For precision specialists, managing obsolete or aging inventory is becoming an increasingly perilous task. Many types of precision equipment are now standard on new tractors and combines. With ag technology and newer tools constantly being released, manufacturers often drop prices on their older models. Dealers with a full stock of precision equipment are feeling the pinch.

Customers expect their dealers to get replacement or loaner precision equipment immediately during peak seasons because they can’t afford delays. However, dealers’ inventory may lose value if they stock too much.

The best strategy lies in striking an equitable balance. But what does this look like?

Precision Farming Dealer caught up with several precision managers and specialists to solicit advice on how to best manage obsolete or aging inventory. Here are the 10 experience-based tips they had to share.

1. Stock Lean

Carrying a light inventory seems like a given, but if a customer comes looking for an item a dealer didn’t stock enough of, they’ll miss out on a sale and disappoint a client. Carrying only what a store needs can limit the loss dealers may face on aging precision inventory.

Newer precision equipment is often the realm of early adopters, but when it ages in inventory, a dealer may find that a farmer with a smaller operation or fewer acres may be willing to buy it at a discount before it loses too much value.

“Overstocking can get you into some trouble,” says Josh Blatz, Precision Land Management specialist with Gellings Implement in Eden, Wis. “We try to be as inventory averse as possible. We have to have certain items, but people aren’t going to show up and expect us to have precision parts for every vehicle from every era.”

Having the bare minimum on the shelves can insulate a dealer from the potential damage of a price drop.

“If the values of a certain receiver or display that you have sitting on the shelf suddenly gets cut in half overnight, it’s not that big of a deal if we have one or two sitting here,” says Gregg Pearson, integrated solutions consultant at Holland & Sons in Princeton, Ill. “If we have 20 of them though, then we’ve got a problem.”

You May Also Be Interested In...

Conquering Equipment Compatibility to Increase Service Performance

Learn how to weave together a rainbow of equipment technologies! Precision Farming Dealer has collaborated with well-respected and experienced precision retailers to offer you this FREE eGuide to teach you the best way to overcome the task of selling equipment that wasn’t made to work together. Hear from real precision dealers on how they manage to provide equipment compatibility solutions farmers need! Download now »

2. Move Product Quickly

Stocking light while selling quickly further reduces risk. These ideal circumstance aren’t always possible, but having a systematic approach helps.

“We’ve started going off a 12 month sales period,” says Kevin Depies, ag salesperson at Ritchie Implement in Cobb, Wis. “If we can’t get something sold on that timetable, we’re going to come up with strategies to get that piece of technology off of our hands and turned into cash that we can invest in new products.”

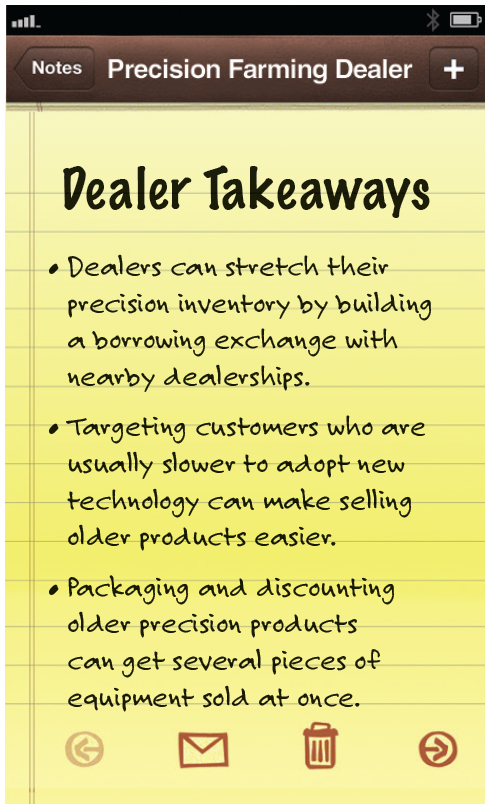

Targeting customers with smaller budgets who are usually slower to adopt new technology can make selling old products easier.

“You’ve got your earlier innovators, your middle guys and then the guys who lag behind,” says Pearson. “The late adopters want to get involved at a lower price. So that’s a major outlet for us to move some of the older product quickly.”

Jon Bickel, owner of Used Precision Ag Solutions in Fort Wayne, Ind., has to pay closer attention to obsolescence than most dealers because dealing strictly in used precision equipment exposes him to greater price volatility.

“It gets frustrating to hold onto something for longer than a year,” says Bickel. “If I can’t move it fast enough, I’ll discount it down to what I paid for it, just to get it off my hands.”

3. Monitor Inventory

Diligent records keep inventory flow seamless, but it can be a tool for spotting stagnant supply as well.

“Most of our precision equipment is in the parts department, so it’s in our inventory system,” says John Bachhuber of McFarlanes’ Equipment in Sauk City, Wis. “We use the DIS business system and it has great tracking ability. This way we can make sure we don’t hold inventory for much longer than a year.”

“When we need to move older product quickly, we do some packaging…” — Gregg Pearson

Coordinating and sharing inventory is also more efficient if it’s tracked correctly — a potential problem for bigger dealer groups.

“The idea is to get to the point where we just don’t carry as much older inventory,” says Ken Diller, precision ag manager of Hoober Inc. in Intercourse, Pa., Precision Farming Dealer’s 2016 Most Valuable Dealership. “That’s not the easiest thing to do if you’ve got 9 locations like us, because you need to keep loaner consoles at each store.”

4. Borrow Equipment in a Pinch

If a dealership can stretch its inventory in favor of stocking light, they may save the headache of excess aged inventory. For multi-store dealerships located close enough to one another, sharing a smaller inventory of certain items between stores may be an option for efficiency and diminished risk.

A less obvious source of shared inventory, however unorthodox, may be a rival dealer’s inventory.

“We actually try to keep an open dialog with nearby dealerships and are careful not burn any bridges,” says Justin Premo, precision farming specialist with Waupun Equipment in Watertown, Wis. “They may have a higher demand for a certain aging products in their area and keep more of it in stock.

“These can be mutually beneficial situations, because I can ask to borrow a particular product from them, and then return the favor when they need something.”

5. Grab Parts from the Lot

Part of the reason dealers are feeling a squeeze is new tractors and combines come pre-equipped with the precision gear that was once sold separately. However, this trend can be used to a dealer’s advantage.

“I used to try to keep a decent amount of nav controllers or receivers around, but now that we’ve got a couple tractors that come standard with those on them. I can actually go out there an rob what I need off the tractor if I get into a pinch,” says Premo. “It might be a hassle, but it’s better than having that piece sit unused, and possibly losing value in the parts inventory. I can just reorder the part and reinstall it later.”

6. Maintain a Comfortable Margin

Precision inventory bloat, as already discussed, can get a dealer into trouble. But if the equipment is purchased at a comfortable margin, there is wiggle room. Stocking at wholesale prices usually works well when the selling window is small, but building in more breathing room can be invaluable.

“Keeping a close eye on inventory helps, but I watch for stock-up programs from Trimble and Case IH-New Holland and take advantage of those,” says Blatz. “For the most part, I’m concerned with displays and steering options, but filling the inventory at a deeper discount gives me flexibility.”

This strategy can also be used when OEMs release product demos to dealers, as the discounts are often steeper. Obsolescence may not be an immediate concern during a product’s demo phase, but stocking equipment at an ideal margin will serve the dealer, according to Premo.

“Demo programs, where the OEM will give me the product at a really reduced price because they’re motivated to get it out to customers, are a good time to buy,” he says. “Dealers don’t want to overstock, but purchasing at sometimes 40% off of list price can lead to higher profits as well as protection from price drops and obsolescence.”

7. Continually Judge Value

Value on aging precision equipment is perpetually in flux. Bickel says there are patterns to watch though.

“Prices on older precision equipment tend not to go down during the big selling seasons like January, February and March,” says Bickel. “Manufacturers try to keep those prices established. It’s during the dealer off-season and end of the year that they’re likely to make adjustments.”

Catching a price drop early can signal to a dealer when it’s time to change the demographic they’re marketing to.

“One of the biggest challenges is finding the value of the product once it’s nearing the end of its useful life or becoming obsolete,” says Depies. “You can find the value by getting it to someone to whom it’s still useful. Obviously, it won’t be an early adopter at that point, but maybe someone with fewer acres or less equipment.”

Once a precision specialist realizes that the value of a product is about to enter a free fall, they can focus on getting it off the shelves faster.

At the rate new precision equipment is being introduced, letting it sit on the shelf too long can result in lost value. Closely monitoring and maintaining a lean inventory will help dealers avoid taking a loss on multiple pieces of precision equipment simultaneously.

“We’ve got a market for that kind of stuff,” says Diller. “We’re in an area where there are a number of smaller farms with older equipment and they’re not looking to spend $7,000 on a yield monitor. They’re happy if they can put a yield monitor in for $3,500, and they’ll buy the older or used components to do it.”

8. Watch OEM Developments

Staying plugged in to manufacturers’ news feeds will alert a dealer to product developments. Even the hunch that a new product or price change is about to hit can steer a dealer toward the right time to quickly liquidate inventory.

“Right now, Deere is on its second series of touchscreen displays, and we’re probably due for the next one soon,” says Pearson. “We also know that the moment the next generation comes out, the value on the older units will probably drop considerably.”

Bickel, who’s also an Ag Leader and Trimble dealer, says dealers could learn all they need to know via the grapevine.

“I’ve always got my ear to the ground for any rumors of a new display coming out or any talk about anything new from a manufacturer,” says Bickel. “You might not find out exactly what it is, but if something big is coming, you’ll hear chatter. Then you’ll know it’s time to reduce stock.”

But guessing when new products will be introduced will only take a dealer so far — knowing and understanding suppliers’ patterns are a more reliable indicator of price changes.

“Deere has always done a great job maintaining products for as long as possible,” adds Pearson. “We still have displays from the late ‘90s that are out running for some of our customers. They may be less valuable, but there is still a use for them.”

Recognizing OEMs’ patterns and examining what effect new product releases have had on older models in the past can give dealers a forecast on the value of aging precision equipment.

“Trimble released a new display last year,” says Blatz. “The values of our older displays may drop a bit, but because Trimble usually tries to focus on updating firmware instead of hardware, I know my older displays will maintain a certain amount of value.”

“If I can’t move a product fast enough, I’ll discount it down to what I paid for it…” — Jon Bickel

9. Check the Calendar

Farmers have their seasons and dealers have theirs. For example, Premo lets the time of year determine the amount of a given product he’s willing to carry.

“I like to watch the seasons,” he says. “I’ll sell as much planting related precision equipment as I can ahead of and during planting. If I have anything left, I’ll try to sell it quickly afterward. But then I’ll wait a few months until we get closer to the next April/May timeframe before starting to build that inventory back up.”

Bickel says that there are also a few other timetables to watch that reliably forecast announcements that may change the value of inventory.

“I have a good idea when changes are going to happen,” says Bickel. “At the Farm Progress show and occasionally at the National Farm Machinery Show in Louisville, are when manufacturers are most likely to release or announce new products. I try to go in to those times of year a little lighter on inventory than I’d be otherwise, just in case.”

“One of the biggest challenges is finding the value of the product once it’s nearing the end of its life or becoming obsolete…” — Kevin Depies

10. Leverage Discount Sales Events

Aging precision equipment usually takes one direction in terms of value — down. Enjoying only a small profit or breaking even aren’t attractive options, but they’re better than taking a loss. Packaging older or used items to sell at a discount can move several pieces of equipment from inventory at once.

“When we need to move older product quickly, we do some packaging,” says Pearson. “We’ll build a low cost guidance package out of older and used items, communicate that to sales staff and get several products off the shelf.”

Bickel says a well-timed eBay auction can occasionally net good results as well. “After holding it too long, I’ll just post an older piece of equipment on eBay at my cost,” he says. “Sometimes, I’ll still end up selling it for more than I was asking. It’s a crapshoot at that point. But I try to time it right. Trying to sell it on eBay while farmers are planting in the spring, or harvesting in the fall will get you a terrible price, if you even sell it.”

Last year, Hoober’s found itself wanting to sell a lot of used and aging precision equipment in a short period. The sales team came up with a plan to hold an exclusive, limited-time sales event.

“On the Monday before Thanksgiving at 5:30 a.m., all the precision farming techs texted about 100 customers each,” Diller says. “We probably sent about 1,100 texts that morning to tell them about the two-day sale.”

In addition, Diller included a few newer items to attract attention. Their goal was to sell $250,000 worth of inventory, but they ended up selling $500,000 worth of products.

“One drawback was that we moved more discounted new product than I’d wanted to,” says Diller. “But we also got rid of a ton of old, obsolete stuff that was sitting on the shelf. When we evaluated the total sale, we still showed an acceptable margin.”

Reboot or Recycle? Strategies for Selling & Servicing Used Precision Technology

Much like with used iron, dealers need to be picky and “buy right” when it comes to selling and servicing used precision farming equipment. Among the top things to consider when it comes to taking in a piece of used precision technology are age and condition of the unit, who potential second customers are and how many of the same unit you have in inventory already.

Age Matters

“At a certain age, I don’t want anything to do with it any more,” says one dealer. “I’m not going to install something that’s 10 years old.”

Another added that his dealership will take a trade up to a generation back because there’s still a market for that equipment. If the equipment gets too old it runs the risk of being obsolete and is hard to sell. “You can’t give too much for it because the guys who want used equipment are usually looking for a cheaper way into precision, so if you got too much into it on the front side, you’re never going to make it on the back side, so think about what you can sell it for and what you need to be given for it when you trade that in or buy a piece of used equipment,” he says.

One dealer says that if a unit is obsolete they send it straight to Craigslist or AgTalk.com. “There are only about a dozen things we’ll take on trade. If it’s not on that list, it goes straight to consignment,” he says.

Buy Right

Dealers agree that you need to be careful how you value used precision technology, and that starts with how much you give the customer for the trade. “How much we’ll give for a trade depends on how many we already have,” says one dealer.

Jason Pennycook, precision farming manager at Johnson Tractor, a 4-store Case IH dealership based in Janesville, Wis., says they’ll give customers 30-40% of the price of the unit new. However he adds, that also depends on the age of the unit.

One dealer suggests that when you take in used controllers or display modules that you take all the cables out. “The cables go straight to the dumpster,” he says. “If a customer is buying a used unit, he’s got to buy new cables for it.”

Regardless of the age of a unit or what you do with the cables, ultimately you should only take the trade if you know you can sell it. “The longer you sit on it, eventually no one’s going to buy it and you’ll have to eat the cost,” Pennycook says.

Dealers also agree that before any used unit is sold it’s up to the dealer to make sure it works, whether that means testing it out at the dealership or sending it off to a service like AgExpress to check it.