Beleaguered this year by complaints about the effects of tariffs, high input costs, low prices and poor trade prospects, the Trump administration rolled out a long-anticipated aid package Monday.

Of particular interest for dealers and manufacturers, during the announcement President Trump also said the administration was going to allow tractor manufacturers — calling out Deere specifically — to remove a lot of the "environmental restrictions they have on machinery."

"There's so much equipment for environmental stuff that doesn’t do anything but makes equipment much more expensive and complicated to work and it's not as good as the old days," Trump said. "But they have to reduce their prices. Farming equipment has gotten too expensive and a lot of the reason is because of environmental [inaudible] on equipment that don't do a damn thing except make it more complicated. We're going to take that crap off that they put on. They’re always under repair because they’re so complicated because they can’t fix them. You have to be a PhD."

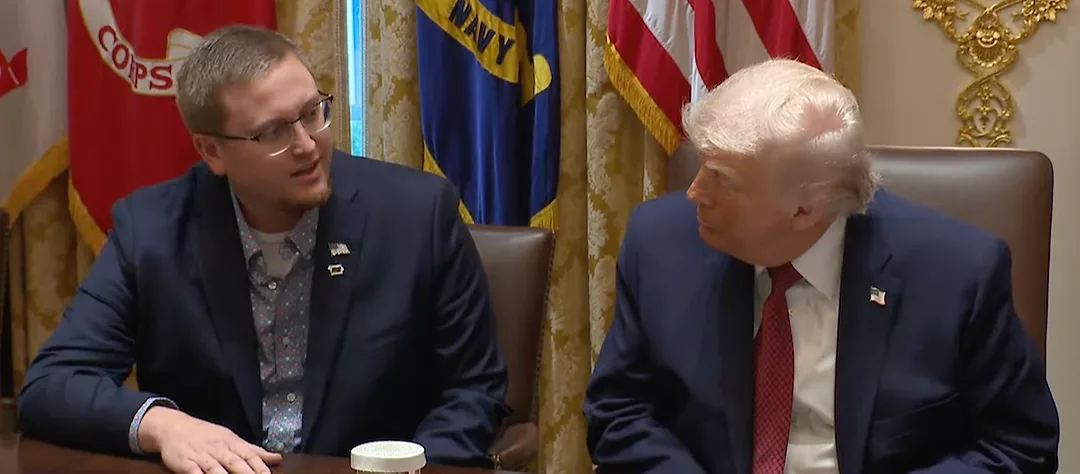

President Trump, USDA Secretary Brooke Rollins, Treasury Secretary Scott Bessent, U.S. lawmakers and farmers from 8 states were present for the announcement of $12 billion available in one-time bridge payments to farmers.

Tariff revenue is being used to fund the payments, which the administration said is in response to “temporary” trade market disruptions and increased production costs still impacting farmers, “following four years of disastrous Biden Administration policies that resulted in record high input prices and zero new trade deals.”

Up to $11 billion will be used for the Farmer Bridge Assistance (FBA) Program, which provides broad relief to row crop farmers who producing barley, chickpeas, corn, cotton, lentils, oats, peanuts, peas, rice, sorghum, soybeans, wheat, canola, flax, mustard, rapeseed, safflower, sesame and sunflower.

FBA will help address market disruptions, elevated input costs, persistent inflation, and market losses, “from foreign competitors engaging in unfair trade practices that impede exports,” the USDA said in a lengthy statement Monday.

In a statement, Rollins said Trump directed the USDA to, “build a bridge program to see quick relief while the president’s dozens of new trade deals and new market access take effect, The plan we are announcing today ensures American farmers can continue to plan for the next crop year. It is imperative we do what it takes to help our farmers, because if we cannot feed ourselves, we will no longer have a country.”

The FBA program applies, according to the USDA, "simple, proportional support to producers using a uniform formula to cover a portion of modeled losses during the 2025 crop year." The national loss average is based on FSA reported planted acres, Economic Research Service cost of production estimates, World Agricultural Supply and Demand Estimates yields and prices and economic modeling.

Farmers who qualify for the FBA program can expect payments to be released by Feb. 28. The USDA said eligible farmers should ensure their 2025 acreage reporting is “factual and accurate” by 5 p.m. EST on Dec. 19.

The USDA said commodity-specific payment rates will be released by the end of the month. Crop insurance linkage will not be required for the FBA program, but the USDA “strongly urges” producers to take advantage of new risk management tools offered through the One Big Beautiful Bill Act, “to best protect against price risk and volatility in the future.”

The remaining $1 billion of the $12 billion in bridge payments will be reserved for commodities not covered in the FBA program, such as specialty crops and sugar.

The $12 billion in farmer bridge payments, including those provided through the FBA program, are authorized under the Commodity Credit Corp. and will be administered by the Farm Service Agency (FSA).

Questions, justification for USDA farmer bridge aid or requests for a meeting on the aid package should be directed to farmerbridge@usda.gov.

The Trump administration has taken some serious heat this year due to the effects of tariffs placed on several countries, especially China, who is historically a major purchaser of soybeans. After declining to place orders earlier this year and seeking other countries for soybeans, China recently started ordering soybeans again.

Rollins noted that in the last several years, the cost of fertilizer is up 36%, manual labor costs are up 47% and interest rates are up 73%. And the lack of new trade deals, she added, turned a trade surplus during Trump's first administration into a $50 billion trade deficit.

Many farmers state they want open markets rather than handouts from Washington. Rollins agrees, but said the FBA program is needed in the short term.

"To get from what happened under last president and the last USDA to this new golden age for farmers — where instead of farming for government checks they farm to feed their family and sell their products and pass it on to the next generation — this bridge is absolutely necessary based on where we are now," Rollins said.

The administration said despite the trade and economic difficulties farmers have faced there are legislative measures through the OBBBA passage that will help in the future.

Reference prices are set to increase between 10-21% for major covered commodities such as soybeans, corn and wheat and will reach eligible farmers on October 1, 2026.

Rollins noted more than $30 billion in aid has already been distributed to farmers this year, including $9.3 billion to over 560,000 farmers for soy, corn, sorghum, and other row crops. That is in addition to $1.2 billion in marketing assistance for 52,000 specialty crop producers,

Some $6 billion in disaster relief was distributed to 388,000 farmers, and another $9 billion will be going out in the next few months.

In addition to $1 billion worth of government purchases of America ag products, the USDA said it secured trade and market access deals with Switzerland, Liechtenstein, El Salvador, Argentina, Japan, Ecuador, Guatemala, Malaysia, Cambodia, Thailand, South Korea, Philippines, Indonesia and Vietnam, as well as the European Union and China.

The administration added OBBBA's approval will make crop insurance more affordable, especially for younger farmers, and the USDA is also expanding eligibility for price support programs by adding more than 30 million new base acres to the program.

The USDA said some of the most impactful provisions for agriculture in the bill are the permanency of the 20% qualified business income deduction, full bonus depreciation and the $15 million per individual estate tax exemption, now also indexed for inflation.

A permanent bonus depreciation means that farmers can continue to write off the entire cost of new equipment, land improvements, new barns and other capital upgrades in the year of purchase, rather than depreciating them over many years.