Listen to audio version of this story:

Despite, or perhaps in part because of the ongoing downturn in the ag market, dealers continue to pursue alternative, sustainable sources of precision revenue to compensate for declining or stagnating hardware sales.

For some, the current market is a prime opportunity to capitalize on new or expanded service offerings, based on customers’ desire to make the most of every dollar invested. At the same time, many dealers have spent years building a solid foundation for precision growth, and seeing sales momentum slow in recent months, they may be less likely to take unnecessary risks, no matter how calculated.

As one owner of an independent Midwest precision dealership forecasts, “It’s only going to get to be more challenging during the next year or two, which means we have to pay attention to what is going on within our precision business and make sure we’re not destroying everything we’ve spent the last 5-10 years building.”

The 2016 Precision Farming Dealer benchmark study reflects a more cautious outlook compared to prior years among the more than 100 farm equipment dealers, independent precision companies and input retailers who contributed to this fourth annual report.

While respondents continue trending toward more service-based revenue streams, they appear to be more selective in which areas — at least in the short-term — to emphasize.

Market Adjustments

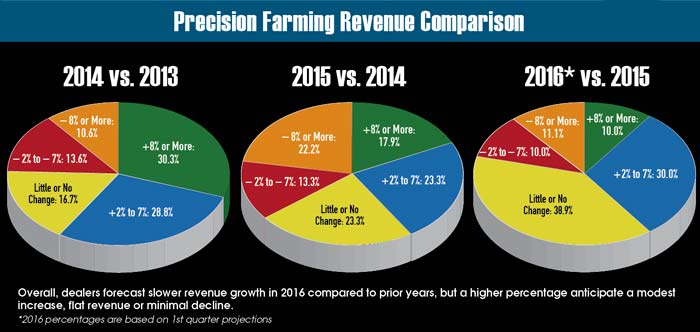

As reported in last year’s benchmark study, the majority of dealers (51.5%) anticipated stagnant or declining precision revenue in 2015. But the reality of this year’s results revealed a more substantial dip than initially forecast.

Based on responses gathered during the first quarter of 2016 from 27 different states and Canada, 22.2% of dealers reported precision revenue declines of at least 8% in 2015, more than double the 10.6% projected by respondents in last year’s benchmark study. The percentage of dealers reporting a 2-7% decline in 2015 revenue was about 2% less than forecast in last year’s benchmark study, 15.1% vs. 13.3%.

As expected, a lower percentage of dealers saw revenue growth in 2015, with 41.2% reporting increases of at least 2% — short of the 48.5% forecast in last year’s benchmark study. Also noteworthy is that only 17.9% of dealers reported revenue increases of at least 8% year-over-year, compared to 19.7% in 2014-15 and 30.3% in 2013-14.

So what are dealers expecting this year? Not surprisingly, only 10% are forecasting revenue growth of 8% or more and 38.9% expect little or no change — by far the highest percentage since the benchmark study began tracking financial projections.

But there is optimism as well that the market will begin to rebound — at least modestly — with 30% of dealers forecasting revenue growth of 2-7% in 2016 — the highest percentage ever — and only 21.1% projecting declines of at least 2%, the lowest percentage in 3 years.

Still, overall revenue expectations are far more conservative than in prior years, with only 40% of dealers forecasting any growth in 2016, compared to 41.2% last year and 59.1% in 2014.

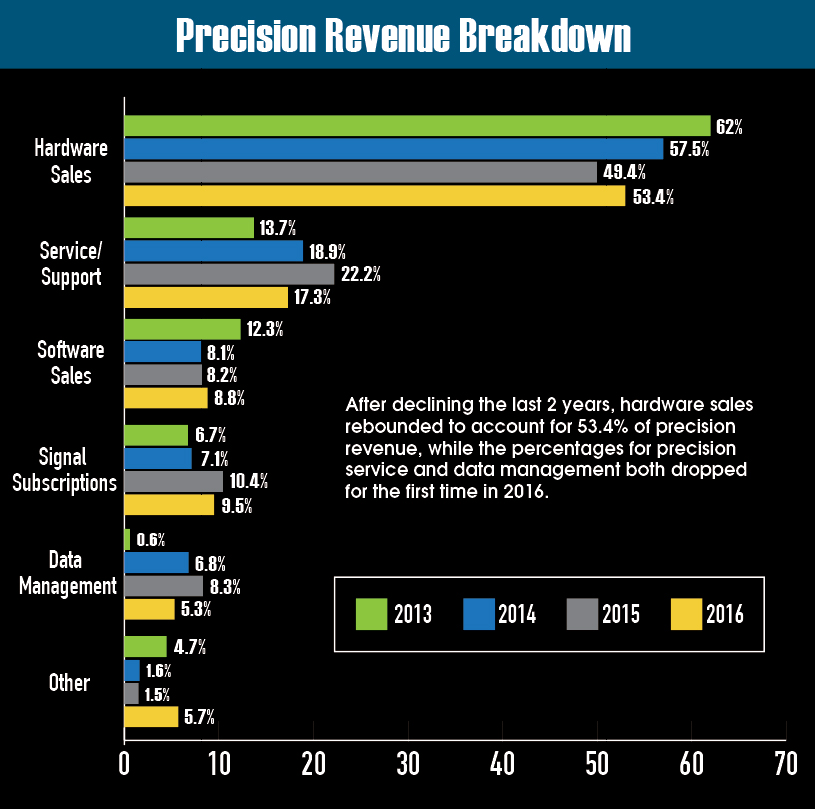

While it’s not surprising to see the pace of precision revenue growth slow down, it’s worth noting a shift — at least for the coming year — in how dealers generate income. The past 3 years had seen a gradual decline in sales of hardware as the dominant moneymaker, while revenue from supplemental services steadily grew.

But both trends stalled this year, as hardware sales rebounded to account for 53.4% of total precision revenue, up from 49.4% in 2015. While nowhere close to the 62% total in 2013, the increase in hardware revenue is closer to the 57.5% from 2 years ago.

Dealers often point to a saturated market for precision mainstays like GPS receivers, monitors and auto-steer systems, but some are finding success selling complementary components or tapping into niche technology markets, which could explain the increase in hardware sales.

However, dealers have also acknowledged a need to decrease their dependence on core precision products as the primary profit center. This was reflected in prior benchmark studies with annual increases in revenue from precision support and data management service.

But both percentages took a step back in 2016. Precision service/support revenue dipped to 17.3%, after 2 years of growth. Since 2013, revenue from this area had increased by nearly 10%, from 13.7% in 2013 to 18.9% in 2014 and 22.2% last year, according to the survey.

The percentage of revenue dealers receive from data management service also declined this year to 5.3%, after a rapid rise. Starting at less than 1% in 2013, data management service increased to 7.1% in 2014 and 10.4% last year.

One precision dealership in Iowa is gradually evolving its business model toward a 50/50 split between hardware and service revenue, but the owner notes that in a down ag market, getting farm customers to buy into data management is a tough sell.

“You need to have a long-term strategy in this area because at some point, when the market recovers, data will be a very relevant and valuable tool,” he says. “But in the short-term, we’re collecting, preserving and getting ready to derive value when we can actually get people to consistently pay for it.”

Evolving Objectives

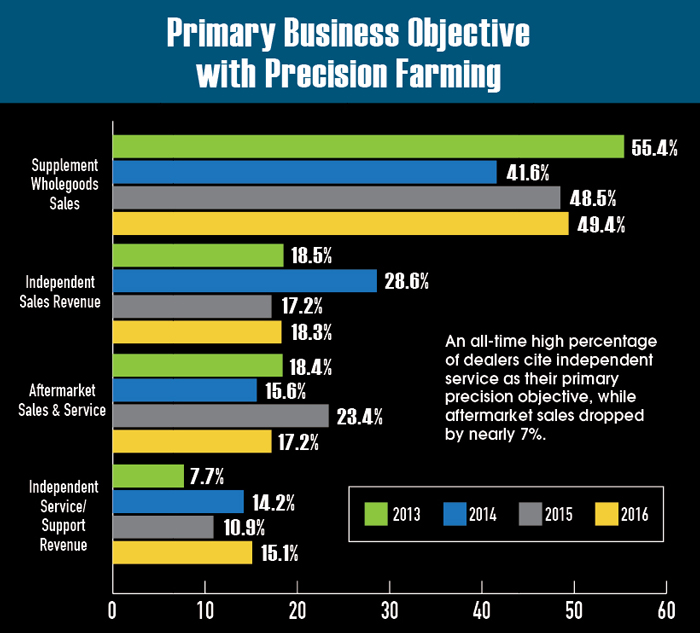

For the fourth year in a row, the majority of respondents — 49.4% — said their primary goal with precision farming is to supplement revenue generated from wholegoods equipment sales. This percentage was slightly ahead of both 2015 (48.5%) and 2014 (41.6%), but well behind 2013 (55.4%).

Worth noting is that 84.9% of respondents to this year’s study identified themselves as traditional farm equipment dealers, which would seem to support the high percentage of dealers viewing precision farming as a complementary business to iron sales.

But this year’s results also revealed a 4 year high for the overall percentage of dealers citing independent service revenue as their primary precision business objective. Some 15.1% of dealers identified this as their number one precision priority, topping the totals from 2015 (10.9%), 2014 (14.2%) and 2013 (7.7%).

In addition, a smaller percentage of dealers cited aftermarket sales and service as their primary objective, with precision business dropping to 17.2% this year, compared to a high of 23.4% in 2015.

Consistent with the dip in aftermarket objectives is a decline in the percentage of precision products being sold through this channel. For the first time in 3 years, aftermarket sales of precision products fell below 50%, but it was still the most popular sales method among respondents at 48%.

The percentage of factory installed sales of precision equipment rose slightly from 38.1% last year to 41.6% in 2016, which is similar to 2014 (40.5%), but well behind the 2013 pace (53.8%).

Interestingly, the only precision sales channel that has grown each of the last 3 years is used equipment, starting at 7.7% in 2013, then 7.9% in 2014, 8.3% in 2015 and 10% for this year. Despite very modest increases, dealers are seeing more opportunity with used technology as farmers look for more affordable upgrades, rather than purchasing brand new systems.

Dealers are also leveraging a slower market to discount used or aging inventory and hold short-term sales of newer technology to attract customers. One Pennsylvania dealer promoted a 2-day “door buster” sale the Monday before Thanksgiving with a goal of selling $250,000 of precision inventory.

“We ended up selling $500,000 worth of hardware and got rid of a ton of old, obsolete stuff that was sitting on the shelf,” the dealership’s precision farming manager says. “When we evaluated the total sale, we still showed an acceptable margin.”

Data Downturn

Even as more dealers emphasize service as a primary source of precision revenue, one area that saw a downturn in this year’s study was data management.

After nearly doubling in 2014 from 31.1% to 54.1%, the percentage of dealers offering data management service continued to increase to 62.1% in 2015. But this year, only 48.9% of respondents said they offer this service, and 17.8% said they don’t but are planning to add it, the lowest total since the inception of the study.

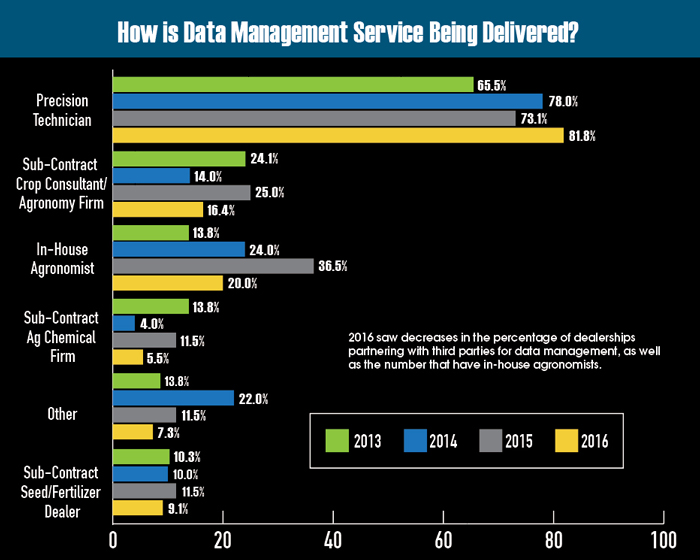

Tied to the decline in data management offerings is a dip in the percentage of external partnerships to deliver these services. Fewer dealers are sub-contracting with crop consultants this year compared to 2015 (16.4% vs. 25%), ag chemical firms (5.5% vs. 11.5%) and seed/fertilizer retailers (9.1% vs. 11.5%).

But there was also a substantial drop in dealers adding in-house agronomists, after 2 years of growth in this area. Only 20% of respondents said they deliver data management services with a staff agronomist, compared to 36.5% last year, 24% in 2014 and 13.8% in 2013.

It could be that those dealerships committing to data management services are doing so with existing resources, rather than risk overextending into a service that is relatively unproven as a profit center. This is supported by a rise in respondents utilizing precision technicians to deliver data management service, with 81.2% of dealers choosing this route in 2016, up from 73.1% last year.

Despite the dips in the data management service segment, by and large, dealers still foresee a bright and profitable future for this area of precision business. At this year’s Precision Farming Dealer Summit in Indianapolis, there were several panels that detailed current opportunities and the long-term outlook for delivering data management service.

“It was apparent, and became more so over time for us, that the bulk of the agronomic decisions that producers are making are carried out through the equipment,” said Devin Dubois, vice president of Integrated Solutions, Western Sales in Rosetown, Sask., at the summit. “And it’s important that we’re dialed into those agronomic intentions so that we can ensure the machine is delivering what the producer wants. Our belief has grown stronger over time that we, as an equipment dealer, must understand this space.”

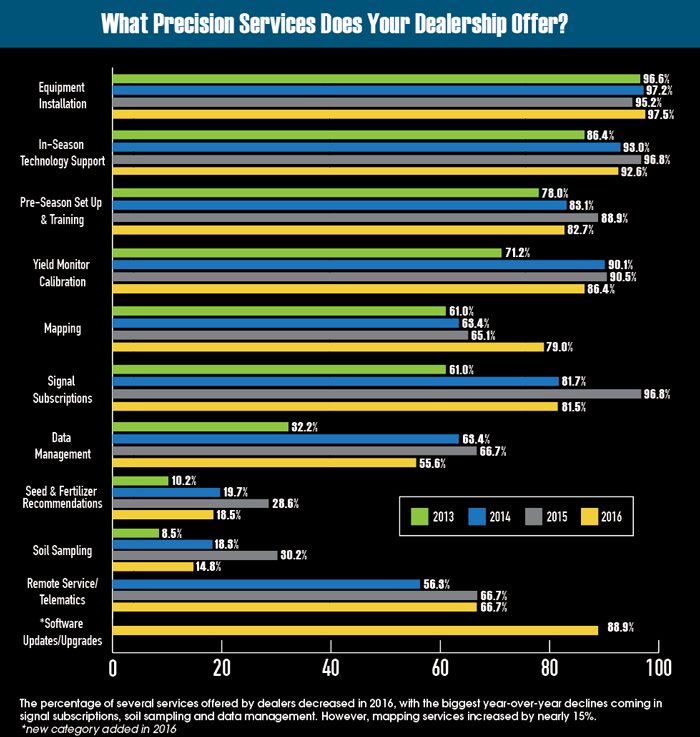

Looking at overall service offerings, data management wasn’t the only area where dealers scaled back. While the percentage of dealers offering a precision service package was relatively stable, dropping only about 2% during the past year from 54.1% to 51.9%, several categories saw double-digit drops.

After a steady increase in past years, soil sampling services dropped from 30.5% in 2015 to 14.8%. Seed and fertilizer recommendation services — intertwined with data management — slipped from 28.6% last year to 18.5% in 2016.

Also declining were GPS and RTK signal subscriptions, from 96.8% in 2015 to 81.5% this year. This comes after nearly a 15% jump in 2014-15. This fluctuation will be worth watching in the future, especially as major manufacturers John Deere and Case IH recently announced the launch of their own RTK networks.

One of the few precision service areas to increase this year was yield and field mapping, which jumped to 79% from 65.1% in 2015.

This service can be billed on a per-acre basis and offer a relatively simple entry point into data management for dealers.

Looking at the breakdown of how dealers are charging for precision services, 4.9% are charging a per-acre fee — a new category option added to the 2016 study. The highest percentage in 4 years are dealers using annual contracts, 23.5%, while the number of dealers billing an hourly rate for precision service dropped from 85.5% in 2015 to 67.9% this year, a 4-year low.

Allocating Resources

One of the ongoing challenges for many dealers is deciding how to structure the precision farming segment of their business. In last year’s report, 66.7% of dealers said they operated a separate department for their precision farming business and 68.6% had a dedicated precision salesperson primarily responsible for technology sales.

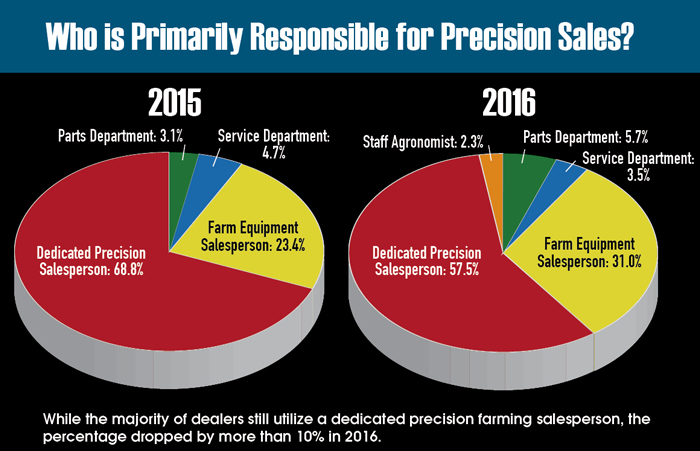

But both of those percentages declined this year, with 61.4% of respondents saying they have a designated precision department and 57.5% indicating they have a dedicated precision salesperson on staff.

Part of the dip can be attributed to more dealers citing farm equipment salespeople as their primary precision sellers, increasing from 23.4% last year to 31% in 2016. Consistent with 2015, smaller percentages of dealers continue to rely on their parts (5.7%) or service (3.5%) departments for precision product sales.

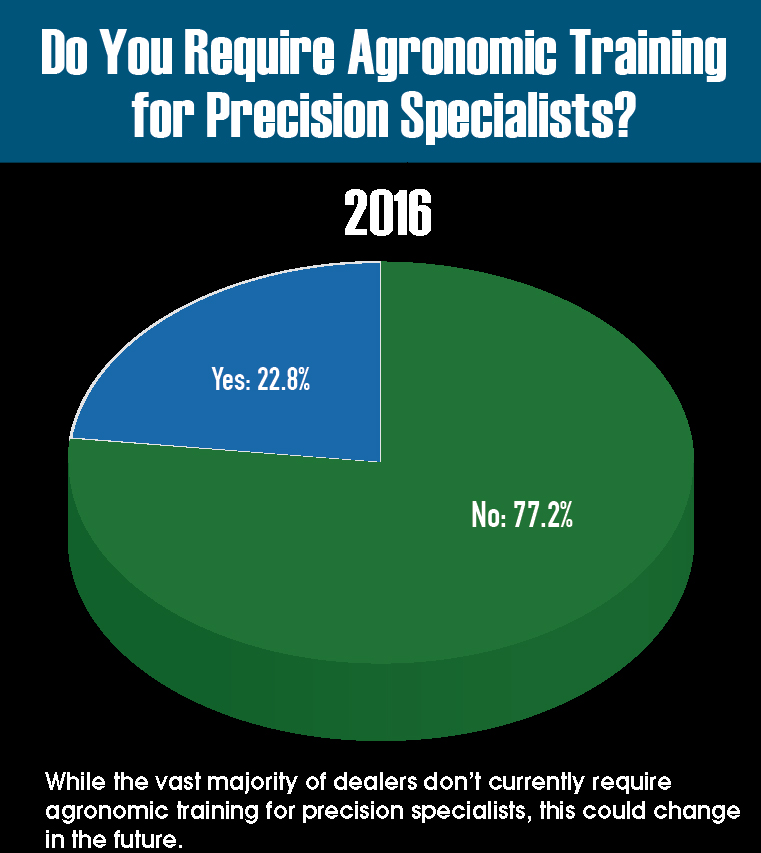

A new category added this year was staff agronomist, and 2.3% of dealers utilize this position as their primary precision salesperson. Also asked this year was whether dealerships require agronomic training for precision specialists, with 22.8% saying they do.

It will be interesting to see if either or both of these percentages increase in the future. In all likelihood, it will depend on how aggressive or tentative dealers are in developing agronomic services.

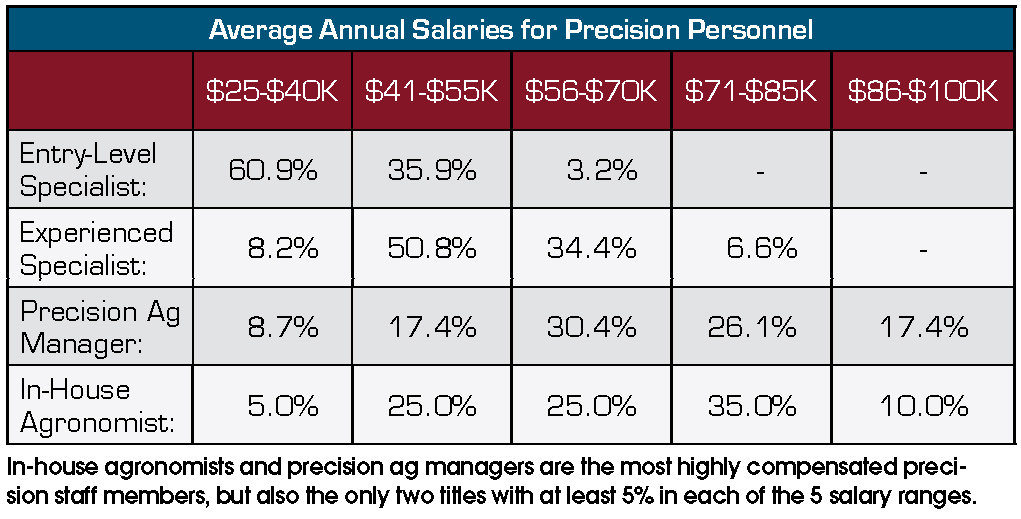

But this much is known — agronomists are well-paid members of a dealership’s precision team. For the first time with this year’s study, we asked dealers to share salary ranges for key precision staff.

Agronomists edged out precision ag managers, 45% to 43.5%, as the largest group of precision employees earning at least $71,000 per year. However, 17.4% of precision ag managers earn at least $86,000 per year, compared to 10% for agronomists.

It’s also worth noting that at least 5% of agronomists and precision ag managers fell within each of the 5 different salary ranges, (see table on page 17) revealing a broad spectrum of how dealerships compensate these employees.

As many dealers can attest, finding and retaining talented specialists is an ongoing challenge. The ability to offer a progressive pay scale and development opportunities are often linchpins to longevity for a precision specialist.

For entry-level positions, some 96.8% of precision specialists earn annual salaries between $25,000-$55,000, with 35.9% making at least $41,000. Some 85.1% of experienced specialists earn between $41,000-$70,000, with 34.4% making at least $56,000, according to respondents.

But salary isn’t the only measurement of job satisfaction for precision staff. Creating and offering incentives can be an effective way to keep talented specialists from reaching the brink of burnout.

One precision dealership in the Midwest recently implemented an annual cap on work hours for experienced specialists and provides bonus compensation for hours worked beyond the cap.

“Working more than 3,100 hours some years, we implemented a 2,600 hour cap and anything beyond that total, I receive a bonus,” says a precision specialist at the dealership. “This is a nice incentive, while also giving us some flexibility and reducing the potential for burnout."

A Look Ahead

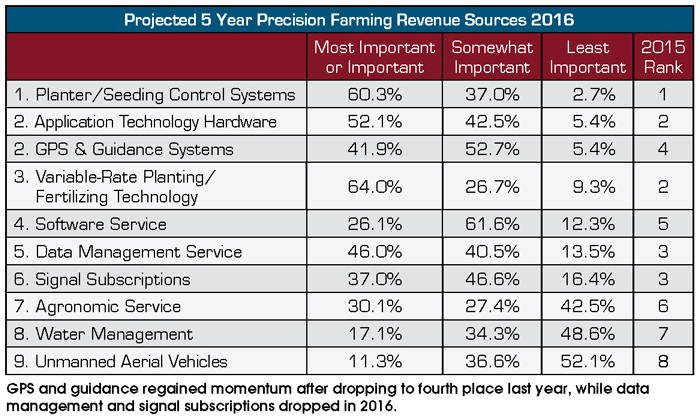

Last year saw a shift in dealers’ outlook at areas where they project the most opportunity to grow revenue in 5 years, with GPS and guidance dropping from first to fourth place and a momentum bump for application and planting technologies.

But GPS and guidance rebounded in 2016, with 94.6% of respondents identifying this area as most important (41.9%) or somewhat important (52.7%), tied for second place with application technology hardware. For the second straight year, planting and seeding control topped the list at 97.3%.

“We have to push cost savings, but it’s going to be hard to sell a $20,000 guidance system,” says one farm equipment dealer from Georgia. “We have to focus on sprayer application equipment and planter upgrades, and this equipment is going to have to be priced around $8,000 because farmers just aren’t spending money this year and it doesn’t look good for next year, either.”

Other notable changes included a 10% drop in the percentage of dealers viewing data management service and signal subscriptions as most important areas for revenue growth. Both tied for third place in 2015, combining the most and somewhat important outlook (89.7%), but slipped to fifth (86.5%) and sixth place (83.6%), respectively this year.

The bottom two categories for precision growth remained unchanged, with 51.5% of dealers classifying water management as most or somewhat important, down 2.5% from 2015. It was followed by unmanned aerial vehicles at 47.9%, down more than 6% from last year.

How dealers view future revenue opportunities may have shifted during the last year, but their priorities for where they plan to invest in precision growth during the next 5 years largely remained the same, albeit with a few interesting wrinkles.

For the first time in 4 years, customer training was alone at the top of the list with 98.7% of dealers rating this segment as most important (66.7%) or somewhat important (32%). This was followed closely by employee training (98.6%), precision staff (96%) and marketing (94.4%).

Despite the overall consistency with how dealers ranked the top four segments in prior years, it’s worth noting a dip in the emphasis placed on adding staff and training them. The percentage of dealers who viewed additional staff as most important dropped from 72.1% in 2015, to 58.7% this year. Those who ranked employee training as most important slid from 91.4% last year to 68.9% in 2016.

This could be a temporary shift as dealers focus more on inter-department training and less on new precision hires during the business downturn. It will be interesting to see if these percentages rebound in 2017.

A new category added to the list this year was CRM and business management systems for precision farming, which ranked fifth (76.4%). While dealers likely have a system in place for overall dealership operations, some say that tracking and managing precision inventory or billable hours can be a challenge.

“For machinery parts inventory, a lot of times it’s self-re-ordered because it’s tracked and employees know how many were sold and when to re-order,” says one Wisconsin dealer. “On the precision side, we don’t automatically re-order anything. When I know we’re getting close to harvest or planting, I go back and check my inventory and if there’s something we need, I’ll get it on the shelf.”

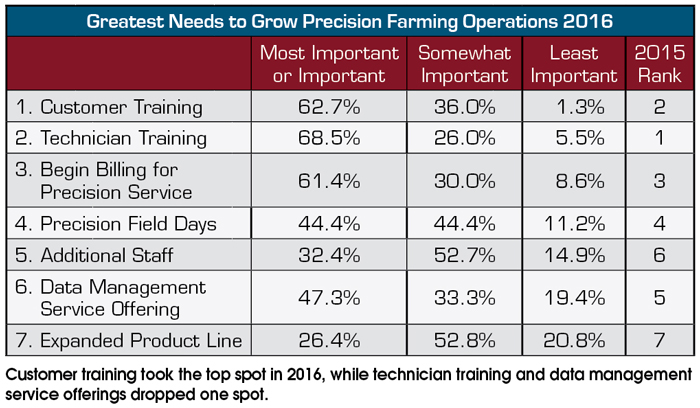

Looking at dealers’ greatest needs to grow their precision business, this year’s responses are largely consistent with prior years. Customer training took the top spot after ranking second last year, with 98.7% of respondents viewing this as the most important or somewhat important area of need.

Technician training was a close second, at 94.5%, after ranking first last year. Billing for precision service again ranked third (91.4%). Adding precision staff moved up from sixth place to fifth (85.1%), but remained a lower priority, compared to 2014 and 2013, when it ranked third and first, respectively.

Data management service dropped one position, from fifth (84.5%) in 2015, to sixth (80.6%) this year.

As dealers continue navigating a challenging market, nearly one quarter of respondents cited low commodity prices as the biggest challenge they’ll face in the coming year.

However, they also acknowledged the need to diversify and adapt in order to develop a profitable precision farming business.

“It’s getting harder to sell precision equipment these days since the newer equipment is all coming with it standard. We’ll make a few sales on aftermarket precision equipment on older equipment, but that’s about it,” says one precision dealer in Iowa. “To overcome the market, it’s going to be all about service. We’ve got to have people who know what they are doing and are able to teach customers how to run their equipment and troubleshoot. If we have good service and the customer knows it, they will be more willing to pay for it.”