Affordable return on investment and the ability to offer alternative solutions to farm customers are two factors dealers point to as drivers of optimism and opportunity for increasing revenue in seeding and planting technologies.

In Precision Farming Dealer’s 2016 annual benchmark study, editors posed the question: What’s going to be the most important source of precision farming equipment revenue in the next 5 years?

Some 60% of respondents identified planter and seeding control systems as a priority, and another 64% percent of dealers viewed variable-rate planting and fertilizing technology as a primary driver of revenue in the future.

So what is driving optimism and how are dealers looking to capitalize on the profit potential precision of these technologies? Affordable return on investment and the ability to offer alternative solutions to farm customers are two factors dealers point to as reasons for developing their planter technology business.

Cooling Planter Sales

“As a company, we’re busier selling planter precision upgrades in the down corn market than we ever were back when farmers got $7 per bushel,” says Charlie Troxell, precision ag specialist for Precision Agri Service Inc. “Back then, everyone was trading in their planters for brand new ones rather than upgrading with aftermarket equipment. Right now, farmers are more likely to spend $40,000 on a planter upgrade than $140,000 on a whole new planter that won’t even be much better than the one they have.”

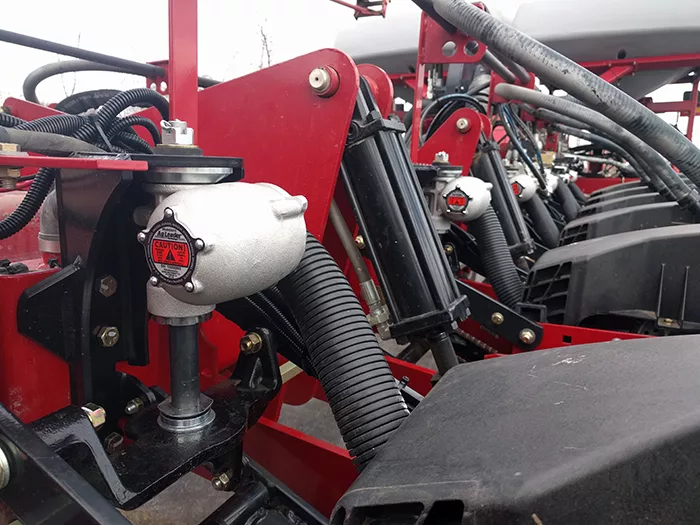

Precision Agri Services Inc., based in Minster, Ohio, is a precision consulting company and dealer. Troxell says that many local farm equipment dealers are sitting on brand new planters because sales in that sector have ground to a halt with low corn prices. He also notes that although farmers are still spending conservatively in terms of how many planter upgrades they purchase, downforce management has been particularly popular.

“The market is heavily weighted toward planter control. Farmers might not be doing the whole gamut of precision planter technology, but many are making one upgrade at a time,” he says. “If we had to look at what we have sold most, I’d say it’s more toward downforce systems.”

Troxell suspects this is because the immediate value of downforce has been easier to prove to customers than other upgrades, such as electric drives or seed meters. In the down market, he feels that his customers are looking for the quickest payback on smaller purchases.

“Simply put, I can take an average meter and make it look good if I can keep all the seeds at depth with a good downforce system,” he says. “On the other hand, I can take the best seed meter on the market and make it look average if I can’t keep the seeds in the ground at the same depth.”

Capitalizing on Planter Upgrades

The benchmark study indicated that dealers are sensing the market demand for precision equipment in the planting and seeding control category. But what strategies are called for to convert that demand into sales?

Ken Larsen, precision specialist at Vetter Equipment, feels that customer education plays a large role in spurring sales in the sector. Vetter Equipment, an 11-store Case IH dealership group in Iowa, holds clinics regularly to that end.

“We have customer clinics in the spring and the fall,” Larsen says. “We focus on trying to show customers what’s available for planter control and how to run it. It’s been important to do hands-on demonstrations in the spring, so farmers without any experience with the equipment get a better understanding of it.”

Another sector for growth that’s attached to the planter control systems are precision service packages aimed at calibrating, adjusting and troubleshooting the systems. Troxell and Larsen both agree though, that designing equitable precision service packages has been tricky.

“We’ve really been pushing our service plans this year, more than we have in the past and we’re getting a lot of interest,” says Larsen. “But we still haven’t hit on that one-size-fits-all solution. We have to do a lot of customization in terms of phone support and labor hours per package, so we can figure out what works best for them and us at the same time.”

Troxell has seen potential in financing options when it comes to increasing sales in the planting and seeding control market. While some farmers may be unwilling to make upgrades with cash, a sale may still be possible through a more creative approach.

“Precision Planting allows their dealer network to work through a big lending institution in the ag world, and we’ve been able to offer really competitive rates through it,” he says. “With a lot of the precision upgrades, if we’re able to show a return on the investment in 3-5 years, it can make financing a $40,000-$100,000 upgrade much easier to pay for.”

Advantages of this approach include an alternative to the other lending institutions that farm customers may be working with, and since the lender Troxell works with is already ag specific, proving the value of upgrades isn’t as hard as it would be with a more traditional lender. “The convincing of the lender is already done,” he says. “It just comes down to convincing the farmer.”

Troxell has had the most success selling planter upgrades by penciling out the return with his customers using the most conservative metrics available. He takes into account the OEM’s estimated yield advantage for the precision equipment, but also tries to show the farmer studies done by impartial parties.

“I look at the estimated yield advantages that some of the seed companies like Becks and Pioneer have put together for equipment like downforce systems,” he says.

By stacking the estimated yield advantage against projected crop prices, Troxell tries to show his customers what they can expect from a given planter upgrade in terms of return.

“We try to be as conservative as possible,” he says. “Some customers use their actual contracted prices. For instance, if a farmer has his corn already contracted at $3.20 per bushel and Precision Planting says he’ll see a 9 bushel advantage with DeltaForce over what he’s currently using, I’ll compare that to the other studies and just cut it down to a 4 to 5 bushel advantage.

“Then we’ll run that through how many acres the customer farms. A lot of farmers can pay back a pretty significant upgrade fairly quickly even at those conservative yield increases. We’ve been able to sell a lot of systems this way.”