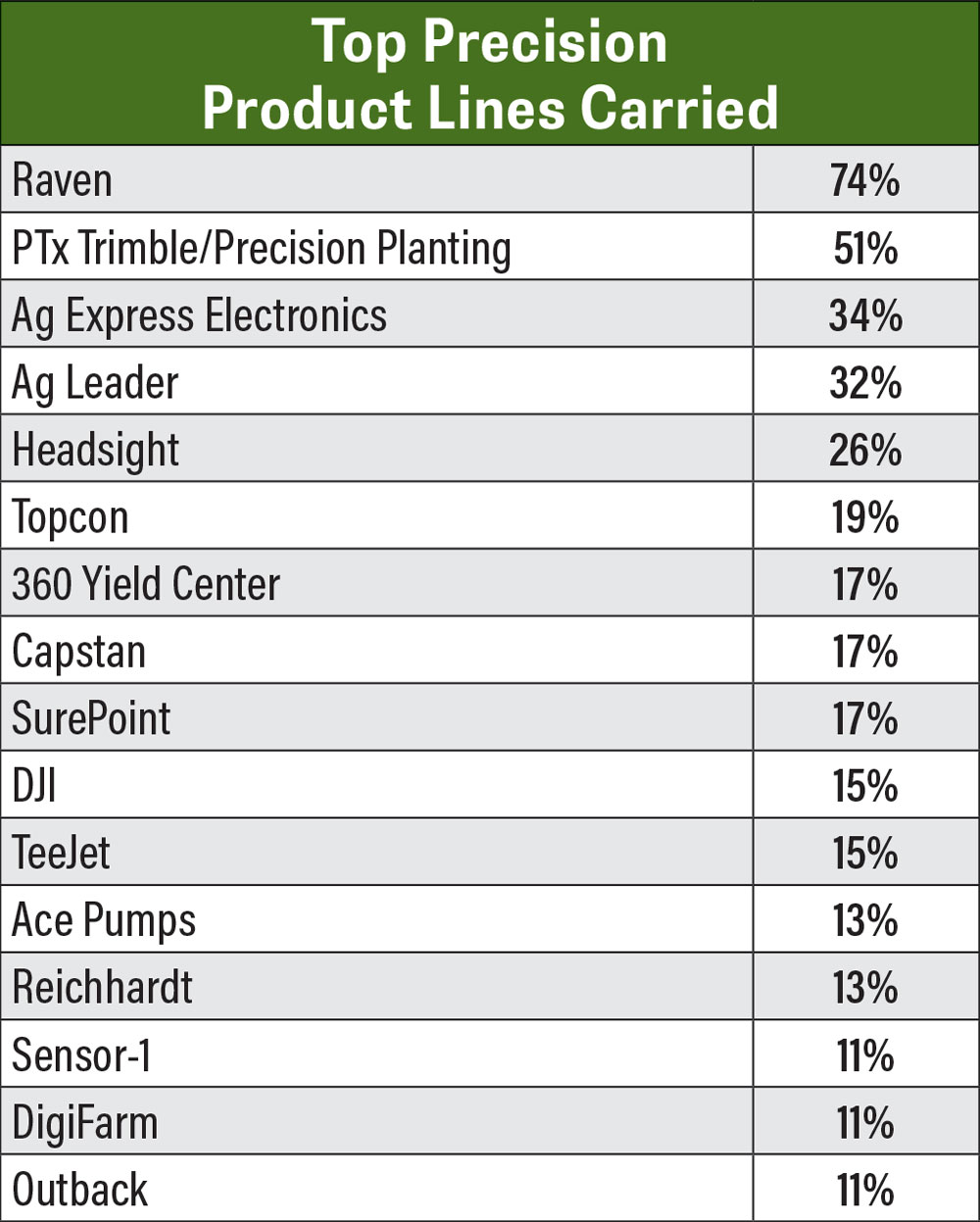

Raven and PTx Trimble/Precision Planting topped the list of most popular brands carried by precision dealers in 2025, followed by Ag Express, Ag Leader and Headsight rounding out the top 5. Source: Precision Farming Dealer Benchmark Study

This table breaks down dealers’ expectations for sales, service and parts revenue in 2026 compared to 2025. Over 43% of dealers forecast an increase in new wholegoods equipment sales and over 46% forecast a bump in parts revenue. Source: Precision Farming Dealer Benchmark Study

Most dealers are optimistic that sales will be at least the same or better in 2026 compared to 2025 for most products and services, with over 36% expecting improved GPS and guidance systems sales. Source: Precision Farming Dealer Benchmark Study

Forty percent of dealers surveyed said their precision specialists are primarily responsible for selling precision farming products. Source: Precision Farming Dealer Benchmark Study