Many precision farming dealers we’ve talked to share the same challenge of trying to increase revenue at a time when qualified help is scarce and technology is evolving at such a rapid rate. It’s difficult to keep pace with training employees, much less educating customers.

To paraphrase a precision specialist in Illinois, who is the primary salesperson for three stores and services hundreds of customers — there isn’t a universal set of instructions on the best way to do this job.

Trial and error is often the “road map” to success — or failure — for many precision farming dealers.

Those who thrive often live on the cutting edge of innovation, making the most of new opportunities in the marketplace.

Farm customers today have no shortage of options when it comes to finding the right precision farming tools to suit their operation.

“Everyone has products,” says a dealer from Iowa. “It’s what you do to service and support those products that keeps customers coming back.”

For the first time, Precision Farming Dealer takes an in-depth look at how dealers are currently structuring and maintaining their precision farming business, as well as plans for the future.

This baseline study lays the foundation for an annual analysis of the performance trends and service objectives of precision farming dealers in North America.

The 2013 results provide an interesting entry point into the current breakdown of nearly 70 dealerships’ precision interests and reveal several notable results.

Objectives & Delivery

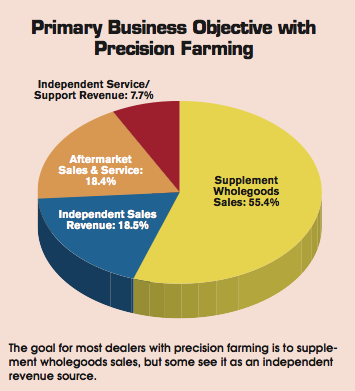

For the majority of dealers, precision farming products serve as a complement to farm equipment sales.

Based on responses from 27 states and Canada, 55.4% of dealers say their primary objective with selling precision technology is to supplement wholegoods sales.

Only 18.5% of respondents say their primary goal with precision farming is to be an independent source of sales revenue. Another 18.4% say their primary goal with precision products is aftermarket sales and service, while 7.7% say their main objective is to make money through independent service and support.

This could change though, as iron dealers grow their precision farming departments, and precision-only operations continue to emerge.

This could change though, as iron dealers grow their precision farming departments, and precision-only operations continue to emerge.

Some iron dealerships have also begun to separate their precision departments from their machinery interests, going so far as to open independent precision ag stores.

One Indiana equipment dealership we visited recently opened a precision-only store to make a statement to customers about its commitment to servicing precision technology. But the dealer also aims to eventually create an independent revenue stream — separate from its machinery sales.

As precision departments potentially outgrow space and resources available within equipment dealerships, it’s possible more may be spun off into stand-alone stores.

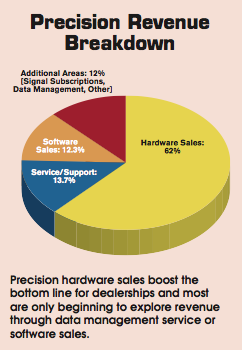

Based on the primary objective of dealerships with their precision farming operations, it’s not surprising that today, precision hardware sales generate the most revenue in this segment.

Respondents say 62% of precision income comes through hardware sales. Products like GPS and auto-steer systems provide tangible paybacks for customers and many dealers view them as “standard” equipment for customers.

However, dealers are beginning to tap into more abstract offerings for customers, but they are not yet a consistent source of revenue.

Precision service (13.7%), software sales (12.3%), signal subscriptions (6.7%) and data management (0.8%) are less common profit centers and indicate that dealers are only beginning to explore new areas of profitability, beyond precision hardware sales.

A Structured Approach

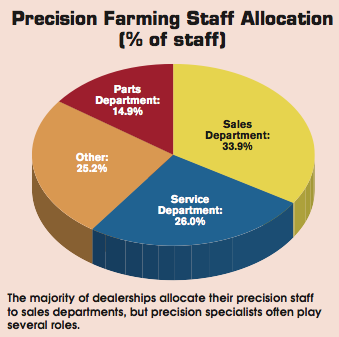

While most respondents report only 1-2 employees working their precision farming operations, the majority also note that those technicians service more than 100 farms. Currently, precision farming specialists often play several roles within a dealership.

Salespeople account for the largest portion of dealers’ precision staff, at 33.9%, followed by service staff (26.0%), other (25.2%) and parts department (14.9%).

The fact that more than a quarter of respondents classified their precision staff as “other” is telling. Many dealerships tell us they struggle to define singular roles for precision hires, or simply can’t afford to at this point.

One of the challenges dealerships face is the ability to find qualified help in order to maintain or expand precision offerings.

“We’re trying to get at least one precision farming specialist in each of our ag locations,” notes one dealer from Pennsylvania. “We’re currently working on hiring already qualified technicians and also ways to recruit young employees to help grow our department long-term.”

As dealerships look to expand their precision departments and define the roles of specialists, this will likely allow them to explore additional service opportunities.

Interest is there among dealers to incorporate paid precision equipment service plans for customers.

At this point, 29.8% of respondents say they offer a precision service package to include elements like software updates, phone support, RTK signal correction, on-farm training and a discounted hourly rate for billable service.

One objective for a Missouri dealer is to start charging more for the services offered and getting a larger percentage of customer understanding for the need to do so.

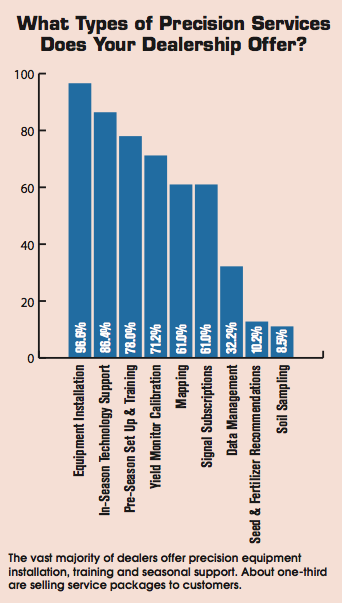

Nearly every dealership offers precision equipment installation for customers (96.6%), in-season technology support (86.4%), pre-season set up and training (78%) and yield monitor calibration (71.2%).

Mapping services and signal subscriptions — both at 61% — are emerging services while only 8.5% of dealers offer soil sampling.

Managing Data

Perhaps the service generating the most buzz as new revenue sources is data management.

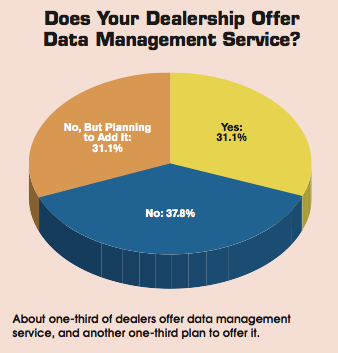

Currently 31.1% of dealers offer data management service in conjunction with sales of precision farming products, while another 31.1% say they plan to add it in the future.

One Ohio dealer says figuring out how to deliver and price data management services is a main objective in the next year.

“Learning how to provide support to services like data management is something we’re looking at,” he says. “Getting as much training as possible will be needed as well as demonstrating those services to customers, so they know how to manage their information.”

One of the considerations for dealerships offering data management is how to best deliver that service to customers.

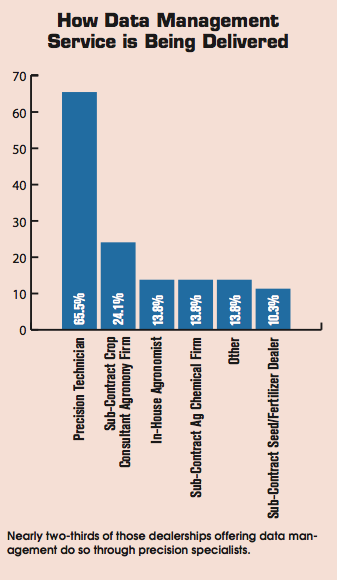

At this point, precision farming specialists are the ones most commonly being called on to do so. According to the survey, 65.5% of respondents say precision technicians are delivering data management services to customers.

However, dealers are also taking advantage of alternative methods to establish data management service as a part of their precision business.

Sub-contracting with a crop consultant or local agronomist (24.1%), local ag chemical firm (13.8%) or local seed/fertilizer dealer (10.3%) are partnership opportunities that could broaden the customer base.

Still, there are a number of dealerships hiring their own in-house agronomists (13.8%). It will be interesting to see if this percentage continues to rise and to what extent dealers commit to diversification of precision farming operations with data management.

The Next 5 Years

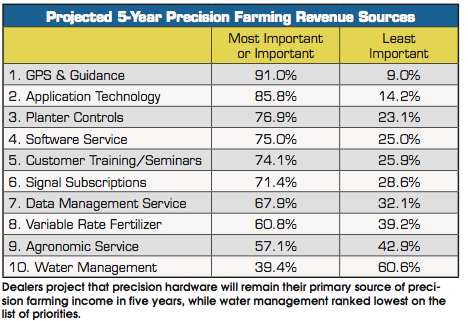

Looking into the future, dealers will continue banking on precision hardware for their primary source of precision revenue.

GPS and guidance equipment sales ranked first on a list of 10 areas where dealers project the most payback from their precision farming investment in the future. Of all the categories, dealers had the most confidence (91%) in choosing GPS and guidance equipment as their top source of revenue in five years.

It’s a safe bet that this equipment will remain in high demand, as dealers note there are plenty of farmers yet to adopt precision technology.

Ranking second and third, respectively, were application technology (85.8%) and planter controls (76.9%), both of which dealers say they are starting to include as options on new farm equipment. Row clutches on planters and auto-boom shut-off on sprayers are increasingly common features being offered to customers.

Fourth on the list was software service, which indicates the investment dealers plan to make in this tool.

However, agronomic service ranked ninth, which may mean dealers will focus more on the computer side of their precision business rather than offering planting prescriptions.

Although some dealers we’ve talked with are adding precision water management tools, 60.6% projected this technology as their lowest source of revenue in five years.

But in order to effectively grow precision farming offerings, dealerships will need to hire additional skilled personnel.

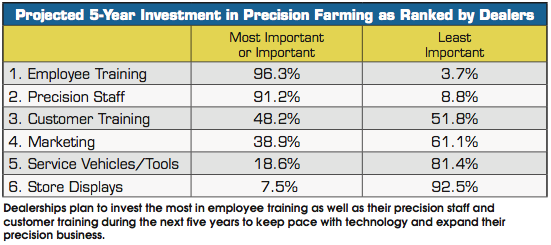

In five years, dealers anticipate their largest investment in precision farming will be in employee training (96.3%) and hiring additional staff (91.2%).

Ranking third is customer training (48.2%). Dealers note that the ability to hire and train new precision specialists will allow them to better educate customers.

“We’ll continue training for our precision farming specialists and increase customer training by using online videos that show customers how to operate their systems and provide a refresher before they go to the field,” notes one Ohio dealer.

While hiring additional staff is in the long-term plan for the dealers, finding new hires is also priority today.

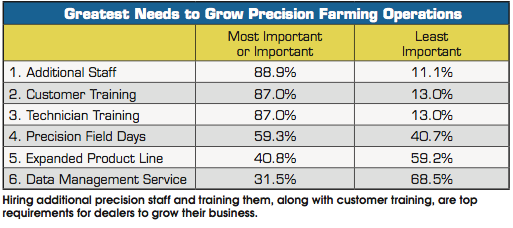

On a list of six needs to grow dealerships’ precision operations, adding staff ranked first, with 88.1% of respondents saying it is the key to building their business.

In talking with dealers last year, most were actively recruiting new precision salespeople or technicians to keep pace with customer demand.

“Keeping up with our customers is a priority,” notes one New York dealer. “Adding new staff and getting them trained will be a big help.”

Not surprisingly, customer and technician training ranked second and third on the list of needs to grow dealers’ precision business.

But interestingly, data management service ranked last, with 68.5% of respondents saying it was their least important need to boost business.

This may suggest that until dealerships have the necessary staff in place, they are not willing to stretch themselves too thin with services they offer.